It wasn’t too long ago that GameStop’s (GME) stock was one of the most closely watched on Wall Street. The purveyor of video games, consoles, and collectibles caught fire after contributors to the social media website Reddit began lauding its potential as a turnaround story.

GameStop’s rise as the first meme stock to capture Main Street investors' attention was due in no small part to the involvement of Ryan Cohen, the former founder of online pet retailer Chewy. Cohen is a proven leader with a penchant for activist investing who seemingly resonated with the WallStreetBets Reddit crowd.

Initially, Cohen bought 5.8 million shares in GameStop in August 2020. Since then, he’s increased his ownership several times, including a roughly $10 million investment in GameStop stock last week. News that Cohen’s venture fund, RC Ventures, owns over 12% of the company sent shares soaring on Tuesday, causing them to do something impressive.

TheStreet

GameStop Stock Gets A Face-Lift

Cohen’s latest purchase follows a big-time shake-up at the company recently. GameStop on June 7 reported discouraging first-quarter financial results. Revenues slipped 10% from the prior year, and the company remained in the red, losing 14 cents per share.

The performance was disastrous enough to prompt the board to fire CEO Matthew Furlong, and announce a new role for Cohen, who has served on GameStop’s board of directors since 2021.

Cohen will be the company’s executive chairman, responsible for capital allocation and management oversight. Mark Robinson was also newly installed as general manager to handle the company's day-to-day management.

The news, which was surprising, unexpected and somewhat frustratingly, came with little explanation.

“GameStop reported a lousy quarter, fired the CEO, reduced the size of the board, and named Ryan Cohen to the post of executive chair. Then ... it didn't hold a conference call. That alone is possibly among the most unprofessional corporate developments I have seen. I know that GameStop has made a habit of avoiding post-earnings conference calls, but when those earnings come with massive changes to the C-Suite? C'mon, man,” wrote Real Money’s Stephen Guilfoyle on June 8.

GameStop Stock Impresses

Given the big changes and lack of clarity, GameStop shares fell over 20% intraday on the news. The initial selling, however, appears to have been a knee-jerk reaction.

A peek under the hood shows a healthy balance sheet despite revenue and earnings headwinds, providing the company with financial wiggle room to reshape itself. The potential to pick up shares at a steep discount wasn’t lost on some investors, including Guilfoyle.

“This stock can, in my opinion, be bought on this dip as long as the investor understands that this is pure speculation. I will initiate a purchase on GameStock stock this morning after this article is public. 22% discounts don't happen every day in firms fundamentally built to take a gut punch and keep on walking,” wrote Guilfoyle.

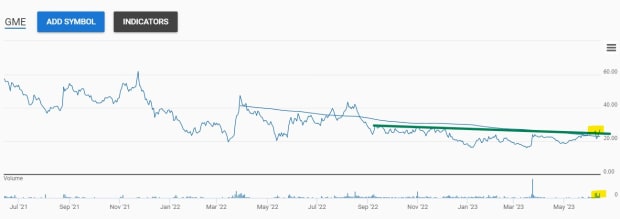

Since then, GameStop has reversed the losses following its disappointing news, rewarding those who stayed put or bought shares like Guilfoyle.

Shares finished higher on June 13 than they were trading before the disappointing earnings report. Impressive. Perhaps, more impressive is that the rally, which has occurred on three consecutive days of above-average trading volume, puts the stock at its highest closing price since last November.

If shares follow through with another above-average volume day on Wednesday, resistance will turn into support, suggesting investors can buy down days.

What’s Next For GameStop Shares?

GameStop has cash on the balance sheet, and Cohen is a proven leader in the C-suite, but it’s not out of the woods yet. The core business of video games and consoles is shifting online, creating headwinds that won’t be easily overcome.

Nevertheless, there could still be an opportunity for shares to move meaningfully higher. Some short sellers likely bought shares to cover positions this week, but plenty of people are still betting against this stock. There were over 55 million shares held short at the end of May, representing over 20% of all shares available for trading, according to Yahoo! Finance. If GameStop reports anything positive, additional short covering could fuel further gains.

Forget GameStop – This Could Be The Next Stock To Go