Consumer expert Martin Lewis has condemned the government’s “painfully slow” pace on regulating the buy now, pay later industry, following indications that tougher rules won’t take effect until 2024.

Buy now, pay later (BNPL) allows shoppers to delay payment for products such as clothes and furniture. This form of credit enjoyed explosive growth during the pandemic, particularly among under-30s and those less financially stable.

But there has been growing concern among regulators, politicians and consumer groups about how easy it is for people to buy more than they can afford and potentially build up sizeable debts. Last year a study found that British consumers have racked up more than £4 billion worth of debt using buy now pay later (BNPL) services.

It said eight million BNPL customers in the UK have outstanding balances which average £538 each (£4.14 billion total). This month the charity Citizens Advice said shoppers were “piling borrowing on top of borrowing, and sinking into ever more desperate situations”.

Buy now pay later providers such as Klarna and Clearpay are commonplace at online checkouts for major retailers such as JD Sports, ASOS and Boohoo.

In February 2021, the government announced that the Financial Conduct Authority (FCA) would be given powers to police the BNPL sector. This will give consumers greater protection and more rights – for example, all firms will have to conduct proper affordability checks before lending, and ensure that customers are treated fairly if they are struggling to repay.

The Treasury said the government would publish a consultation on draft legislation “towards the end of this year” with an aim to introduce secondary legislation to parliament by mid-2023.

Following this, the FCA will have to consult on its rules for the sector, with industry insiders adding that “We are probably not going to see anything in law until 2024,” the Guardian reported.

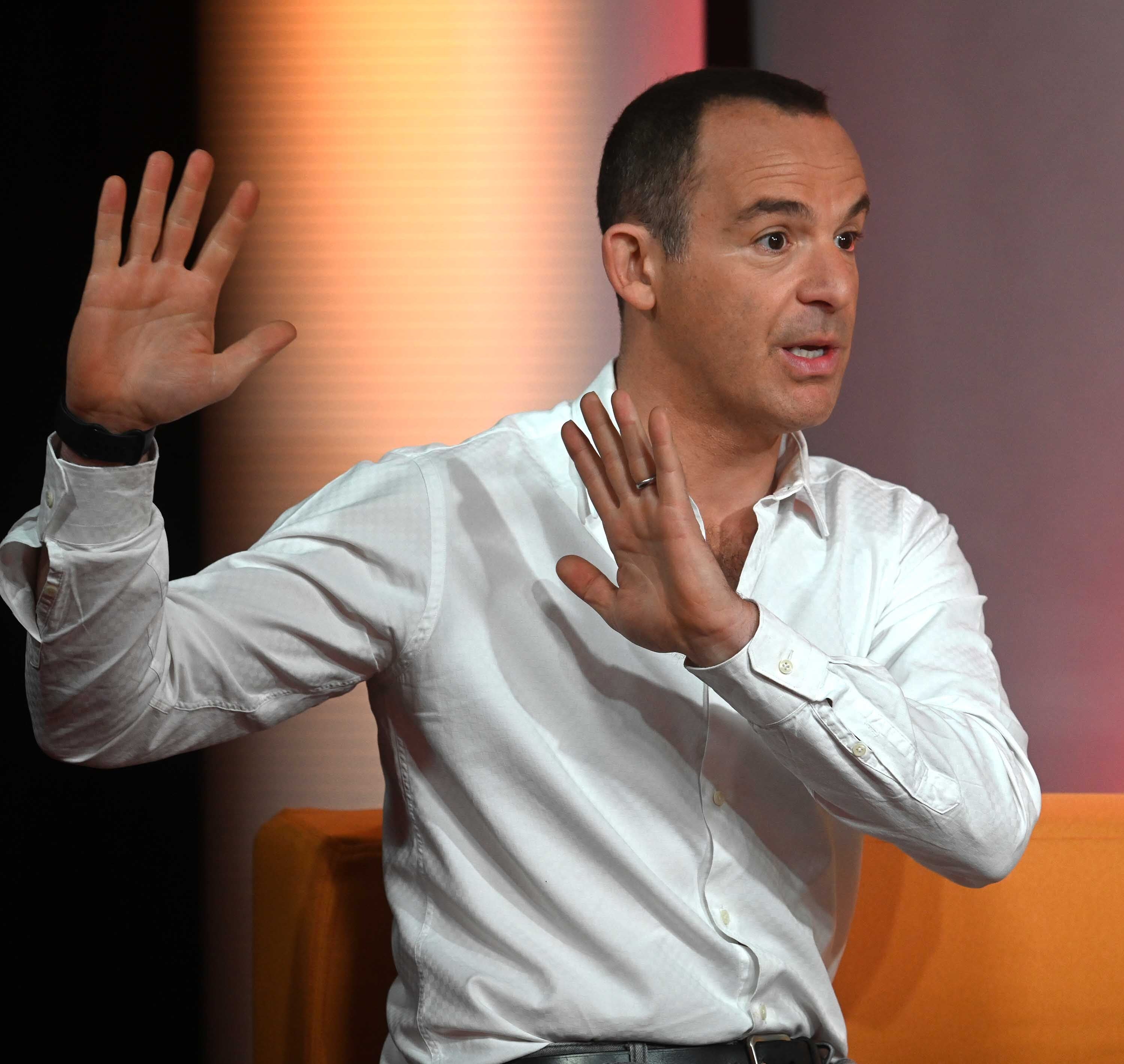

In response to the announcement, Mr Lewis, founder of MoneySavingExpert.com, said: “The pace of progress is painfully slow. Buy now, pay later regulation is desperately needed, so my pleasure that it’s finally to happen is tempered by frustration at how long it is taking.”

Advice and information charity Citizen’s Advice said BNPL is “like quicksand - easy to slip into and very difficult to get out of.”

“Split payments are offered as a temptation at the checkout, but the consequences can be devastating for those who are least able to deal with them,” Matthew Upton, director of policy at Citizen’s Advice said.

“Over half of young people who have used BNPL in the last year struggled to make a repayment. The BNPL sector has grown incredibly quickly and we need consumer protections to keep pace.”

The Treasury said it is working toward finalising new regulation on BNPL schemes but has experienced delays after research revealed further exploitative schemes which will now be included in the legislation.