Financial giants have made a conspicuous bearish move on AbbVie. Our analysis of options history for AbbVie (NYSE:ABBV) revealed 13 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 53% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $257,880, and 10 were calls, valued at $538,961.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $160.0 to $192.5 for AbbVie during the past quarter.

Analyzing Volume & Open Interest

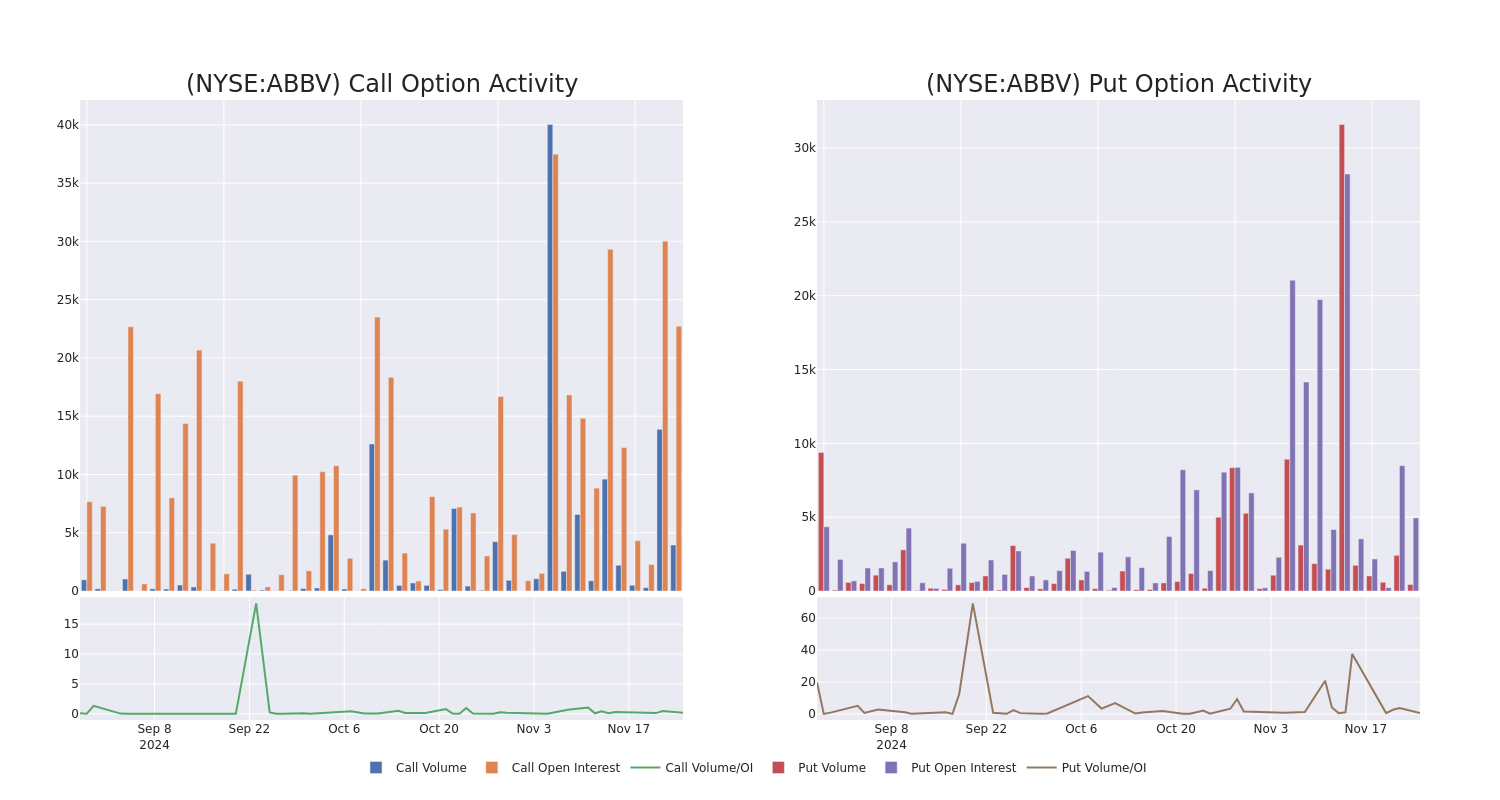

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for AbbVie's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across AbbVie's significant trades, within a strike price range of $160.0 to $192.5, over the past month.

AbbVie Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | PUT | TRADE | BULLISH | 03/21/25 | $6.55 | $6.3 | $6.3 | $175.00 | $189.0K | 689 | 319 |

| ABBV | CALL | TRADE | BEARISH | 01/17/25 | $14.95 | $14.2 | $14.2 | $165.00 | $142.0K | 4.0K | 107 |

| ABBV | CALL | SWEEP | BEARISH | 01/16/26 | $26.75 | $26.4 | $26.4 | $165.00 | $124.0K | 490 | 47 |

| ABBV | CALL | TRADE | BEARISH | 12/20/24 | $1.92 | $1.78 | $1.8 | $185.00 | $54.0K | 3.6K | 695 |

| ABBV | CALL | SWEEP | BEARISH | 12/20/24 | $3.8 | $3.7 | $3.7 | $180.00 | $36.6K | 4.7K | 328 |

About AbbVie

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

AbbVie's Current Market Status

- With a trading volume of 3,563,685, the price of ABBV is up by 0.2%, reaching $177.31.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 67 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AbbVie with Benzinga Pro for real-time alerts.