With 11 billion tonnes of goods traded internationally by sea every year, shipping accounts for around 3% of global greenhouse gas (GHG) emissions. This is more than commercial aviation, for example, which is responsible for 2.6% of the planet’s emissions. Despite this, shipping is often overlooked when considering the overall carbon neutrality of our societies.

Numerous voices, from the South and the North, are calling for the introduction of a carbon tax on maritime transport, a sector currently exempt from the Kyoto Protocol and therefore untaxed. Such a tax would align with the objective of setting a uniform global carbon price, and would be based on the “polluter pays” principle, where the cost is borne by those whose behaviour generates emissions. It would thus be fair. It would generate revenues that could be used to finance climate change adaptation and mitigation policies, while modifying behaviours and reducing emissions.

As economic researchers, we examined whether these multiple objectives could be achieved simultaneously. We estimate that while a tax of $40 per tonne of CO2 could generate up to $60 billion in revenue, it would only reduce shipping emissions by 1.75%, far below the reduction ambitions announced by the International Maritime Organization (IMO). The other side of the coin is that the tax would have an economic cost of 166 billion dollars, due to higher transport costs and reduced consumer purchasing power. It would also affect poor countries more than rich ones. Let’s take a closer look at why.

Simulations that question the rationale for taxing maritime transport

Using international trade data, we simulated the tax revenues and short-term effects of implementing a carbon tax of US$40 per tonne of CO2 on shipping emissions for 185 countries ($40 per tonne is at the low end of the range of targets set by experts, corresponding to an increase of around 30% in the price of heavy fuel oil based on 2018 prices). Our study identifies several points for consideration. It questions both the double dividend regularly put forward for environmental taxes, which are supposed to reduce emissions while financing the transition, and the polluter-pays narrative, which would position the shipping tax as a fair tax.

The tax revenues generated by this hypothetical tax are estimated at between $19.6 and $59.5 billion, for an economic cost or budget loss of $166 billion worldwide. The cost/revenue ratio is therefore high. In other words, if the sole objective is to mobilise financial resources, this tax is probably not the most effective approach.

Furthermore, the impact of the tax on reducing carbon emissions from shipping falls short of the IMO’s stated ambitions for reducing GHG emissions from the maritime sector. We estimate that the average distance traveled at sea per $1 of cargo would be reduced by 2.59% with the tax, resulting in a decrease in shipping emissions of approximately 1.75%. When considering the reorientation of certain trade flows toward more carbon-intensive modes of transport, such as road or air, the overall effect of the tax on carbon emissions from trade becomes even more modest, ranging from -0.72% to +0.12%.

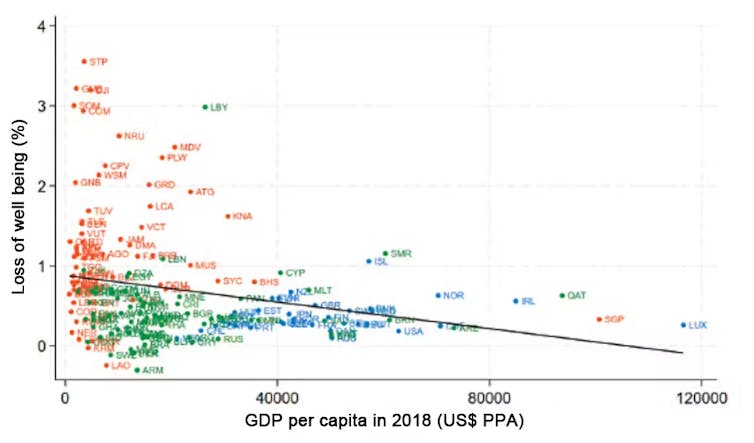

Additionally, the introduction of a maritime carbon tax would disproportionately affect consumers in poorer countries compared to those in wealthier ones. Countries that are far from world markets and heavily reliant on maritime transport for trade would be most affected. Poorer countries are also disadvantaged by the type of goods they typically trade, which are often bulky and of low value. Small island developing states such as Comoros and Haiti, as well as vulnerable countries like Gambia and Guinea Bissau, would be among the most affected. Therefore, the tax would be highly inequitable, and this must be taken into account when allocating its generated revenue.

Impact of carbon tax on welfare by country as a function of GDP per capita

Other studies using alternative methodologies to estimate the effect of a tax on shipping confirm its disproportionate effect on poorer countries.

These results, concerning both the reduction in carbon emissions from shipping and the economic impact on poor countries, underscore the importance of clarifying the objectives we aim to achieve with the introduction of a carbon tax on shipping. Such a tax cannot be viewed as a silver bullet for decarbonising the sector and financing the energy transition. Its pros and cons must be carefully weighed against those of other international taxes currently under consideration, such as a carbon tax on civil aviation, a tax on financial transactions or a tax on the ultra-rich. This comparative analysis will help identify tax instruments that are the fairest, least costly, most incentivising or which generate the highest revenues.

How can we support carbon pricing in this sector?

The introduction of a global carbon price, applicable across all sectors and stakeholders, has been identified as a crucial element in the fight against climate change. Therefore, implementing a carbon tax on shipping should be accompanied by a carbon tax on air freight, to prevent trade flows from shifting toward this significantly more carbon-intensive mode of transport.

Furthermore, introducing compensation mechanisms for poor and vulnerable countries, particularly the Least Developed Countries and Small Island Developing States, aligns with a fairness objective, given the disproportionate impact of the tax on these countries.

Finally, it seems clear that achieving the IMO’s goal of zero GHG emissions by 2050 will require carbon pricing to be accompanied by more directly binding mechanisms that encourage a technological revolution in the sector.

Vianney Dequiedt is scientific director of the Foundation for International Development Studies and Research.

Édouard Mien has received funding from the French National Research Agency (ANR).

Audrey-Anne de Ubeda ne travaille pas, ne conseille pas, ne possède pas de parts, ne reçoit pas de fonds d'une organisation qui pourrait tirer profit de cet article, et n'a déclaré aucune autre affiliation que son organisme de recherche.

This article was originally published on The Conversation. Read the original article.