Love—real love—requires sacrifice. It’s not just about hypothetical scenarios of support but actually putting in the time and effort to help the people closest to you. Some relatives might reward that genuine devotion by writing you into their will, promising you an inheritance.

Unfortunately, getting money and access can breed a lot of envy. Even among your nearest and dearest. One anonymous man went viral after turning to the internet for help. He opened up about how he got a sizable inheritance from his beloved grandfather. However, the author’s younger brother began pressuring him to give him over half of the sum because he was desperate for cash due to his debt and situation at home. You’ll find the full story, as well as the internet’s reaction, below.

Bored Panda reached out to personal finance expert Sam Dogen, the founder of the Financial Samurai blog and the author of the bestseller ‘How To Engineer Your Layoff.’ He was kind enough to shed some light on keeping envy in check and what steps someone can take if they’re overwhelmed by debt. Read on for his insights.

Inheritances can be a mixed blessing because the money and assets you receive are tinged by the loss of your loved ones

Image credits: lucigerma / envatoelements (not the actual photo)

A man who received a sizeable amount of money from his grandfather asked for advice after his desperate sibling suddenly demanded most of the cash

Image credits: Zinkevych_D / envatoelements (not the actual photo)

Image credits: Anonymous

Gratitude is a good antidote for feeling envious about other people’s success

We asked Dogen about how someone might go about keeping their envy in check if it has already started affecting their relationships with their family. According to him, gratitude plays a vital role here.

“First, recognize that envy comes from focusing too much on what others are getting, instead of what you already have. If you shift your mindset to gratitude, you’ll naturally start feeling less envious. Remember, no one’s financial gain can take away from the life you’ve built and the choices you’ve made to get where you are. You have your own financial independence and life path to follow, so don’t let comparisons drag you down,” Dogen told Bored Panda in an email.

Next, he urged the person to focus on the fact that family is more important than money. “The last thing you want is to let jealousy ruin lifelong relationships over something material. Having honest conversations about your feelings with your family, if possible, can also ease tensions. Even if the inheritance isn’t split the way you imagined, maintaining strong family bonds is worth much more in the long run,” the founder of Financial Samurai said.

If the situation feels unmanageable, it might be worth getting a financial counselor. They can help mediate the conflict. “Sometimes, an outside perspective can bring clarity and help you see the bigger picture, especially if you’re working toward long-term peace and financial independence of your own. In the end, your relationships are worth far more than any inheritance. Stay focused on what truly matters, and don’t let envy rob you of your peace.”

Image credits: Marcus Aurelius / pexels (not the actual photo)

There are two main ways that you can start tackling overwhelming debt, but it all starts with finding the courage to face the truth about your finances

Meanwhile, we asked Dogen for some advice regarding getting rid of debt. It can feel like you’re underwater if you have multiple sources of debt and don’t know where to even begin. “If you’re feeling completely overwhelmed by debt, the first thing you need to do is acknowledge the situation without letting it consume you. Debt can feel like a mountain on your back, but it’s a solvable problem once you start taking small, actionable steps. It’s kind of like facing a big, messy room—at first glance, it feels impossible to clean. But once you start by picking up one piece at a time, it becomes much more manageable,” the personal finance expert advised.

“Start by looking at the full picture. Open every bill, face your balances, interest rates, and minimum payments head-on. This process might feel scary, but it’s essential to know exactly where you stand. When you avoid dealing with your debt, it just looms larger in your mind, creating even more stress. After you’ve taken inventory, you can start building a basic budget. This will help you see how much you’re making versus how much you owe. If you don’t have enough to cover your basics like rent, food, and utilities, you might need to make some temporary sacrifices, like cutting out non-essentials or looking for ways to increase your income,” Dogen told Bored Panda.

Now that you’ve established your budget, you can focus on how to tackle the debt. According to Dogen, there are two main approaches. The first is the “debt snowball method, which focuses on paying off your smallest debts first to build momentum.” Meanwhile, the second is the “debt avalanche, where you tackle the debt with the highest interest rates to save money in the long run.” Dogen noted that both methods can work: “It’s just about finding which one motivates you the most.”

“As you move forward, try to automate your progress. Setting up automatic payments ensures you won’t miss anything and face penalties, and if you can, automate a bit extra toward your highest-priority debt. The goal is consistency. The path to financial freedom isn’t an overnight journey, but by taking it one step at a time, you’ll begin to feel less overwhelmed and more empowered. Every small action is a step toward regaining control.”

Image credits: Alena Darmel / pexels (not the actual photo)

If you know that your family is likely to fight over your will, it might be best to sort things out while you’re still alive

According to Investopedia, older relatives “usually know” if the younger members of their family are likely to fight over their inheritance. So, they should take steps to minimize all of that potential conflict before they pass away.

They could, for example, express their wishes in a will or set up a trust. Alternatively, they could use a third party like an executor or a trustee to split the inheritance so there are no gray areas or different interpretations.

Meanwhile, the relatives can also give their other family members gifts while they’re still alive to ensure there’s no (or, well, less) displeasure over the final verdict. It’s easier to mediate these conflicts in person than from beyond the grave. In 2024, parents can gift each child up to $18,000 without owing taxes on those gifts, as per Investopedia.

The author’s younger brother is far from the only person struggling with debt. Business Insider reports that the average citizen of the United States has a debt of $104,215, including mortgages, student loans, credit cards, as well as auto loans. The biggest part of the average consumer debt is—somewhat unsurprisingly—made up of mortgages.

The average American debt is more than three times as much as the amount of money that the author’s brother asked for. Though having debt weighing you down can introduce a lot of stress into your life, it’s not an insurmountable challenge. A bit of spending hygiene, better budgeting, and careful saving can change the trajectory of your financial life. However, the effect won’t be immediate. It’ll take many months and years to get back on track.

The author faced a serious dilemma, whether to go forward with his business idea or support his struggling brother

The core issue here is the question of what’s fair. On the one hand, we have the author who put in consistent effort taking care of his grandfather because he loved him, wanted to spend time with him, and wanted to improve the quality of his life. His grandad rewarded him with $50,000, a very generous sum of money.

That money is his to spend as he chooses. Whether that’s to pursue the woodworking business that he has dreamed of, putting everything into a high-yield savings account, giving it all away to charity, or splitting the inheritance among all of his family and friends. At the end of the day, it’s his decision, and pressuring him one way or another is a tad unfair.

On the other hand, it’s hard to ignore your family’s financial struggles. Human beings are hardwired for empathy, so if you see someone who needs help, your instinct is probably to help them. In this case, the author’s younger brother asked for $30,000 of the $50,000, because he was “drowning in debt” and his wife was pregnant. In short, he was desperate for a cash injection.

However, there are some quibbles with this narrative. For one, if things were that bad, why did the brother not ask anyone for help beforehand? He only asked for help once he knew there was a large sum of money up for grabs.

Image credits: Mikhail Nilov / pexels (not the actual photo)

Though everyone needs a helping hand from time to time, it’s also important to strive for independence and take care of your own financial well-being

Furthermore, why is it just the older brother’s duty to help his younger sibling out? If the debt situation is so awful, surely, more family members would be interested in lending a hand? Though it’s hard to judge a situation from afar, it feels like there’s a lot of opportunism at play here.

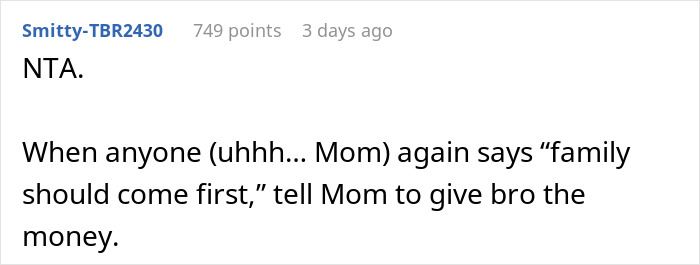

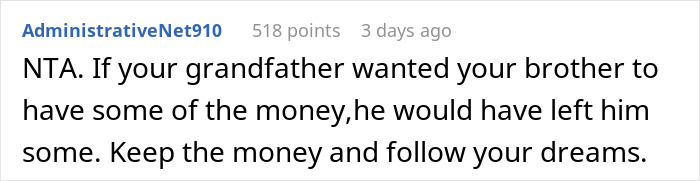

The anonymous man’s tale made a big splash on the internet. At the time of writing, the post has 8.2k upvotes and has garnered a whopping 3.2k comments from people all over Reddit. Most readers sided with him, telling him that it’s okay to use the money to pursue his lifelong dreams.

Meanwhile, many internet users also noted that the man’s younger brother is a grown-up who’s responsible for his own actions and financial health. Unfortunately, the author of the story deleted his account after his post went viral, so we were unable to reach out to him for further comment on what happened with his family next.

What would you do if you were in the story author’s shoes, Pandas? Would you give in to your sibling’s demands and give him the huge chunk of cash to help him out? Or would you move forward with your business goals? Have you ever personally witnessed anyone fighting over how to split an inheritance? Share your take and experiences in the comments.

Most internet users assured the man that he wasn’t doing anything wrong to follow his dreams. Here’s their take on what happened

A few readers had a very different view. From their perspective, the author should have reacted differently