Investors with a lot of money to spend have taken a bearish stance on Gilead Sciences (NASDAQ:GILD).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GILD, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 8 options trades for Gilead Sciences.

This isn't normal.

The overall sentiment of these big-money traders is split between 37% bullish and 62%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $103,960, and 7, calls, for a total amount of $499,525.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $75.0 to $97.5 for Gilead Sciences over the recent three months.

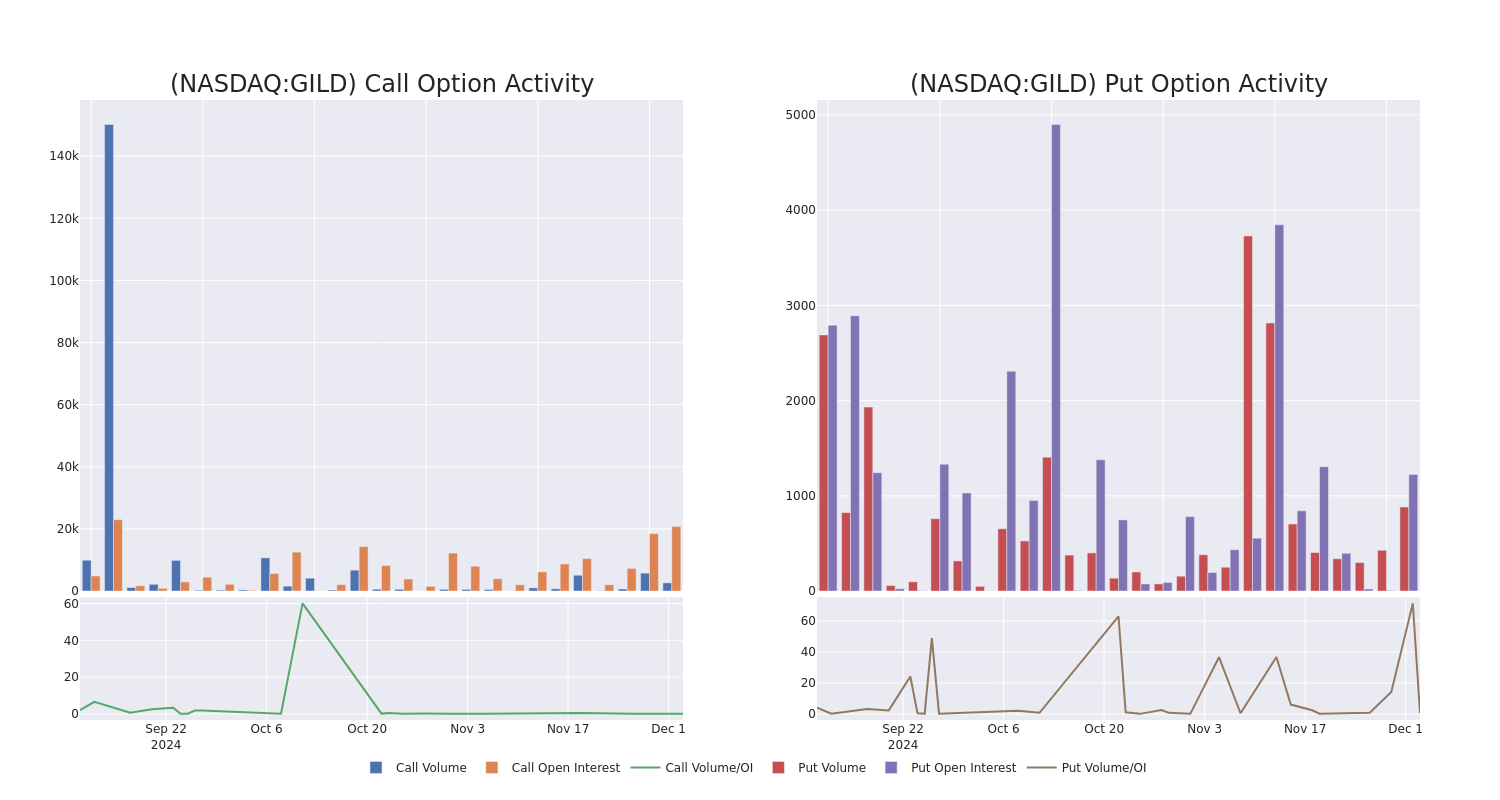

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Gilead Sciences's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Gilead Sciences's whale activity within a strike price range from $75.0 to $97.5 in the last 30 days.

Gilead Sciences 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GILD | CALL | SWEEP | BULLISH | 01/17/25 | $2.65 | $2.5 | $2.61 | $95.00 | $236.6K | 11.5K | 920 |

| GILD | PUT | SWEEP | BEARISH | 12/20/24 | $2.3 | $2.21 | $2.3 | $94.00 | $103.9K | 1.2K | 883 |

| GILD | CALL | SWEEP | BEARISH | 12/20/24 | $1.91 | $1.9 | $1.9 | $94.00 | $90.2K | 622 | 493 |

| GILD | CALL | SWEEP | BEARISH | 02/21/25 | $7.1 | $7.0 | $7.0 | $90.00 | $52.5K | 936 | 76 |

| GILD | CALL | TRADE | BULLISH | 01/17/25 | $19.25 | $19.25 | $19.25 | $75.00 | $38.5K | 3.2K | 20 |

About Gilead Sciences

Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C. Gilead's acquisition of Pharmasset brought rights to hepatitis C drug Sovaldi, which is also part of newer combination regimens that remain standards of care. Gilead is also growing its presence in the oncology market via acquisitions, led by CAR-T cell therapy Yescarta/Tecartus (from Kite) and breast and bladder cancer therapy Trodelvy (from Immunomedics).

Where Is Gilead Sciences Standing Right Now?

- Currently trading with a volume of 2,570,655, the GILD's price is down by -0.41%, now at $93.63.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 63 days.

Expert Opinions on Gilead Sciences

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $97.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Gilead Sciences, targeting a price of $105. * Maintaining their stance, an analyst from UBS continues to hold a Neutral rating for Gilead Sciences, targeting a price of $96. * An analyst from JP Morgan persists with their Overweight rating on Gilead Sciences, maintaining a target price of $105. * An analyst from RBC Capital has decided to maintain their Sector Perform rating on Gilead Sciences, which currently sits at a price target of $84. * An analyst from Baird has decided to maintain their Neutral rating on Gilead Sciences, which currently sits at a price target of $95.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Gilead Sciences, Benzinga Pro gives you real-time options trades alerts.