Woking, UK-based Linde plc (LIN) operates as a specialty chemical company. It offers various atmospheric gases and is involved in the processing of oxygen, nitrogen, argon, carbon dioxide, acetylene, and more. With a market cap of $196.4 billion, Linde’s operations span the Americas, Europe, the Indo-Pacific, and Africa.

Specialty chemical giant Linde has notably underperformed the broader market over the past year. LIN stock prices have observed a marginal 44 bps uptick on a YTD basis and declined 9.7% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.4% gains in 2025 and 12.7% returns over the past year.

Narrowing the focus, LIN has also underperformed the Materials Select Sector SPDR Fund’s (XLB) 2% uptick in 2025, but marginally outperformed XLB’s 10% plunge over the past 52 weeks.

Linde’s stock prices dropped 2.7% in the trading session following the release of its Q3 results on Oct. 31. While the company’s Indo-Pacific sales remained under pressure, its Americas sales grew by 6% and EMEA sales observed a 3% growth. Overall, the company’s topline increased 3.1% year-over-year to $8.6 billion, surpassing the Street’s expectations by 17 bps. Meanwhile, its adjusted EPS increased 6.9% year-over-year to $4.21, exceeding the consensus estimates by 72 bps.

Despite the better-than-expected earnings, Linde reduced the high-end of its full-year earnings guidance, which wasn’t received well by the investors.

For the full fiscal 2025, ending in December, analysts expect LIN to deliver an adjusted EPS of $16.43, up 5.9% year-over-year. The company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

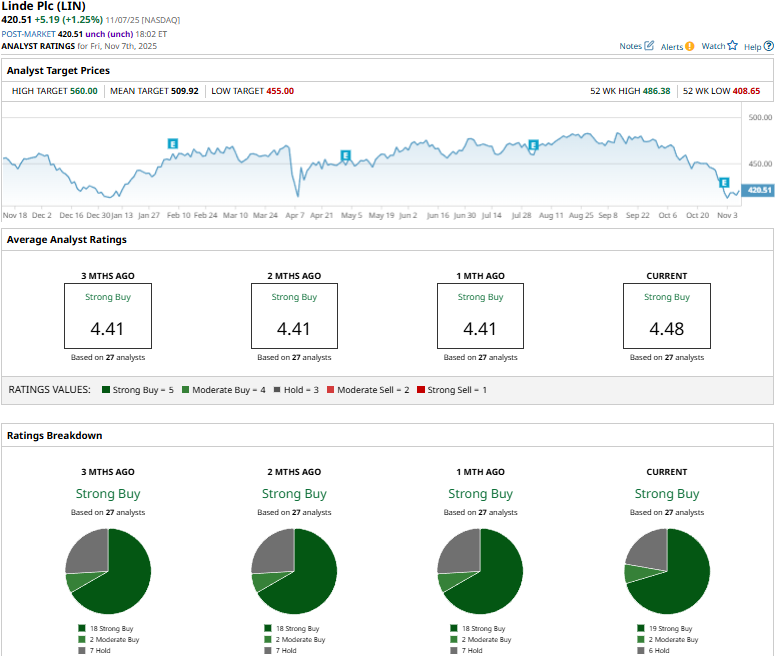

Among the 27 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 19 “Strong Buys,” two “Moderate Buys,” and six “Holds.”

This configuration is slightly more optimistic than a month ago, when only 18 analysts gave “Strong Buy” recommendations.

On Nov. 6, RBC Capital analyst Arun Viswanathan reiterated an “Outperform” rating on LIN, but lowered the price target from $576 to $540.

Linde’s mean price target of $509.92 represents a 21.3% premium to current price levels. Meanwhile, the street-high target of $560 suggests a 33.2% upside potential.