Key takeaways:

- Fenghuang Qiushi has submitted a new application to list in Hong Kong, its fourth such submission in just 16 months

- The company is highly dependent on Tencent Music, deriving 38.1% of its revenue from the company last year

By Tina Yip

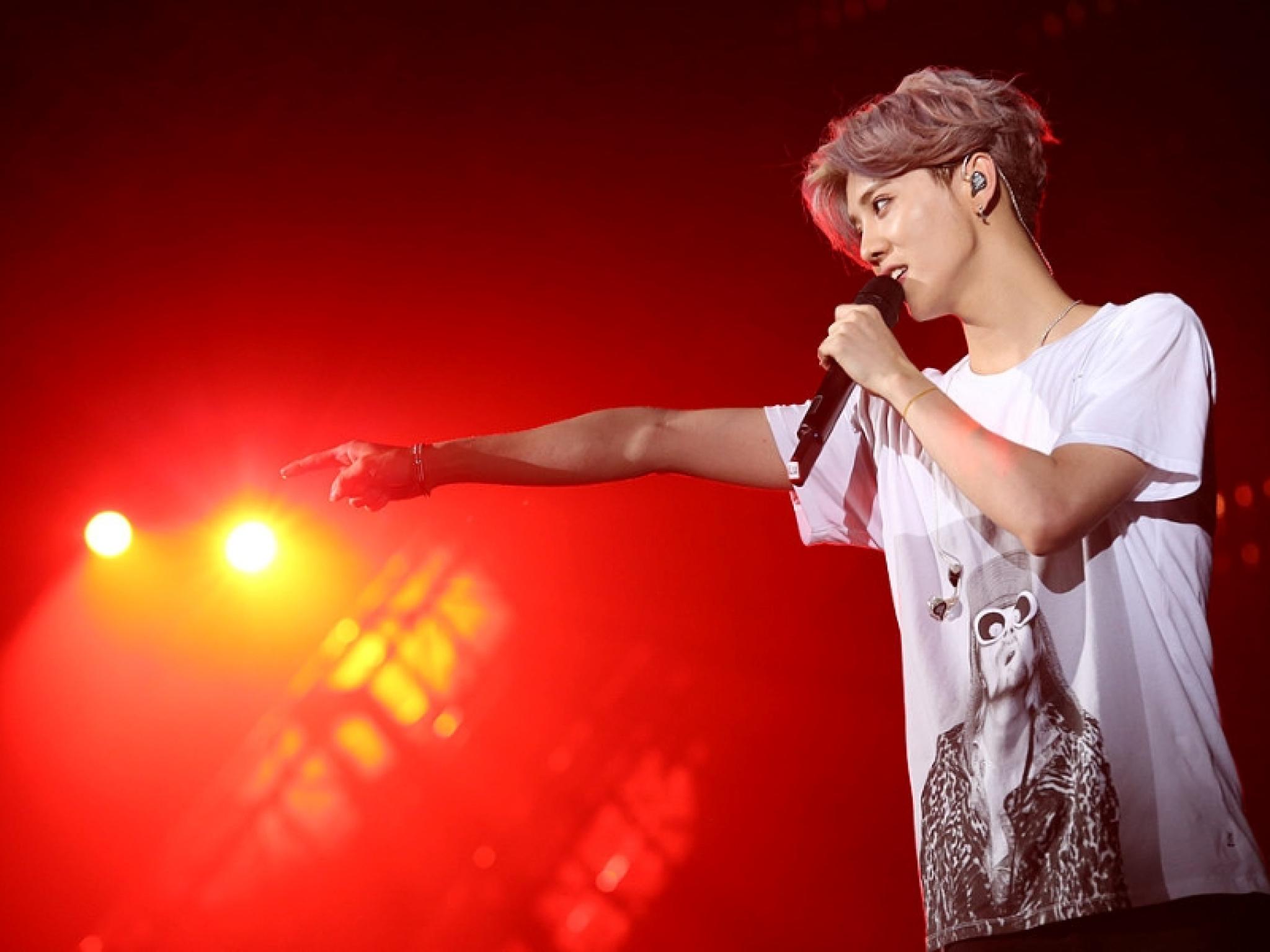

Once he was a member of a K-pop group called EXO. Now he’s a frequent star in movies and TV dramas. And he once appeared on China’s annual Spring Festival Gala, the world’s most-watched program, ushering in each Lunar New Year.

Now pin-up star Lu Han has yet another role to play, this time as main attraction in the newly filed Hong Kong IPO application by music entertainment company Fenghua Qiushi Group Holdings Ltd. In fact, this isn’t the first time Lu has starred in such a role. The April 1 filing represents Fenghua Qiushi’s fourth attempt at an IPO in just 16 months, following failed forays – which all later expired – in January, September and November last year.

Many things can lead to a listing’s abortion, including bad market sentiment or failure to satisfy exchange officials’ questions during listing hearings. When that happens, applicants can always take another stab by submitting updated documents. Fenghua Qiushi is doing just that, with Alliance Capital Partners Ltd. acting as the deal’s sole sponsor.

The company didn’t explain why it failed in its last three attempts. But analysts have cited skepticism about the company’s financial health. Fenghua Qiushi represents nine musicians and 10 training artists, led by Lu Han and the famous Black Panther act. Major concerns arise over its dependence on Lu Han and another major undisclosed “client X”, believed to be Tencent Music (NYSE:TME).

So, has anything changed with the latest application?

Not much, other than updated financial information. The company is quite up front about its continued reliance on Lu Han. In the three years from 2019 to 2021, the star single-handedly raked in 14.2 million yuan ($2.23 million), 15 million yuan and 7.6 million yuan, respectively. That accounted for 25.5% and 21.2% of its revenue in 2019 and 2020, though the figure dropped to 9.3% in 2021. Before that, he brought in 50 million yuan in concert earnings in 2018, representing a whopping 70% of Fenghua Qiushi’s total revenue that year.

His declining revenue contribution over the last two years can largely be chalked up to pandemic-related concert cancellations, meaning the figure is likely to go back up once he can take the stage again.

The company has three main operations: music licensing and recording; concert management and production; and artist management. Music licensing and recording is the largest, with revenue up 7.2% last year to 73.71 million yuan – accounting for 90.1% of the year’s total of 81.85 million yuan. Revenue associated with the client believed to be Tencent Music accounted for 78.6%, 68.1% and 38.1% in the last three years, respectively.

Companies like Fenghua Qiushi typically represent pop stars and make money by charging online streaming services for royalties. But exclusivity demands by the largest platforms often mean that companies like Fenghua Qiushi can only license their music to a single platform. Many are hoping that could change as China steps up its ongoing crackdown on monopolistic practices, including the outlawing of such exclusive licensing deals in new amendments last year to China’s anti-monopoly law.

Fewer productions

Content is everything for music licensing companies. In that regard, Fenghua Qiushi had 689 digitized musical works, 410 created by the company itself, at the end of last year. But the number of new productions has been falling steadily in past three years, from 57 in 2019 to 36 in 2020 and just 21 last year. As that happened, total production costs fell from 8.07 million yuan to 7.22 million yuan and 2.17 million yuan, with average cost per production also dropping from 202,000 yuan in 2019 to 104,000 yuan last year. The plummeting costs have helped to keep the company’s gross margins for its productions quite high, exceeding 80% for its music licensing and recording business in each of the last three years.

Under contracts with some of its streaming partners, the company is required to add at least 100 new productions each year or 50 over a specified time period. That means when its own productions fail to top that number, Fenghua Qiushi must purchase music from outside sources. Last year alone, it bought 262 such musical productions, a huge jump from the previous year when it only bought 16.

The company may be looking to raise money now as it aims to significantly ramp up its own productions to 180 over two years and stockpile enough money to produce concerts that are expensive to stage. The production target is particularly tall when one considers the company has only put out 114 such musical productions in the last three years combined.

In one worrisome sign, Fenghua Qiushi’s net profit fell 18% last year to 39.1 million yuan. But what concerns investors more is the company’s future, especially if it loses Lu Han. The company is quite clear on that point, noting it isn’t sure if Lu Han will stay once his current contract is up.

Policy risks

Changing regulations in China’s sensitive media landscape also pose a major risk for the company. Last August, the Chinese National Radio and Television Administration announced new regulations to clamp down on inappropriate conduct in show business, specifically targeting the effeminate appearance of some male artists. Lu Han came under fire in that instance due to his looks, and had to cut his hair and show pictures of himself with whiskers to show off his manhood.

The company also runs the risk of having its partners punished, which in turn could deal it a blow. Five of its artists were once in the running on a TV talent show that was so popular that it had 2 billion views. But the show was later banned for being a “star cultivation show.” Such shows are likely to be heavily scrutinized going forward, depriving the company of a major venue for cultivating future stars.

We can calculate Fenghua Qiushi’s valuation using some of China’s many listed entertainment production companies, including Shaw Brother (0953.HK), Transmit Entertainment (1326.HK) and H&R Century Union (000892.SZ). The three have estimated price-to-earnings (P/E) ratios ranging from 8 times to 37 times. Using a 20 times P/E as the average, Fenghua Qiushi could expect a relatively modest valuation of HK$960 million ($123 million).

With so much change in the air – both good and bad – a company like Fenghua Qiushi remains very much a work in progress that investors could have difficulty assessing. In such an environment the lyrics from a Lu Han song may summarize the company’s chances of success for its fourth IPO attempt: “You might know where it comes and where it will go. But does that mean you can catch it?”