Jon Peddie Research (JPR) has released a snapshot of its latest PC market analysis, showing that over the last three months, global shipments of CPUs for notebooks and desktop PCs have declined, compared to the constant growth throughout 2023. The portion of those shipments for desktop PCs has also continued to shrink, and JPR predicts that this trend will carry on for the next few months of 2024.

In total, JPR estimates that 62 million client-based CPUs were shipped in the first quarter of this year. That's a decrease of 10%, compared to the final quarter of 2023, but it is 32% better than this time last year. 2023 was a good year for AMD and Intel, as CPU shipments went from 47 million to 69 million, over the 12 months.

The small decline for the start of 2024 might be viewed as being a negative thing, but Jon Peddie, the president of JPR, believes otherwise.

"Q1’s decrease in client CPU shipments from four quarters of positive news threw a few off, especially investors. It’s actually good news in a sense if it is an indication that the market has stabilized and has returned to its traditional cyclic behavior. If that’s the case, and we think it is, Q2 will also be down."

The cyclic behaviour Peddie is referring to is when a new range of products gets launched, generating a boost in shipments. That tails off over time, reaching a low point before the next round of new models is released, kick starting the cycle again. However, in recent years, the overall trend has been on the slide, as various markets have been very sluggish, especially the likes of China.

We're expecting AMD to launch its Zen 5 architecture later this year, though it may announce new Ryzen, Threadripper, and EPYC chips at Computex in June. Intel is also aiming to launch Lunar Lake for mobile platforms and Arrow Lake for desktop PCs this year, too, so the glut of fresh chips should result in a healthy boost to global CPU shipments.

Add in competition from Qualcomm in the form of the Snapdragon X Elite and Microsoft's big Windows update, and you've got the perfect recipe for a significant improvement in shipments.

Best gaming PC: The top pre-built machines.

Best gaming laptop: Great devices for mobile gaming.

One potential spanner in the works is whether the markets are willing to pay for the expected higher prices of products festooned with AI labels. Embedded AI accelerators are all well and good, but if the rest of the chip isn't anything special, then AMD, Intel, and the rest might not get the sales they're hoping for.

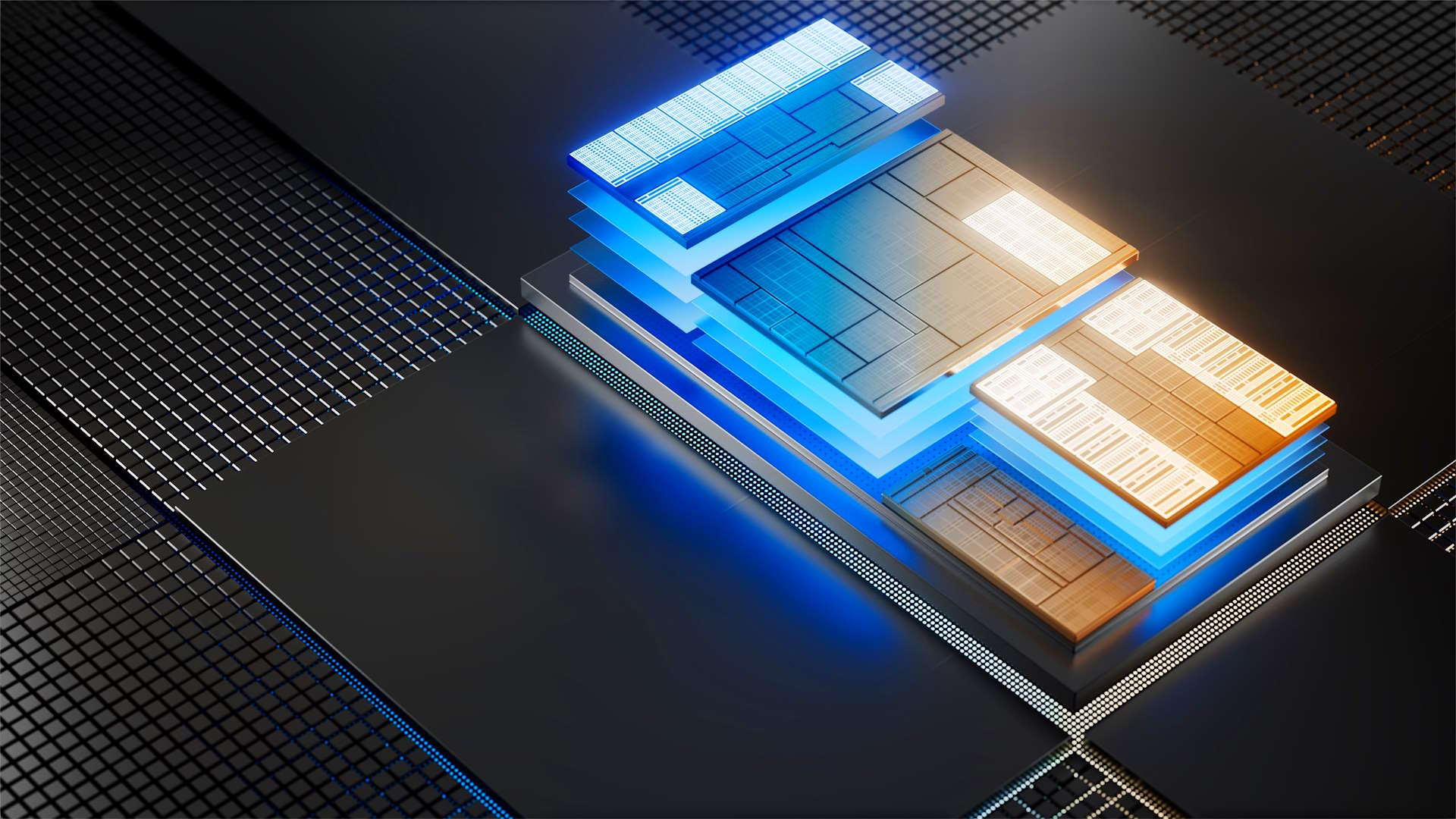

Intel's Meteor Lake wasn't a huge hit with PC enthusiasts, mostly because the CPU part of the CPU (it's all multiple tiles/chiplets, these days) wasn't notably better than the generation of processors preceding it.

With billions of dollars being spent throughout the entire industry on building new fabrication plants (let alone the billions spent on R&D), a disappointing year of shipments is the last thing that CPU vendors and investors want.