With a market cap of $43.9 billion, The Kroger Co. (KR) is a leading food and drug retailer in the United States. The company operates a variety of store formats, including combination food and drug stores, multi-department stores, marketplace stores, and price impact warehouses, offering groceries, pharmacy services, general merchandise, and specialty products.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Kroger fits this criterion perfectly. In addition to retail, Kroger manufactures and processes food products and sells fuel through its fuel centers, serving customers both in-store and online.

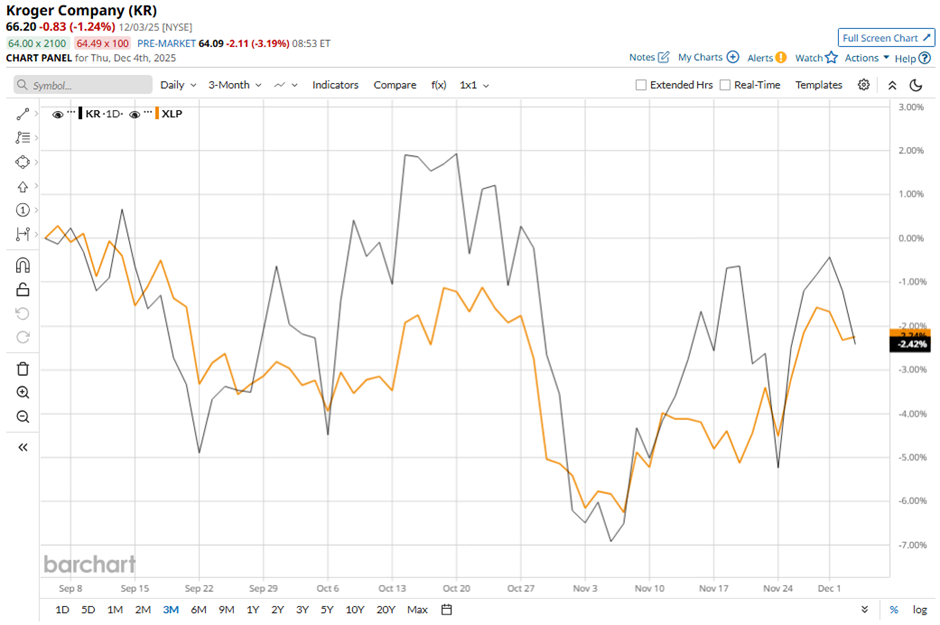

Shares of the Cincinnati, Ohio-based company have pulled back 14.6% from its 52-week high of $74.90. Shares of Kroger have declined 5.7% over the past three months, lagging behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 2.3% decrease over the same time frame.

Longer term, KR stock is up 4.6% on a YTD basis, outperforming XLP’s marginal rise. Moreover, shares of the company have increased 6.8% over the past 52 weeks, compared to XLP’s 4.4% decrease over the same time frame.

Despite a few fluctuations, the stock has fallen below its 200-day moving average since mid-September.

Kroger reported strong Q3 2025 results on Dec. 4, including a 2.6% increase in identical sales without fuel and 17% growth in eCommerce sales. Investors also reacted positively to Kroger raising the lower end of its full-year adjusted EPS guidance to a new range of $4.75 to $4.80, supported by adjusted FIFO operating profit of $1.09 billion. Confidence was further boosted by management’s expectation that the eCommerce business will become profitable in 2026 and by continued share repurchases under the remaining $2.5 billion authorization.

In comparison, rival The Procter & Gamble Company (PG) has lagged behind Kroger stock. Shares of Procter & Gamble have decreased 16.1% over the past 52 weeks and 12.4% on a YTD basis.

Despite the stock’s better performance relative to the sector over the past year, analysts are cautiously optimistic about its prospects. KR stock holds a consensus rating of “Moderate Buy” from the 21 analysts covering it, and the mean price target of $77.50 is a premium of 17.1% to current levels.