Houston, Texas-based Kinder Morgan, Inc. (KMI) operates as an energy infrastructure company. Valued at $60.5 billion by market cap, the company owns and operates pipelines that transport natural gas, gasoline, crude oil, carbon dioxide, and other products, as well as terminals that store petroleum products and chemicals and handle bulk materials like coal and petroleum coke. The midstream giant is expected to announce its fiscal fourth-quarter earnings for 2025 in the near future.

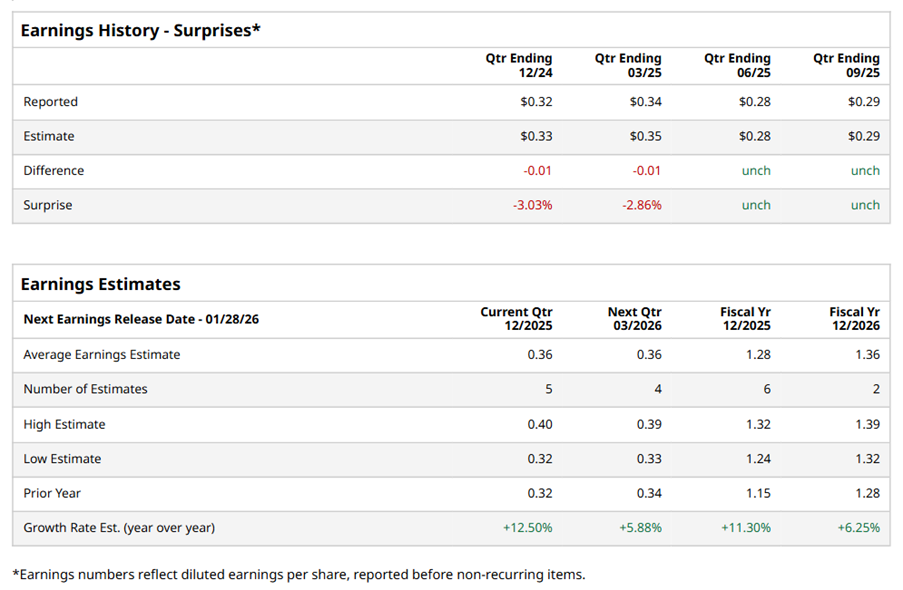

Ahead of the event, analysts expect KMI to report a profit of $0.36 per share on a diluted basis, up 12.5% from $0.32 per share in the year-ago quarter. The company met the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

For the full year, analysts expect KMI to report EPS of $1.28, up 11.3% from $1.15 in fiscal 2024. Its EPS is expected to rise 6.3% year over year to $1.36 in fiscal 2026.

KMI stock has underperformed the S&P 500 Index’s ($SPX) 14.8% gains over the past 52 weeks, with shares down marginally during this period. Similarly, it underperformed the Energy Select Sector SPDR Fund’s (XLE) 4.8% returns over the same time frame.

On Oct. 22, KMI reported its Q3 results, and its shares fell 4.8% in the following trading session. Its adjusted EPS of $0.29 met Wall Street expectations. The company’s revenue stood at $4.1 billion, up 12.1% year over year. KMI expects full-year adjusted EPS to be $1.27.

Analysts’ consensus opinion on KMI stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 20 analysts covering the stock, 10 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and nine give a “Hold.” KMI’s average analyst price target is $31.74, indicating a potential upside of 16.7% from the current levels.