If you’re preparing to tie the knot, you’re likely focused on the joyful details with your future spouse — the venue, the honeymoon and building a life together. However, one crucial topic often gets overlooked by newlywed couples: your financial future in the event of a divorce.

Learn More: Here’s Why Couples Fight About Money and How They Can Stop, According to Rachel Cruze

Find Out: Mark Cuban Tells Americans To Stock Up on Consumables as Trump's Tariffs Hit -- Here's What To Buy

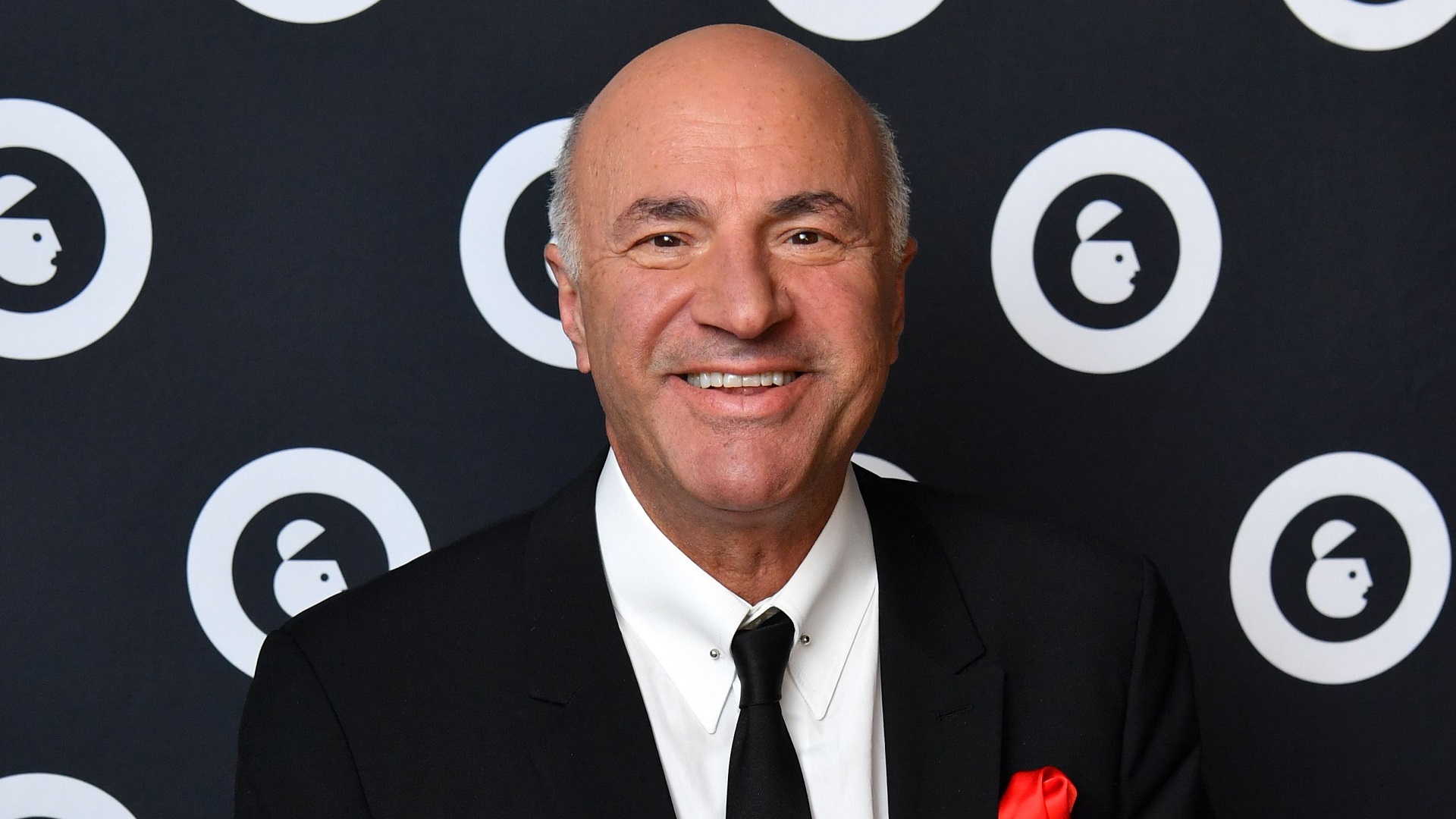

According to “Shark Tank” investor Kevin O’Leary, every couple, regardless of their income, should consider a prenuptial agreement to protect their individual finances in case anything happens down the line. O’Leary even partnered with HelloPrenup, an online prenuptial agreement platform, to advocate for smarter financial planning before marriage.

Here’s why O’Leary believes a prenup is essential for all couples, even those that aren’t wealthy.

Why Every Couple Should Consider a Prenup

Although a marriage typically means the joining together of finances, O’Leary said that it’s important to maintain your own accounts.

“Each spouse should have their own financial identity,” he told GOBankingRates. “They should never give that up, because you don’t know what’s going to happen in marriage. The stats aren’t great. And if you give up your financial identity, you are lost when you get divorced. You’re in a lot of trouble.”

A prenuptial agreement can ensure that any financial accounts that are yours alone stay that way, even if your marriage comes to an end. After all, according to HelloPrenup, roughly 50% of marriages end in divorce, yet only 10% of couples have a prenuptial agreement.

Read Next: Here’s Why You Always Want To Know Your Net Worth, According to a Financial Expert

How Prenups Can Strengthen Financial Communication

It might be uncomfortable to bring up the topic of a prenuptial agreement, but the process of creating one can spark some necessary conversations about your finances as a couple.

“The other thing I like about the prenup is it’s a form of due diligence on your partner,” O’Leary said. “What matters in a marriage is not just the romantic aspect — you’re founding a financial entity, and you’re doing that to support a family one day.”

Having these conversations allows you to find out a lot about your potential spouse before you walk down the aisle. “A prenup forces you to do that, which I think is fantastic,” O’Leary said.

Prenups Aren’t Just for the Wealthy — Here’s Why

It’s a common misconception that you don’t need a prenup unless you are rich, but as O’Leary pointed out, even if you are not rich now, you will likely build wealth over the course of your marriage.

“The assumption when going into marriage — [especially] if you’re getting married in your 20s — is that you will be successful, and you will slowly get wealthier,” he said. “That’s the whole American Dream in the first place, and so you want the foundation to start with the prenuptial agreement.”

Couples marrying today should factor in not only expenses like children from a prior marriage into their premarital agreements, but also taxes, spousal support, separate properties and even the state laws surrounding marriage where you live specifically.

Caitlyn Moorhead contributed to the reporting for this article.

More From GOBankingRates

- 5 Old Navy Items Retirees Need To Buy Ahead of Winter

- I Paid Off $40,000 in 7 Months Doing These 5 Things

- How Much Money Is Needed To Be Considered Middle Class in Your State?

- 3 Reasons Retired Boomers Shouldn't Give Their Kids a Living Inheritance (And 2 Reasons They Should)

This article originally appeared on GOBankingRates.com: Kevin O’Leary Says You Need a Prenup — Even If You’re Not Rich