On Tuesday, Jeff Bezos’ Amazon.com, Inc. (NASDAQ:AMZN) unveiled advanced AI chip clusters designed to enhance the performance of its partner, Anthropic.

This development aims to challenge the current market leaders, Nvidia Corporation (NASDAQ:NVDA) and ChatGPT-maker OpenAI.

What Happened: During Amazon's biggest re:Invent conference of the year, the tech giant deployed hundreds of thousands of its Trainium2 semiconductors into clusters, significantly boosting Anthropic’s processing power.

The new chip cluster, named Project Rainier, is expected to be the world’s largest dedicated AI hardware set, containing over 100,000 chips.

Amazon intends to provide an alternative to Nvidia’s GPUs, which are often expensive and scarce. The company said it will provide customers with computing power supported by Nvidia's new Blackwell chip beginning early next year, reported Bloomberg.

See Also: Apple’s Foldable iPhone Could Spark Smartphone Market Revival In 2026, Says Expert

Amazon Web Services announced that it began providing customers with its latest chips starting Tuesday.

Amazon’s CEO, Andy Jassy, introduced the Nova models, which can generate text, images, and video. These models are Amazon’s latest attempt to rival OpenAI’s advanced GPT models.

Why It Matters: This latest development in AI chip clusters is part of Amazon's ongoing partnership with Anthropic. The e-commerce giant has boosted this collaboration with a $4 billion investment in the AI startup, bringing the total to $8 billion.

This partnership also positions AWS as Anthropic’s primary cloud provider and training partner, leveraging AWS Trainium and Inferentia chips for future models.

Earlier in September, Amazon also received some positive news when the U.K.’s Competition and Markets Authority approved this partnership, allowing Amazon to proceed without regulatory hurdles.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Last month, Amazon reported third-quarter sales of $158.9 billion, reflecting an 11% increase compared to the last year. This figure surpassed the Wall Street consensus estimate of $157.2 billion, according to data from Benzinga Pro.

Price Action: Amazon’s stock rose by 1.30% on Tuesday, finishing at $213.44. In pre-market trading, it saw a further increase of 0.35%, reaching $214.18. So far this year, Amazon shares have surged by 43.76%, significantly outperforming the Nasdaq 100 index, which gained 28.32% over the same period.

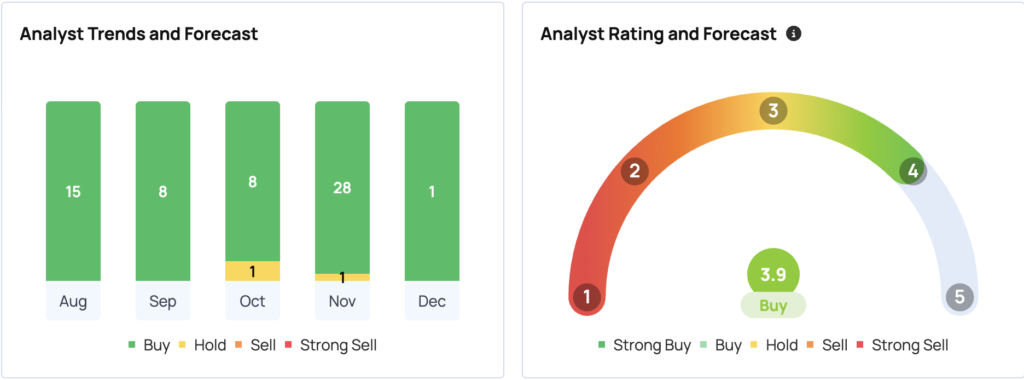

Amazon holds a consensus price target of $238.16 from 38 analysts, with the highest target of $285 set by JMP Securities on Nov. 1. The latest ratings from BMO Capital, MoffettNathanson, and Redburn Atlantic point to an average target of $239.67, suggesting an 11.92% upside.

Check out more of Benzinga's Consumer Tech coverage by following this link.

Read Next:

Image via Shutterstock