Zoom Video Communications, Inc. (ZM), a leading provider of communication platforms, recently posted impressive second-quarter earnings. In addition, the company's forecasted profits for the third quarter have outperformed Wall Street predictions, with an adjusted profit per share anticipated to fall between $1.07 and $1.09, a figure surpassing the Refinitiv analysts' average estimate of $1.03.

Even though the company's revenue expansion no longer matches the fourfold increase witnessed during the global pandemic, there is still a sense of optimism within ZM. The confidence primarily emanates from solid technical investments and what appears to be significant potential for growth in the Asia-Pacific region.

Considering these factors, it would be prudent to examine the trends of ZM's primary financial indicators to understand better the potential benefits of investing in its stock.

Analyzing Zoom Video Communications' Financial Performance Trends: Growth, Downturn, and Volatility (October 2020 - July 2023)

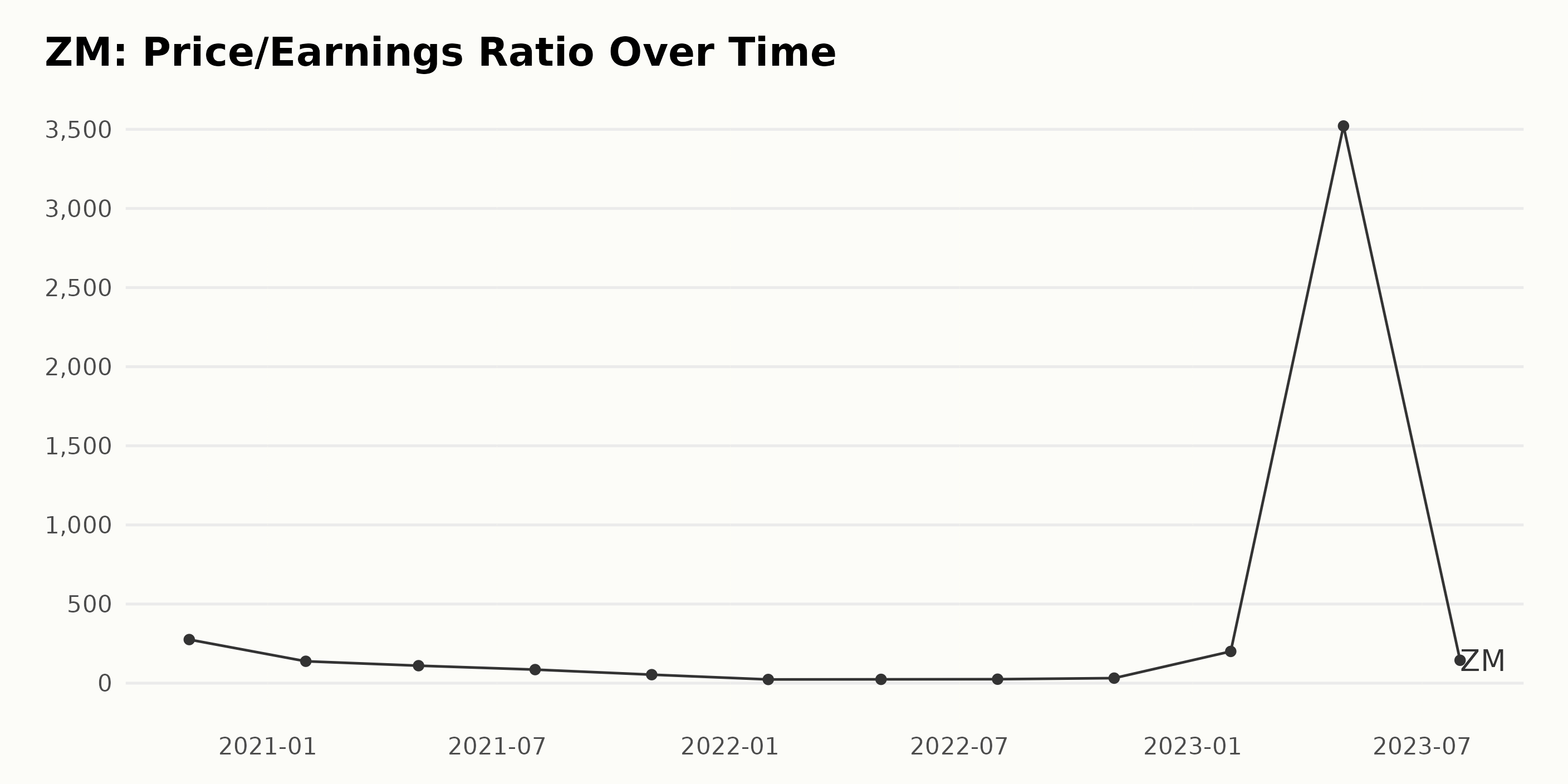

ZM's reported Price/Earnings ratio (P/E) exhibited significant fluctuations and a trend of sharp boom and bust over the series interval. Notably, several key points clearly illustrate this trend:

- Beginning in October 2020, ZM's P/E was notably high at 275.598.

- A consistent decline occurred over the following year, reaching a low of 23.468 in January 2022. This represents a decrease of about 91.49% from the original value in October 2020.

- A modest uptick occurred over the following months, bringing ZM's P/E to 31.877 in October 2022.

- However, a sudden and substantial surge occurred at the beginning of 2023, skyrocketing ZM's P/E to an unprecedented 3,521.008 in April 2023 - a growth of approximately 11,076.38% from its value in January 2023.

- As quickly as it shot up, ZM's P/E plummeted back down to 144.755 in July 2023, reflecting yet another dramatic shift.

From the data, we understand that ZM’s P/E experienced considerable volatility, which was characterized by a significant downturn between October 2020 and January 2022, a modest recovery for the rest of 2022, an extreme surge in early 2023, and a sudden fall by July 2023.

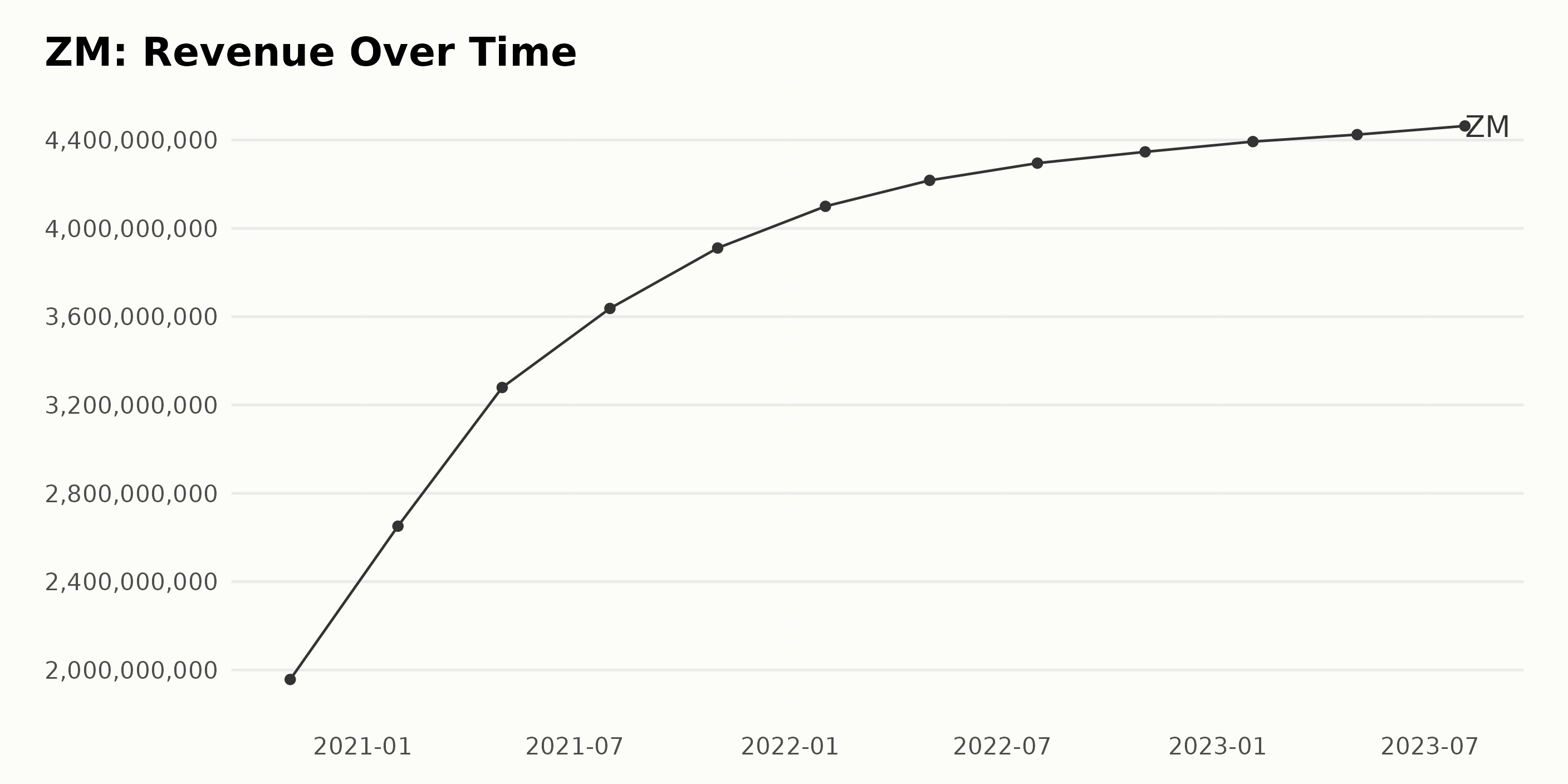

The trend and fluctuations in the trailing-12-month revenue of ZM show a largely consistent increase over the reported period, though the sharpness of the increase begins to level off gradually as we move towards more recent data. Here are notable points:

- On October 31, 2020, the revenue was $1.96 billion.

- By January 31, 2021, there was a considerable increase to $2.65 billion.

- A steady rise is observed through 2021, with an evident peak at $3.91 billion by October 31, 2021.

- The first half of 2022 showcases a somewhat slower upward trend, but the revenue still manages to rise to $4.29 billion by July 31, 2022.

- Revenue continues to grow but at a diminishing rate, reaching $4.35 billion by October 31, 2022, and $4.39 billion by January 31, 2023.

- From April to July 2023, the growth is marginal, going from $4.42 billion to $4.46 billion.

There is a substantial increase when we measure the growth rate from the first value to the last. The revenue has gone from $1.96 billion in October 2020 to $4.46 billion by July 2023. This signifies a growth of approximately 128%. This growth showcases how ZM has significantly expanded its revenue base over the period.

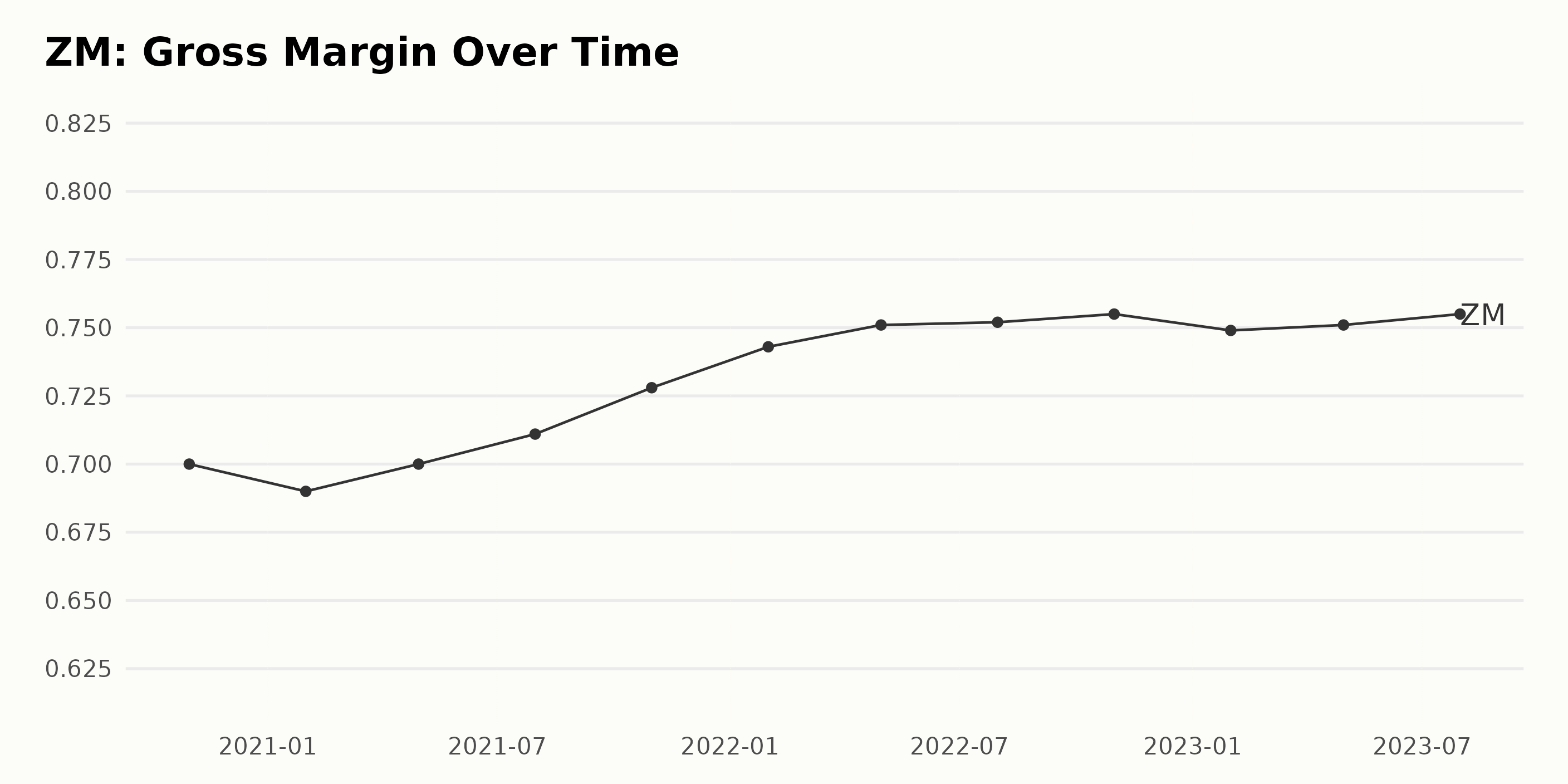

The gross margin for ZM shows an overall upward trend over the evaluated period. Here is a summary of the percentage fluctuation over time:

- October 2020: 70%

- January 2021: 69%

- April 2021: 70%

- July 2021: 71.1%

- October 2021: 72.8%

- January 2022: 74.3%

- April 2022: 75.1%

- July 2022: 75.2%

- October 2022: 75.5%

- January 2023: 74.9%

- April 2023: 75.1%

- July 2023: 75.5%

Though the company experienced a slight dip in January 2021, it quickly recovered and maintained a consistent growth trajectory. The gross margin peaked at 75.5% in October 2022 and July 2023. From the start of the period in October 2020 (70%) to the end in July 2023 (75.5%), the growth rate indicates an increase of around 5.5%.

The last observed value in July 2023 was similar to the peak value reached in October 2022, offering a sign of consistency in the company's gross margin over time. Despite minor fluctuations, the data depicts a positive upward trend for ZM's gross margin in the given time frame.

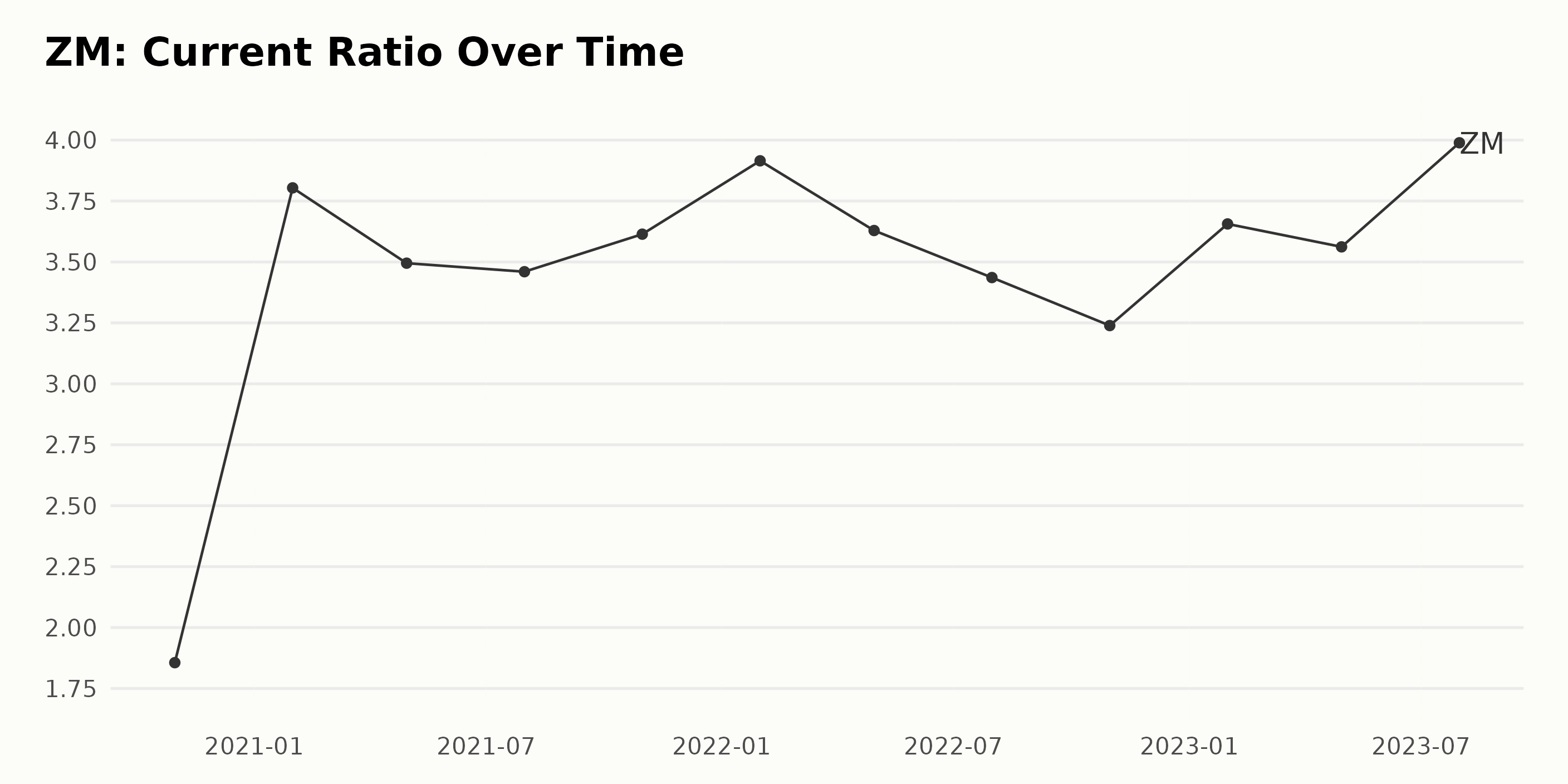

Based on the comprehensive data presented, the current ratio of ZM has shown an overall increasing trend from October 2020 to July 2023, with some fluctuations in between.

- In October 2020, the current ratio was 1.86.

- It saw a significant increase by January 2021, reaching 3.80, and has remained above 3 since then.

- However, there were periods of minor drops: April 2021 (3.50), July 2021 (3.46), April 2022 (3.63), July 2022 (3.44), and October 2022 (3.24).

- After dropping to 3.24 in October 2022, it increased again, reaching 3.66 in January 2023, 3.56 in April 2023, and peaking at 3.99 in July 2023.

The growth rate from October 2020 (1.86) to July 2023 (3.99), calculated from the first to the last value in the series, is approximately 114%. The current ratio peaks twice during the period, first in January 2021 (3.80) and then in July 2023 (3.99). However, regular fluctuations demonstrate a level of volatility in ZM's financial liquidity.

The most recent data from 2023 indicates an improving trend in the company's current ratio, implying a stronger ability for the company to meet its short-term obligations.

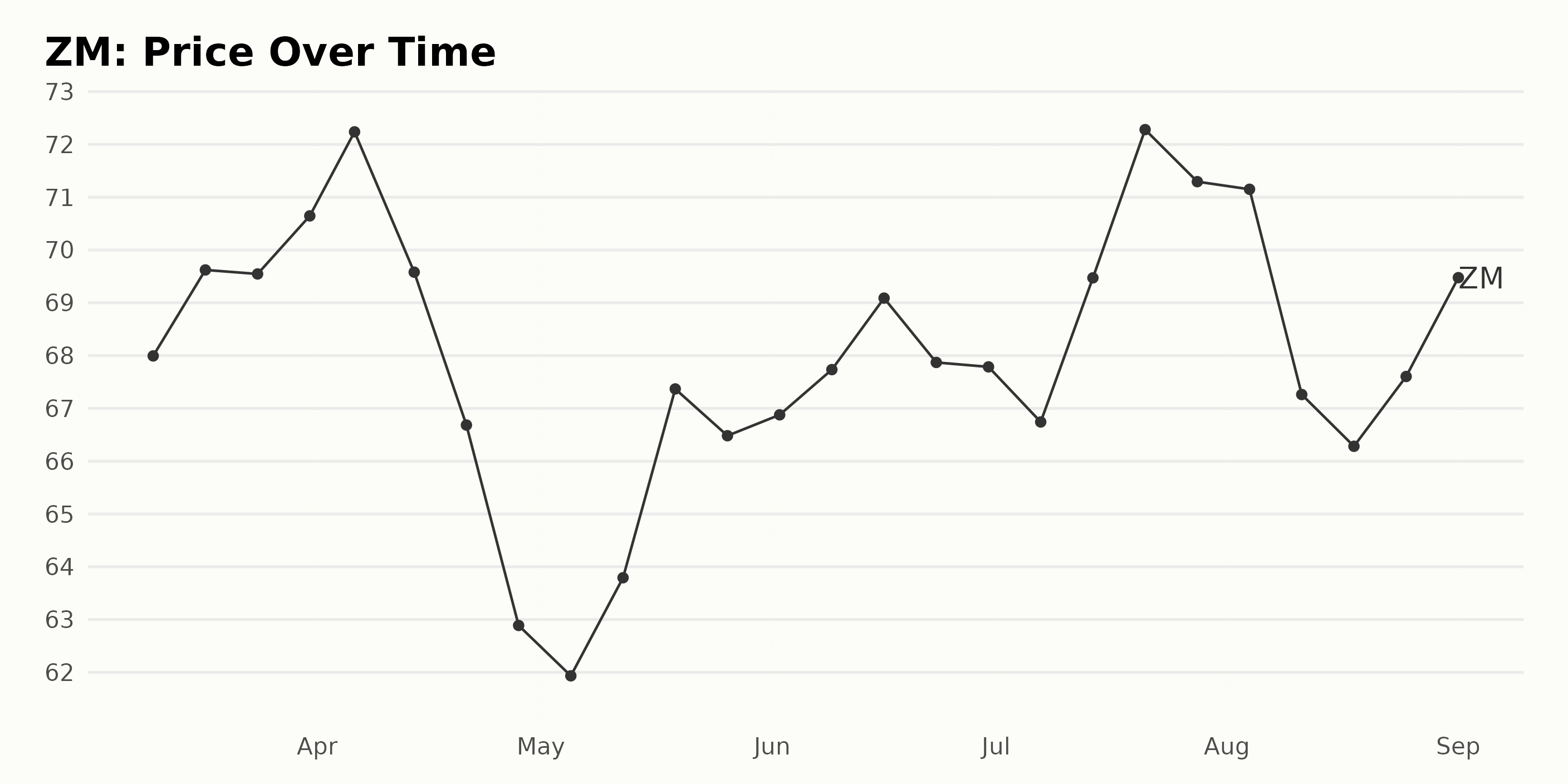

Analyzing the Volatility Trends in Zoom Video Communications Share Prices in 2023

Below, you can find the analysis of the data for ZM:

- On March 10, 2023, the share price was $67.99.

- This gradually increased, reaching $72.24 on April 6, 2023.

- However, by the end of April, there was a notable decrease in the share price to $62.89.

- In May, there was an overall trend of growth where the price rose from $61.93 to $67.37.

- The price fluctuated slightly during June, seeing a slight peak at $69.09 and ending the month at $67.79.

- In July 2023, we observed another significant rise, with the share price reaching $72.28 but dropping slightly at the end of the month to $71.29.

- Furthermore, in August, there was a decline where the share price dropped to $66.28 before picking up again at the end of the month.

- On September 1, 2023, the share price was $71.72.

In terms of growth rate, the price demonstrated an initial increasing trend up until April, followed by a sharp deceleration until the end of the same month. The share price then started to grow again, with some fluctuations, reaching a peak in July and then decreasing in August, followed by a final increase in early September.

This pattern signifies a certain level of volatility in the stock's performance over the examined period. Here is a chart of ZM's price over the past 180 days.

Zoom Video Communications Shows Remarkable Growth, Quality, and Value in 2023

The POWR Ratings grade for the company ZM, which falls under the Technology - Services category, has shown some improvements over the period from March 11, 2023, to September 2, 2023. Here's a summary of its performance:

- From March 11, 2023, to April 1, 2023, ZM held a steady B (Buy) POWR grade and ranked #26 out of 77 stocks in its category.

- In April 2023, it improved slightly, ranking #24 during the weeks of April 8 and April 15 and eventually reaching the #22 position by the week of April 22. By the end of the month (April 29), it had moved up to the #21 position.

- During May 2023, ZM's rank fluctuated between #24 and #18 while maintaining its B (Buy) POWR grade.

- Continuing into June 2023, there was a promising improvement as ZM reached the #16 rank during the weeks of June 3 and June 17. However, the month ended with a drop as its rank fell back to the #22 position on June 24.

- The month of July saw similar performance, with the rank fluctuating between #22 and #17 while still maintaining the B (Buy) POWR grade.

- In August, ZM saw a substantial improvement, ending the month with a B (Buy) POWR grade and a #9 rank in the category as of September 4, 2023.

Although the ranking fluctuated from March to August, the latest data shows a significant improvement both in POWR grade and rank within its category.

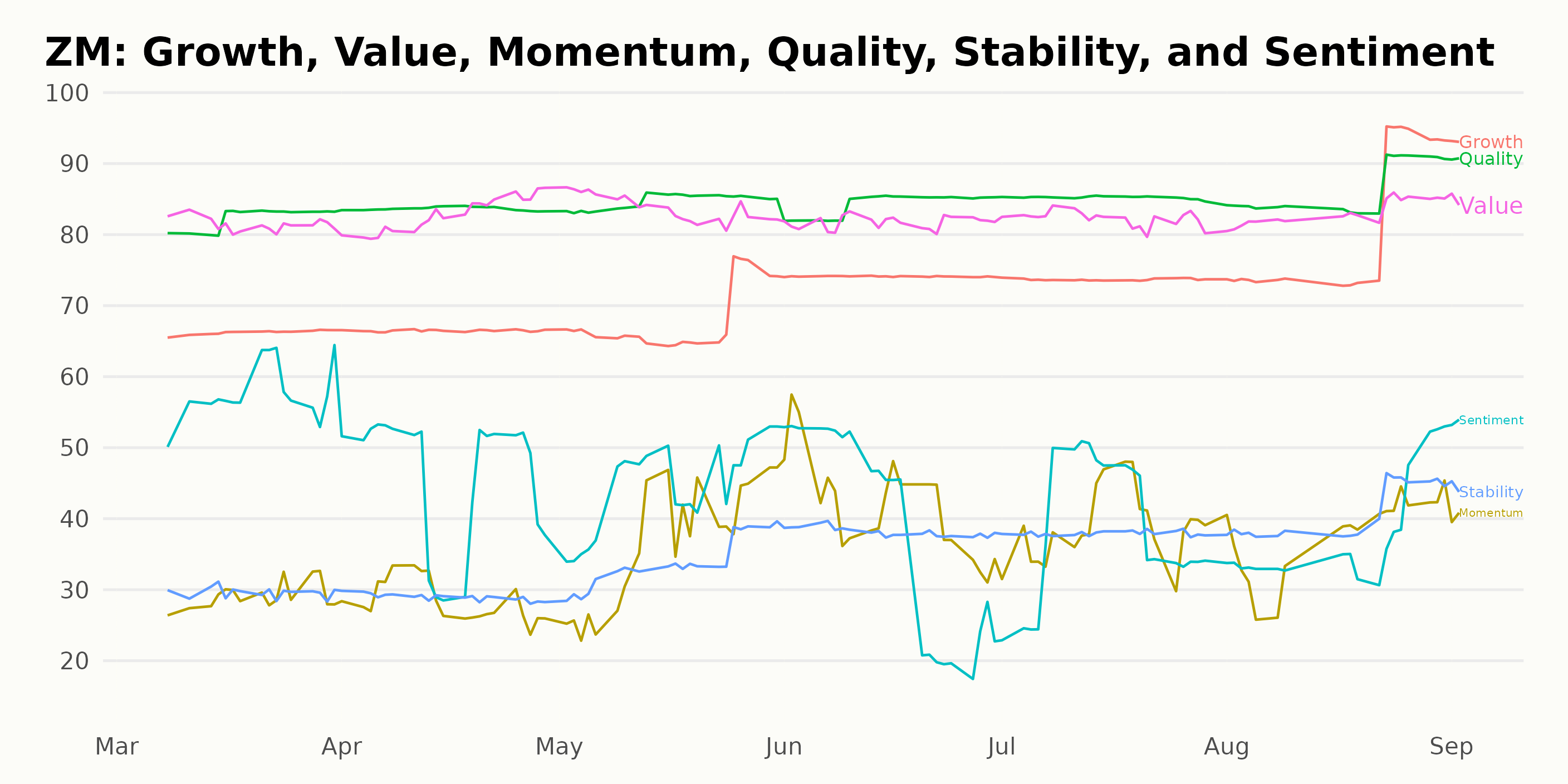

Based on the POWR Ratings for ZM, the three most noteworthy dimensions are Growth, Quality, and Value. These dimensions have the highest values in the data.

- Growth: The Growth ratings steadily improved from March 2023 to September 2023. It began with a score of 66 in March 2023, maintained until April of the same year, then gradually climbed to 93 by September 2023. This steady increase indicates an ongoing positive trend in ZM's capacity to expand its market share or sales revenue.

- Quality: The Quality dimension consistently got high scores, starting at 82 in March 2023 and incrementally increasing to reach a peak of 91 by September 2023. High and increasing scores demonstrate ZM's consistent performance and robust financial health over the examined timeframe.

- Value: Starting at 81 in March 2023, the Value rating saw minor fluctuations but remained generally stable or slightly increasing. By the last assessment in September 2023, it reached 85. This consistently high rating shows ZM's ability to provide good value to its investors.

From these observations and trends, one can infer that ZM performed noticeably well regarding Growth, Quality, and Value across the dated range.

How does Zoom Video Communications, Inc. (ZM) Stack Up Against its Peers?

Other stocks in the Technology - Services sector that may be worth considering are Serco Group plc (SCGPY), NetScout Systems, Inc. (NTCT), and Teradata Corporation (TDC) - they have better POWR Ratings. Click here to see the stocks in the Technology - Services industry.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

ZM shares were unchanged in premarket trading Monday. Year-to-date, ZM has gained 5.88%, versus a 18.87% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

Is Zoom Video Communications (ZM) Worth Chasing in September? StockNews.com