New York-based International Flavors & Fragrances Inc. (IFF) manufactures and markets food, beverage, health and biosciences, scent, and complementary adjacent products. It is valued at a market cap of $19.7 billion.

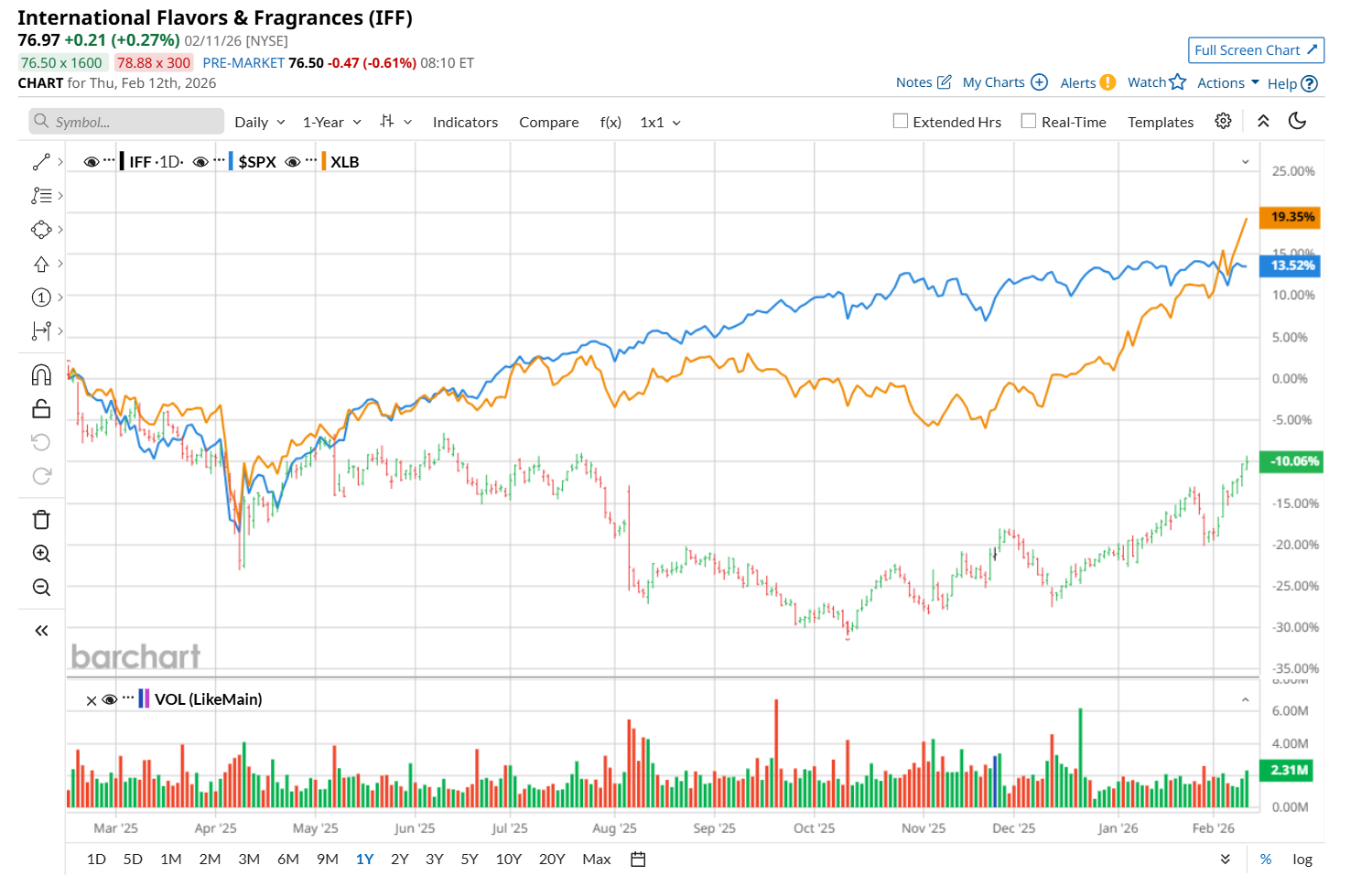

This scent company has lagged behind the broader market over the past 52 weeks. Shares of IFF have declined 9.7% over this time frame, while the broader S&P 500 Index ($SPX) has soared 14.4%. However, on a YTD basis, the stock is up 14.2%, outpacing SPX’s 1.4% return.

Narrowing the focus, IFF has also trailed the State Street Materials Select Sector SPDR ETF (XLB), which rose 20.1% over the past 52 weeks and 18.2% on a YTD basis.

On Feb. 11, IFF delivered mixed Q4 results. The company’s revenue declined 6.6% year-over-year to $2.6 billion, but topped analyst estimates by 3.2%. On the earnings front, its adjusted EPS dropped 14% from the year-ago quarter to $0.80, missing consensus estimates of $0.85.

For fiscal 2026, ending in December, analysts expect IFF’s EPS to grow 7.4% year over year to $4.51. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

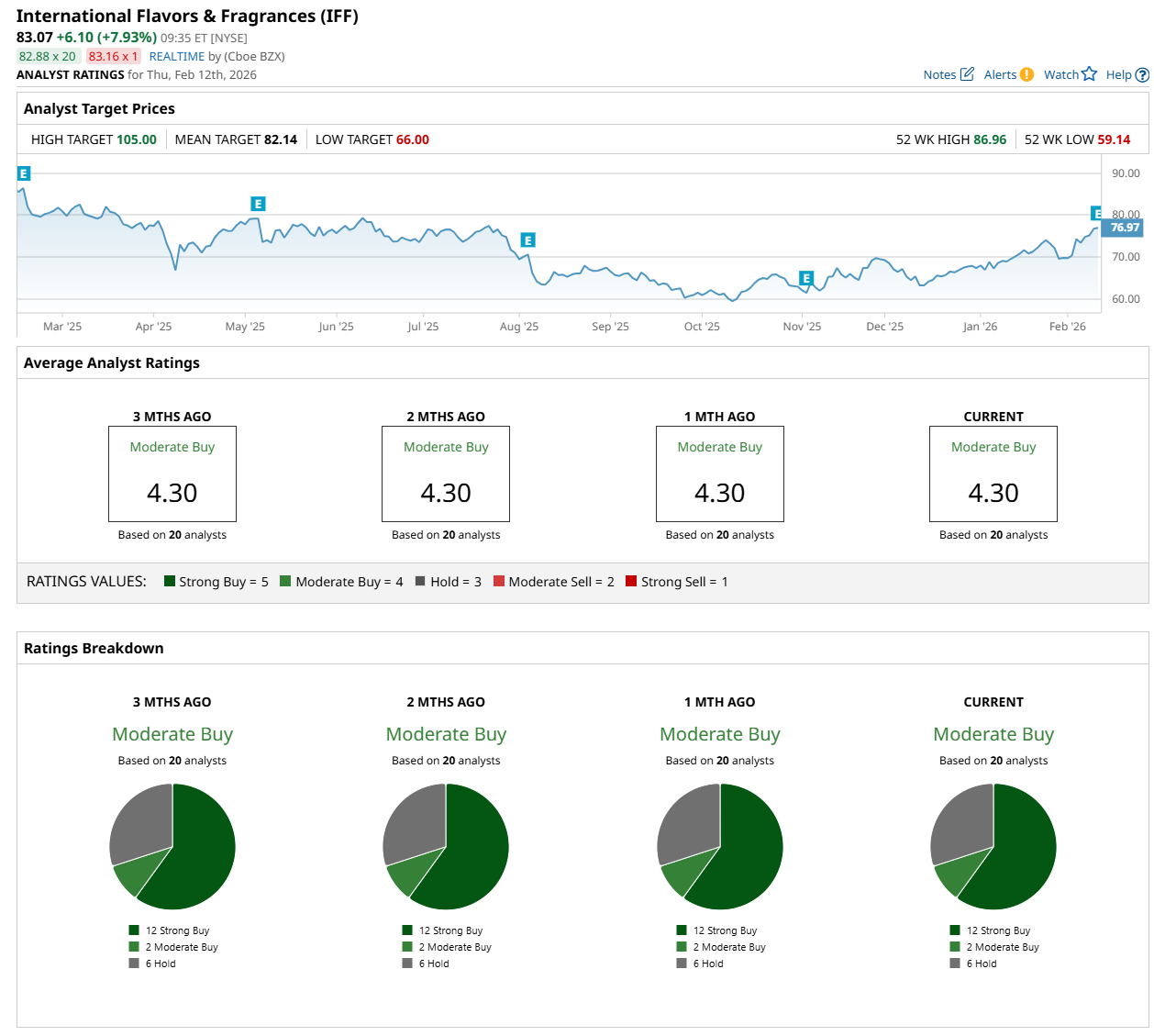

Among the 20 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 12 “Strong Buy,” two “Moderate Buy,” and six "Hold” ratings.

The configuration has remained stable over the past three months.

On Jan. 21, Argus Research analyst Alexandra Yates maintained a “Buy" rating on IFF and set a price target of $80.

While the company is trading above its mean price target of $82.14, its Street-high price target of $105 suggests a 26.4% potential upside from the current levels.