Valued at a market cap of $29.3 billion, Fox Corporation (FOXA) is a news, sports, and entertainment company based in New York.

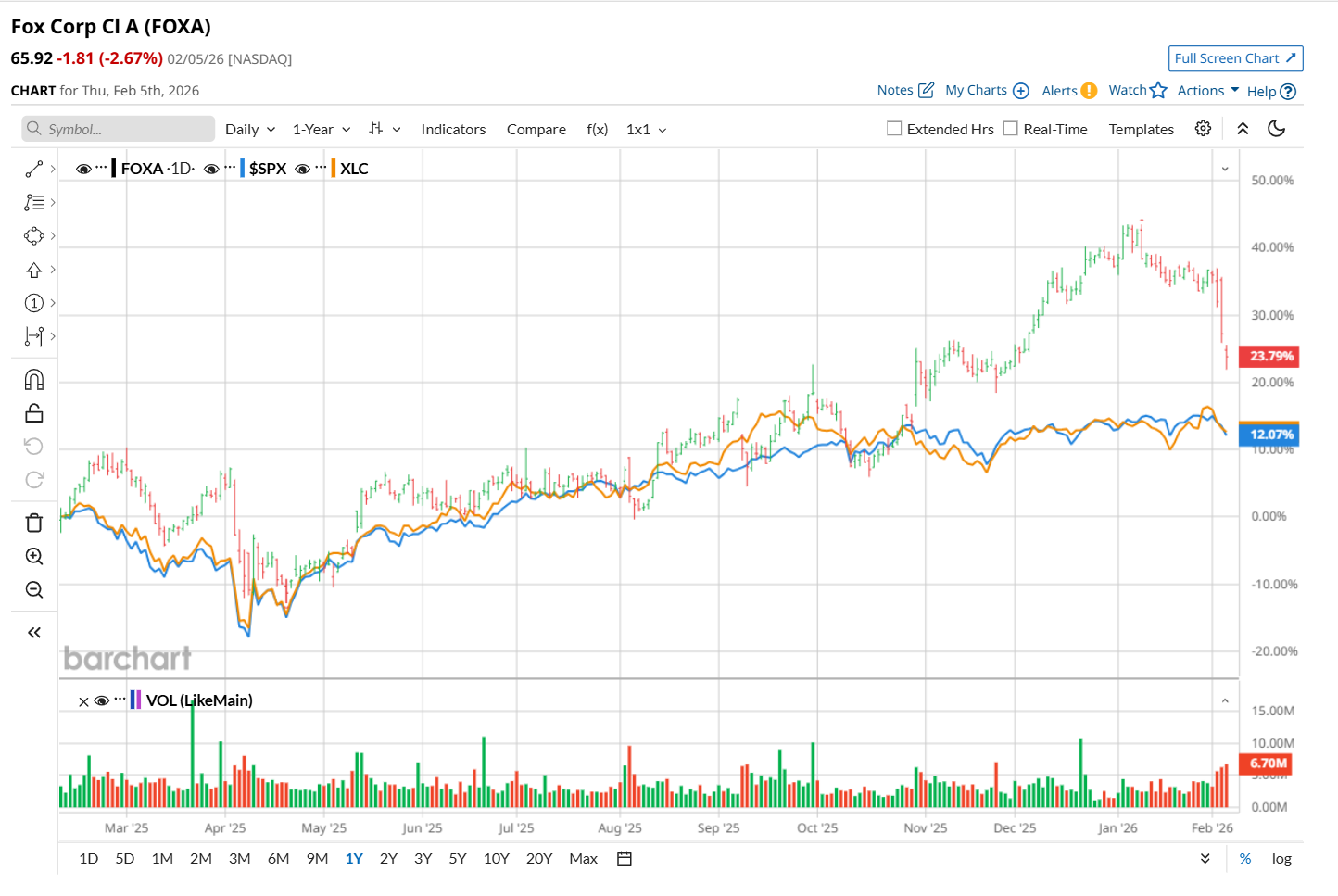

This entertainment company has outpaced the broader market over the past 52 weeks. Shares of FOXA have rallied 20.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.2%. However, on a YTD basis, the stock is down 9.8%, lagging behind SPX’s marginal drop.

Zooming in further, FOXA has outperformed the State Street Communication Services Select Sector SPDR ETF’s (XLC) 13.4% rise over the past 52 weeks. However, it has trailed XLC’s 1.3% YTD decline.

On Feb. 4, shares of FOXA plunged 3.6% after its Q2 earnings release, despite delivering stronger-than-expected results. Primarily due to robust growth in its distribution revenues, the company’s total revenue grew 2% year-over-year to $5.2 billion, beating analyst expectations by 2.4%. However, its adjusted EBITDA declined 11.4% from the same period last year to $692 million as the revenue increase was more than offset by higher expenses. Additionally, its adjusted EPS of $0.82 fell 14.6% from the prior-year quarter, but handily topped analyst estimates of $0.47.

For fiscal 2026, ending in June, analysts expect FOXA’s EPS to decline 5.9% year over year to $4.50. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

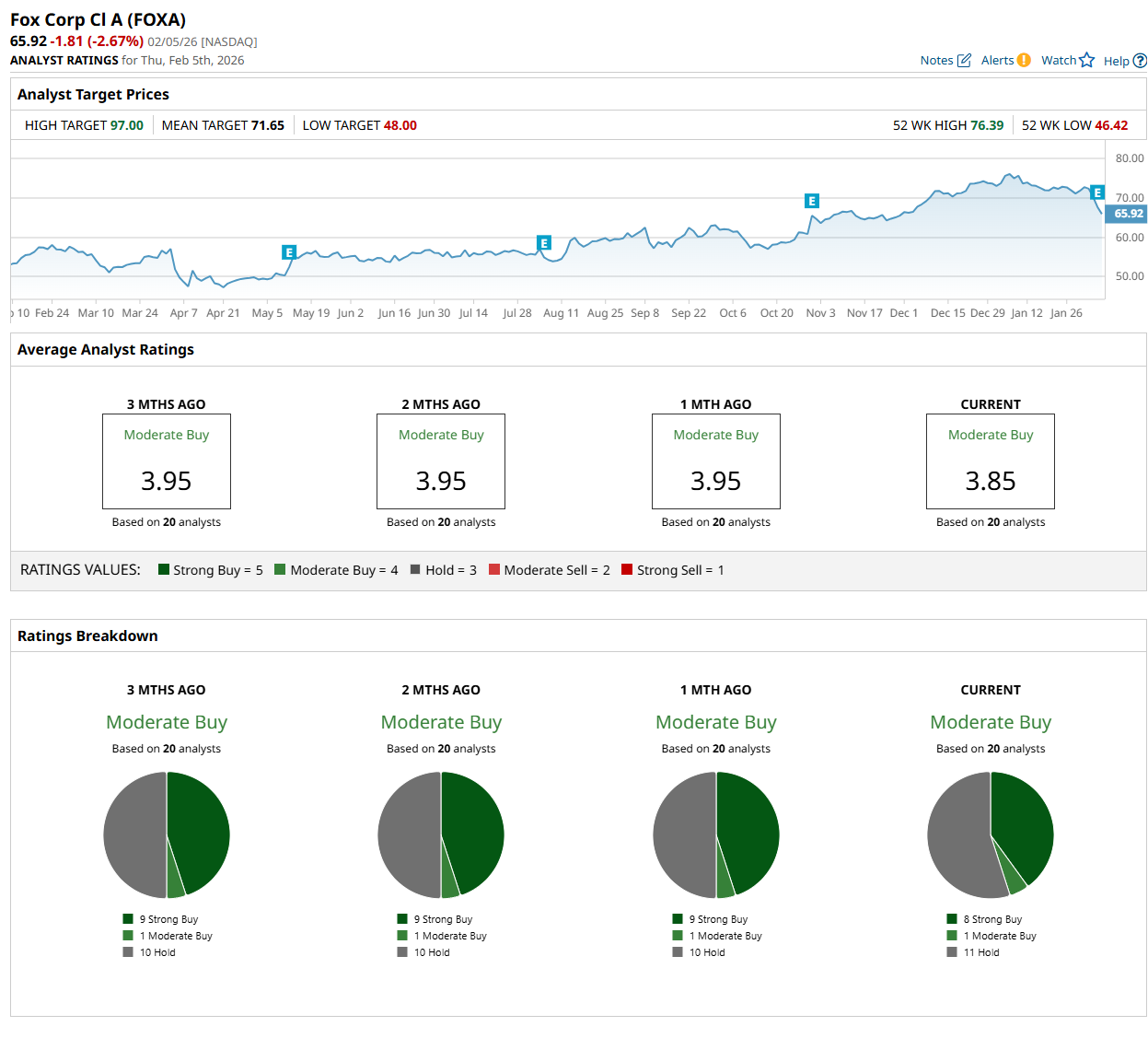

Among the 20 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on eight “Strong Buy,” one "Moderate Buy,” and 11 "Hold” ratings.

The configuration is less bullish than a month ago, with nine analysts suggesting a “Strong Buy” rating.

On Feb. 5, Evercore Inc. (EVR) analyst Kutgun Maral maintained a “Hold” rating on FOXA and set a price target of $70, indicating a 6.2% potential upside from the current levels.

The mean price target of $71.65 represents an 8.7% premium from FOXA’s current price levels, while the Street-high price target of $97 suggests a 47.1% potential upside from the current levels.