/Aflac%20Inc_%20sign-%20by%20yu_photo%20via%20Shutterstock.jpg)

Columbus, Georgia-based Aflac Incorporated (AFL) is a leading provider of supplemental health and life insurance, best known for its workplace insurance products that help cover expenses not paid by primary medical plans. Valued at a market cap of $59.5 billion, the company operates primarily in the United States and Japan, with Japan representing a major share of its revenue and earnings

This insurance company has lagged behind the broader market over the past 52 weeks. Shares of AFL have gained 9.5% over this time frame, while the broader S&P 500 Index ($SPX) has soared 12.2%. However, on a YTD basis, the stock is up 6.5%, compared to SPX’s marginal drop.

However, zooming in further, AFL has outpaced the SPDR S&P Insurance ETF’s (KIE) 1.8% uptick over the past 52 weeks and 1.7% YTD decline.

On Feb. 4, Aflac Incorporated reported its Q4 2025 results, sending shares up 1.4%. Total revenue declined 9.3% year over year to $4.9 billion. Its adjusted earnings decreased 5.4% to $818 million, though adjusted EPS rose marginally to $1.57. Net investment gains dropped 46.3% year over year to $537 million from $1 billion, reflecting weaker derivatives, currency, and securities performance. Shareholders’ equity strengthened to $29.5 billion, or $56.85 per share, up from $26.1 billion a year earlier, and the company generated a strong annualized return on equity of 19%, highlighting solid capital strength despite softer earnings.

For the current fiscal year, ending in December, analysts expect AFL’s EPS to decline 1.7% year over year to $7.36. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in two of the last four quarters, while missing on two other occasions.

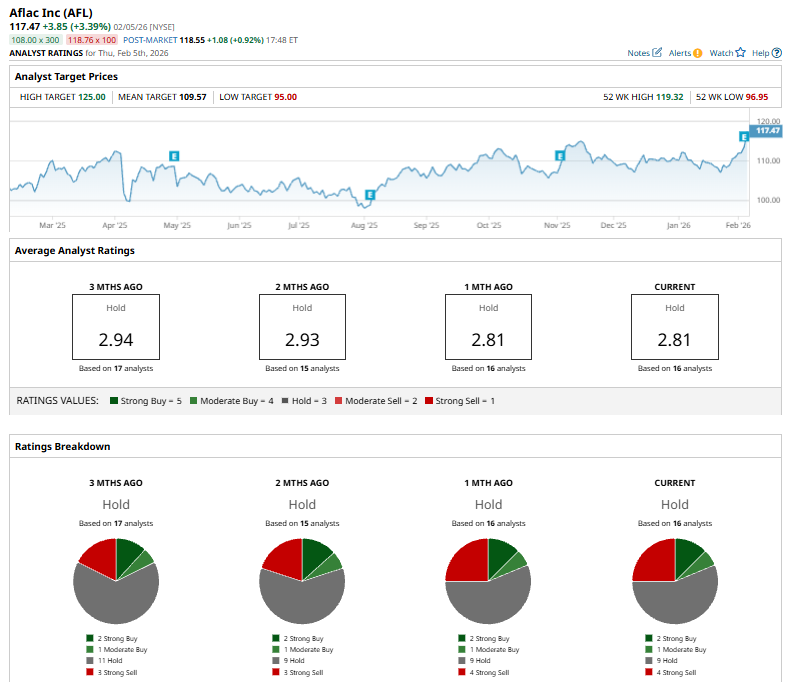

Among the 16 analysts covering the stock, the consensus rating is a "Hold,” which is based on two “Strong Buy,” one "Moderate Buy,” nine "Hold,” and four "Strong Sell ratings.

The configuration has remained consistent over the past three months.

On Jan. 8, Barclays lowered its price target on Aflac Incorporated to $101 from $104 and maintained an “Equal-Weight” rating as part of its 2026 outlook. The firm said it is cautiously optimistic on life insurers, citing strong capital positions, solid cash flow, and industry consolidation as key positives, while noting that spread compression and rising technology spending remain ongoing headwinds.

While the company is trading above its mean price target of $109.57, its Street-high price target of $125 suggests an upside potential of 6.4% from the current market prices.