/Royal%20Caribbean%20Group%20sign%20by-%20JHVEPhoto%20via%20iStock.jpg)

Valued at a market cap of $72.5 billion, Miami, Florida-based Royal Caribbean Cruises Ltd. (RCL) is a global cruise company. It operates 67 ships across its Royal Caribbean International, Celebrity Cruises, and Silversea Cruises brands.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Royal Caribbean Cruises fits this criterion perfectly. The company offers a wide range of itineraries, serving travelers around the world.

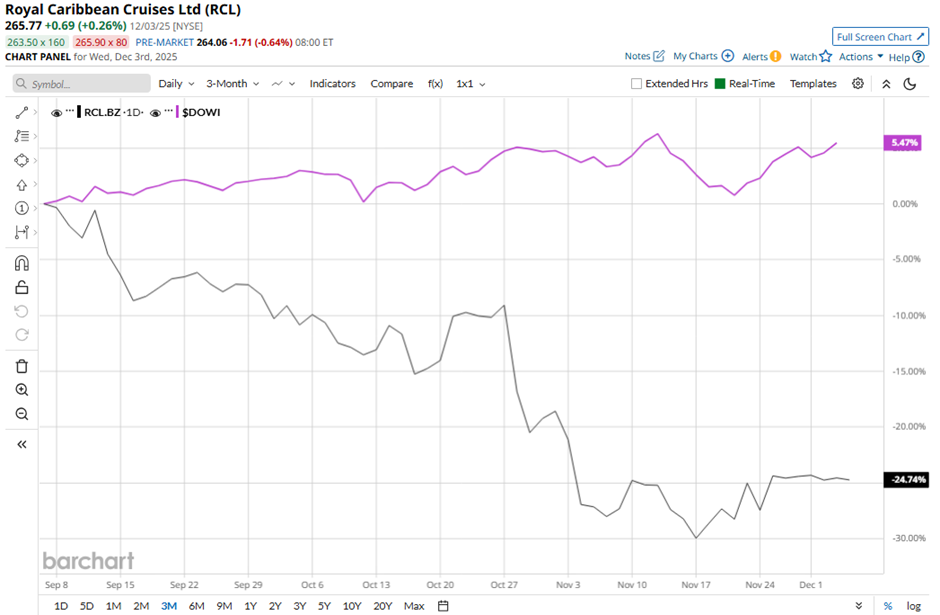

Shares of Royal Caribbean Cruises have declined 27.9% from its 52-week high of $366.50. Over the past three months, its shares have decreased 25.1%, underperforming the broader Dow Jones Industrials Average's ($DOWI) 5.8% rise during the same period.

Longer term, RCL stock is up 15.2% on a YTD basis, outpacing DOWI's 12.6% gain. Moreover, shares of the cruise operator have returned 8.1% over the past 52 weeks, compared to DOWI’s 7.1% increase over the same time frame.

However, the stock has been trading below its 50-day moving average since mid-September.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $5.75, shares of RCL tumbled 8.5% on Oct. 28 because revenue of $5.14 billion missed forecasts. Investors also reacted to rising costs, with NCC ex-fuel up 4.8% and Gross Cruise Costs per APCD up 2.7%, alongside pressures from adverse weather and the extended closure of Labadee, which weighed on expectations for Q4. Additionally, the company issued softer Q4 guidance of $2.74 to $2.79 in adjusted EPS.

In comparison, rival Airbnb, Inc. (ABNB) has performed weaker than RCL stock. ABNB stock has dipped 8.6% YTD and 12.6% over the past 52 weeks.

Despite the stock’s outperformance relative to the Dow over the past year, analysts remain cautiously optimistic about its prospects. RCL stock has a consensus rating of “Moderate Buy” from 25 analysts in coverage, and the mean price target of $335.92 is a premium of 26.4% to current levels.