Philip Morris International Inc. (PM) is a leading multinational tobacco company that manufactures and sells cigarettes and a growing range of smoke-free nicotine products, including heated tobacco, vaping, and oral nicotine, with its headquarters in Stamford, Connecticut. Its market cap is around $243.6 billion.

Companies valued at over $10 billion are typically classified as “large-cap stocks,” and Philip Morris International falls into this category, reflecting its considerable scale, stability, and influence within the tobacco industry. Its robust brand portfolio, most notably Marlboro, gives the company strong pricing leverage and a durable competitive edge.

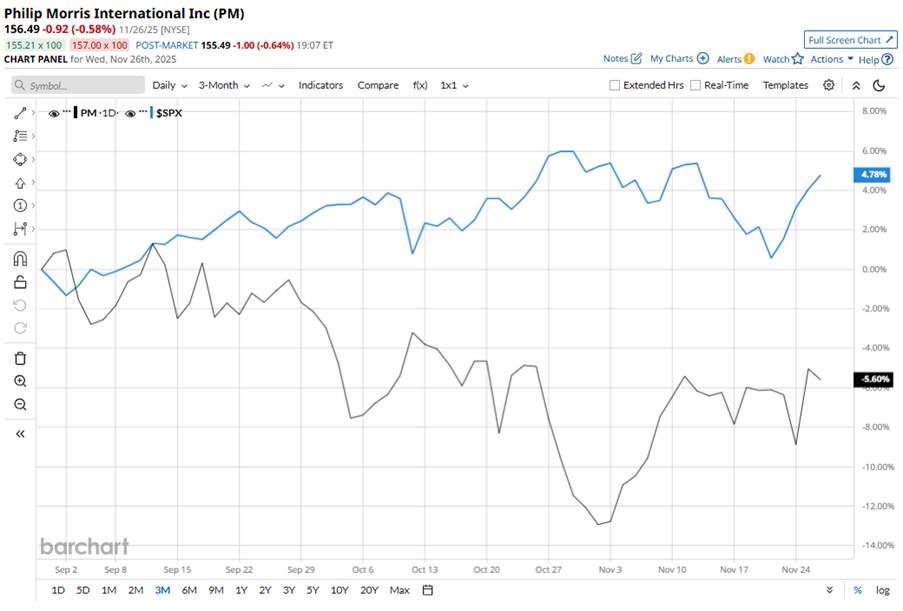

PM stock is trading 16.2% below its 52-week high of $186.69, reached on June 16. The stock is down 6.1% over the past three months, underperforming the S&P 500 Index’s ($SPX) 5.4% gain during the same time frame.

Over the longer term, Philip Morris’ shares rose 18.3% over the past 52 weeks, and 30% on a year-to-date (YTD) basis. By contrast, the SPX is up 13.1% over the past 52 weeks, surging by 15.8% YTD.

PM stock spent most of the year cruising above its 200-day line, a steady bull run that looked like it had strong tailwinds. But as autumn rolled in, the momentum slipped. By October, it sank below the 200-day moving average, and by late July, the stock dipped under its 50-day moving average, too. Now PM’s chart is like a once-confident rally pausing to catch its breath.

PM stock has surged over the past year because the company’s push into “smoke-free” products like ZYN nicotine pouches and IQOS heated-tobacco units has gained strong consumer traction worldwide, boosting revenues and margins. At the same time, continued pricing strength on its traditional combustible tobacco business in several markets has helped preserve cash flow and profitability.

Philip Morris’ rival, Altria Group, Inc. (MO), has underperformed PM, with 1.9% gains over the past year and a 12.2% surge YTD.

The stock has a consensus rating of “Strong Buy” from 14 analysts covering it, while its mean price target of $187.38 suggests 19.7% upside potential ahead.