/PayPal%20Holdings%20Inc%20logo%20on%20phone-%20by%20bizoo_n%20via%20iStock.jpg)

San Jose, California-based PayPal Holdings, Inc. (PYPL) is a leading global fintech company that provides digital and mobile payment solutions enabling consumers and merchants to send, receive, and manage money across online and in-person channels. With a market cap of $58.7 billion, PayPal operates a broad payments ecosystem that includes services like Venmo, Braintree, Xoom, and Honey, supporting e-commerce, peer-to-peer transfers, and global transactions.

Companies worth $10 billion or more are generally described as “large-cap stocks.” PayPal fits this bill perfectly. With billions in annual revenue and a large global user base, PayPal plays a key role in powering secure, seamless digital payments in today’s cashless economy.

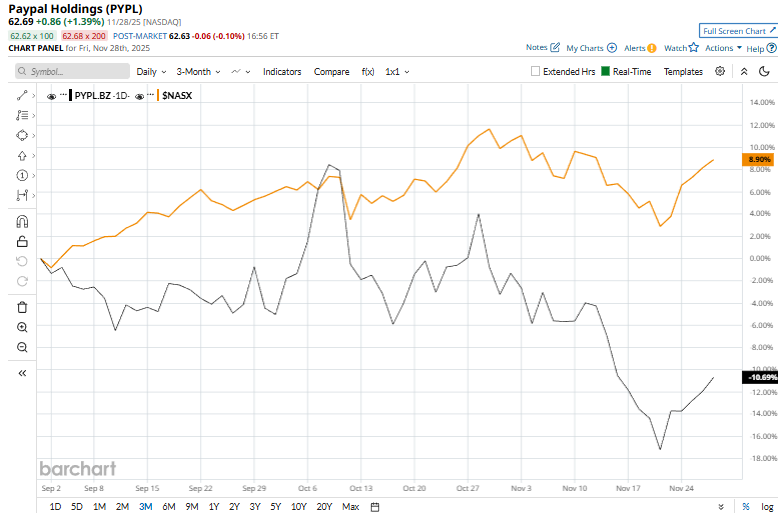

Despite its notable strengths, PYPL stock has tanked 33.1% from its 52-week high of $93.66 touched on Dec. 9, 2024. Meanwhile, over the past three months, PYPL stock has declined 10.5%, notably underperforming the Nasdaq Composite’s ($NASX) 7.7% rise during the same time frame.

PayPal’s performance has remained grim over the longer term as well. PYPL stock has plunged 26.6% on a YTD basis and 27.6% over the past 52 weeks, notably underperforming NASX’s 21% surge in 2025 and 22.6% gains over the past year.

To confirm the bearish trend, PYPL stock has dipped below its 50-day and 200-day moving averages since the end of October.

Shares of PayPal climbed 4.4% on Nov. 21 as investor optimism increased around the possibility of a Federal Reserve interest rate cut in December, following comments from New York Fed President John Williams suggesting rates could be lowered “in the near term.” Market expectations for a December cut jumped from 37% to 70%, driving a broad rally in financial stocks. While lower rates may pressure bank margins, investors often see them as a boost for economic growth, lending activity, and reduced default risk, helping support sentiment around companies like PayPal.

When compared to its peer, PayPal has underperformed Block, Inc.’s (XYZ) 24.8% gains over the past 52 weeks and a 21.4% rise in 2025.

The stock maintains a consensus “Moderate Buy” rating among the 42 analysts covering it. As of writing, PYPL’s mean price target of $80.88 suggests a 29% upside potential from current price levels.