/ON%20Semiconductor%20Corp_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Valued at a market cap of $22 billion, ON Semiconductor Corporation (ON) provides intelligent sensing and power solutions. The Scottsdale, Arizona-based company provides power management chips, silicon carbide (SiC) solutions, image sensors, and other high-performance semiconductors used in electric vehicles, advanced driver-assistance systems (ADAS), renewable energy, factory automation, and data-center applications.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and ON fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the semiconductor industry. Strong design-win momentum, long-term supply agreements, and investment in silicon carbide manufacturing continue to support the company’s role as a key enabler of sustainable, energy-efficient technologies.

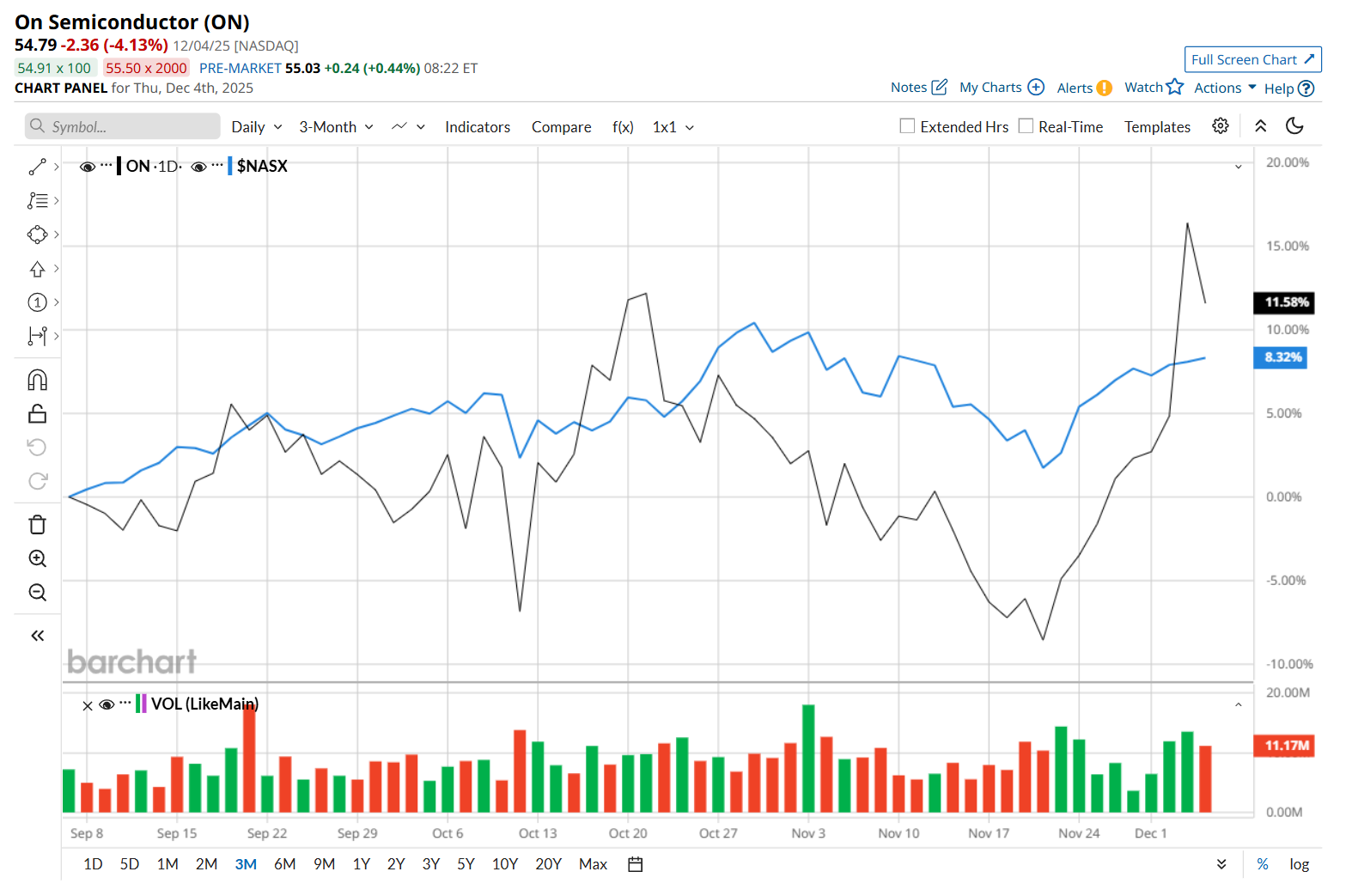

This tech company is currently trading 22.4% below its 52-week high of $70.58, reached on Dec. 17, 2024. Shares of ON have gained 14% over the past three months, outperforming the Nasdaq Composite’s ($NASX) 8.3% rise during the same time frame.

However, on a YTD basis, shares of ON are down 13.1%, trailing behind NASX’s 21.7% return. Moreover, in the longer term, ON has declined 17% over the past 52 weeks, considerably lagging behind NASX’s 19.1% uptick over the same time frame.

To confirm its recent bullish trend, ON has been trading above its 200-day and 50-day moving averages since late November.

On Nov. 3, shares of ON closed up marginally after its better-than-expected Q3 earnings release. The company’s revenue declined 12% year-over-year to $1.6 billion, but topped analyst expectations by 2%. Moreover, its adjusted EPS of $0.63 also fell 36.4% from the year-ago quarter and surpassed consensus estimates of $0.60.

ON has also considerably underperformed its rival, STMicroelectronics N.V. (STM), which gained 1.7% over the past 52 weeks and 5.7% on a YTD basis.

Looking at ON’s recent outperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 33 analysts covering it, and the mean price target of $58.78 suggests a 7.3% premium to its current price levels.