In my Q2 Barchart energy report, I highlighted the recovery in the NYMEX natural gas futures market. While the price of nearby natural gas futures moved 26.26% higher in Q2 2023, it was still 37.47% lower than the December 2022 closing price on June 30, 2023, at the $2.798 per MMBtu level. Natural gas futures have moved lower in lethargic trading conditions in July and early August, even though U.S. cooling demand soared with temperatures over the past weeks.

While natural gas sleeps below $3 per MMBtu, it is easy to be complacent about the energy commodity that can suddenly turn highly volatile. Over the coming weeks, the summer will end, and futures markets will begin to focus on the winter and the peak heating season, a traditionally bullish and volatile period for NYMEX natural gas futures.

An ugly decline led to price consolidation

One year ago, in August 2022, nearby NYMEX natural gas futures rose to over $10 per MMBtu for the first time since 2008.

The twenty-year chart highlights the over 74% decline from $10.028 in August 2022 to below $2.60 per MMBtu in August 2023. Nearby futures reached $1.946 in April 2023, where they ran out of downside steam.

The short-term chart of the September NYMEX natural gas futures contract illustrates the consolidation between $2.249 and $2.911 per MMBtu since March 2023, with the price at the midpoint of the trading range at $2.577 on August 4.

The forward curve reflects seasonality

Natural gas prices tend to peak as the winter approaches.

The forward curve out to January 2026 shows prices above $3.70 per MMBtu in January 2024 and above the $4 per MMBtu level in January 2025 and January 2026. As heating demand increases during the coldest months, natural gas prices tend to reach seasonal highs.

The current expectations are for significantly higher prices over the coming months. On August 4, natural gas for delivery in January 2024 was trading at a 45% premium to natural gas for delivery in September 2023.

Natural gas inventories are high in August 2023

If increasing demand does not push prices higher over the coming months, natural gas prices for delivery in early 2024 will likely move lower as inventories remain elevated.

Source: EIA

The chart illustrates at 3.001 trillion cubic feet for the week ending on July 28, 2023, natural gas stockpiles across the United States were 22.4% above the level in late July 2022 and 12% over the five-year average for this time of the year. Currently, supplies remain sufficient for the upcoming peak demand season.

European prices have come down

The most significant factor pushing U.S. natural gas prices to a fourteen-year high in August 2022 was Russia’s invasion of Ukraine. Russia supplies Western Europe with natural gas through its pipeline system and threatened to use natural gas exports as an economic weapon against the European countries supporting Ukraine. Natural gas prices moved to record peaks in 2022. Meanwhile, a warmer-than-average winter pushed prices lower as the demand for heating during winter was lower than in past years.

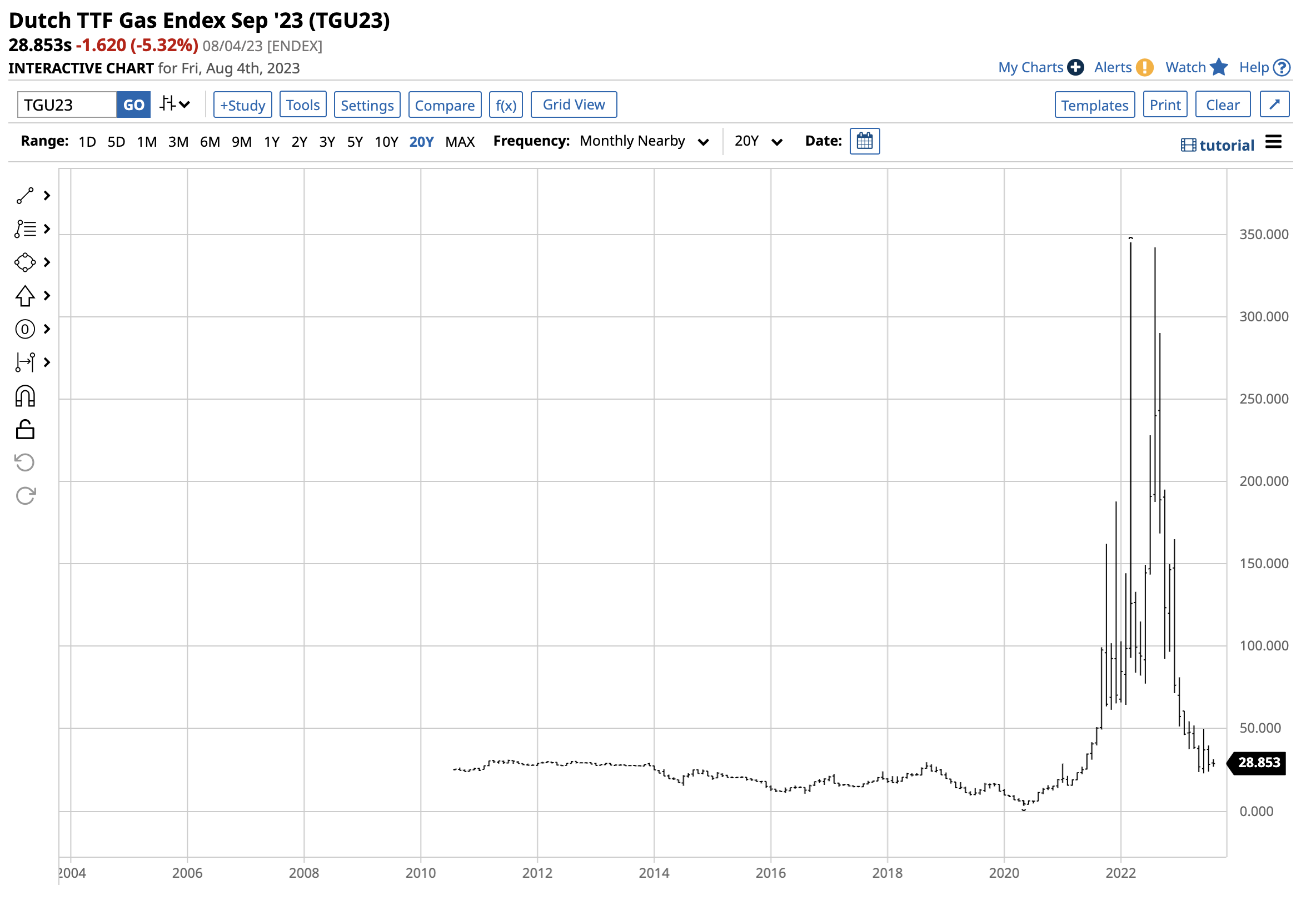

The long-term chart of U.K. natural gas futures prices shows the spike to a record high in March 2022 and the correction that took the energy commodity back to levels seen in previous years before the war in Ukraine.

Natural gas futures prices in the Netherlands followed the same volatile path.

While the 2022/2023 winter was warm, there are no guarantees the upcoming 2023/2024 cold season will be the same. Sanctions on Russia and Russian retaliation could cause sudden upside price spikes over the coming months if European natural gas demand increases and Russia decides to cut off supplies. Since U.S. liquified natural gas travels worldwide by ocean vessel, a significant rally in European prices could lead to higher U.S. natural gas futures prices over the coming months.

Four reasons why bullish action can return over the coming months

At the $2.577 level on August 4, 2023, nearby U.S. natural gas futures have declined by over 74% from the August 2022 high. At below $4, the price for January 2024 is less than half the level at the continuous contract high. The following factors could send natural gas prices higher over the coming weeks and months:

- The recent consolidation indicates that natural gas may have reached a significant bottom below the $2 per MMBtu level.

- Any war escalation in Ukraine could reignite Western European natural gas supply fears, leading to higher prices. Rising European prices will likely push U.S. futures prices higher.

- Natural gas is a highly volatile and seasonal commodity that will enter the peak demand season over the coming months. Price often peaks in November through January.

- Natural gas has a long history of price explosions and implosions. The odds favor higher than lower prices at the current price levels for the coming months.

Trading natural gas is not for the faint of heart. The price variance can be dangerous, as we witnessed with the move from $1.44 in June 2020 to $10.028 per MMBtu in August 2022. The move below $2 in April 2023 exemplifies the wild price swings in the combustible and volatile energy commodity. Therefore, passive investing is dangerous, and trading is the optimal approach to this market.

Successful natural gas trading on the long or short side requires careful attention to risk-reward dynamics. Potential rewards are a function of acceptable risks, and it is only appropriate to change a risk level when the price moves in the desired direction. Stick to a predetermined risk level to avoid letting losses mount.

In August 2023, I am more friendly to the upside but will go with the price flow and trends over the coming weeks and months.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.