Like most precious metals, platinum (PLV23), has not done much recently. As measured by the abrdn Physical Platinum Shares ETF (PPLT), it is up 7.5% over the past 52 weeks and down 7.2% year-to-date.

The price is around $1,000 per ounce, a bit above the five-year average of $940 an ounce.

But is now the time for platinum to regain some of its luster? Let's take a look. . . . .

Platinum Physical Shortage

For those unfamiliar with platinum, some of its main uses include its usage in catalytic converters that reduce vehicles’ harmful emissions, as well as in glass fiber for wind turbines, electronics and petrochemical plants.

The fundamentals in the platinum market are certainly pointing to higher prices.

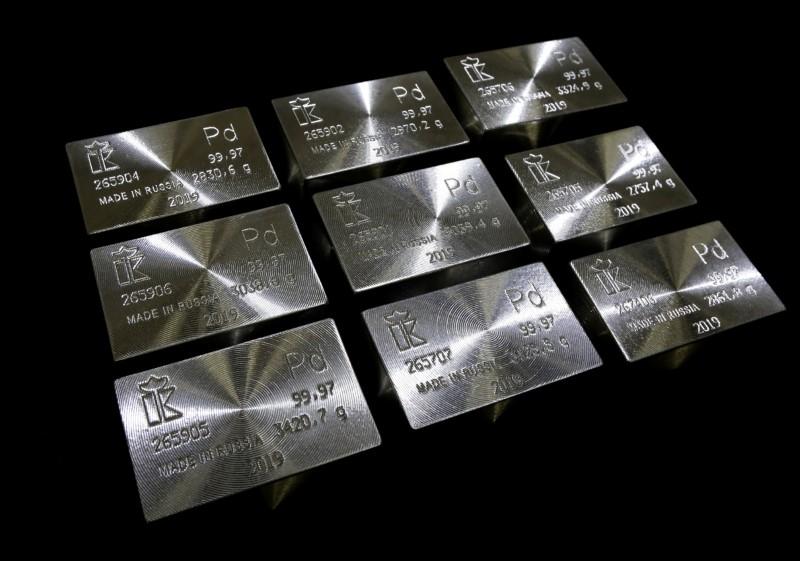

The global platinum market is expected to rack up its largest deficit since records began in the 1970s, as supply falters in South Africa. This country is the world's largest producer of the metal, accounting for about 70% of global output. Its production amounted to an estimated 140 metric tons in 2022. Russia comes in a distant second, having produced only 20 metric tons that same year.Meanwhile, global platinum demand is forecast to surge 28% this year to 8.2 million ounces, thanks to investors interest adding to strong industrial consumption and increasing use of the metal in car catalytic converters in the first quarter. This is according to the World Platinum Investment Council (WPIC), an industry body.

The physical shortage is being exacerbated by the electric supply woes in top producer South Africa.

The head of South Africa’s Eskom electricity monopoly has warned that the rolling blackouts plaguing the country could hit record levels in the coming winter months, unless the utility can prevent its decrepit fleet of power plants from being overwhelmed by breakdowns.South Africans, who are already enduring power cuts lasting up to 12 hours out of every 32 hours, were told by Calib Cassim, Eskom’s acting CEO, that it was “going to be a difficult winter”, where the outages could stretch to up to 16 hours.

No wonder then that the WPIC revised its deficit forecast up 77% from just three months ago, to 983,000 ounces this year, the biggest since 2014.“It would be a record deficit in ounces since records going back to the 1970s,” said Edward Sterck, director of research at WPIC. He added that the last time 12% of demand could not be met by new supply and recycling was in 1999.

This deficit is a stark contrast from the bumper surpluses the prior two years when car production was hit by semiconductor shortages.

Demand Booming in 2023

The World Platinum Investment Council believes that industrial demand in 2023 will be the strongest ever for platinum. This is despite fears over a global economic slowdown. The WPIC points to the chemical and glass plant expansions in China, as well as ongoing substitution of platinum for palladium in auto exhaust systems.

The precious metals research consultancy, Metals Focus, forecast platinum demand should rise by 12% this year to 8.15 million ounces, as automakers produce more platinum-intensive heavy duty vehicles and switch away from more expensive palladium.

Metals Focus added that, with power outages in top producer South Africa limiting supply, the deficit will swell to 953,000 ounces, up from just 53,000 ounces in 2022, and the most since at least 2014.

Even some bears are actually bullish.

In an outlook published in mid-May, Johnson Matthey PLC (JMPLY) , the catalyst technology firm, forecast softer growth in demand — at only 20% in 2023. But even it expects a supply deficit of 128,000 ounces, the first deficit since 2020.

The really bearish bears say that there are huge stockpiles have been built up over the past few years. And yes, global stockpiles do sit at a rather large 3.8 million ounces.However, the bears are ignoring the seismic shift that has taken place in the past several years. Today, about 85% of the inventory is being held in China, where the platinum is “captive”. Keep in mind that China held less than 5% of the world's platinum inventory a mere four years ago.

Adding up all of these factors, it makes platinum a speculative buy at current prices. I expect 2023 to be the first year of serial deficits in the platinum market. I suggest investors slowly build up a position in a physical platinum ETF, such as the aforementioned PPLT.