For information on the third coronavirus relief package, please visit our “American Rescue Plan: What Does it Mean for You and a Third Stimulus Check” blog post.

As you examine your taxes and seek ways to pay less, you might wonder if lowering your effective tax rate can help you reach that goal. The good news is that there are many legitimate options to lower your tax rate.

Our TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to tax experts online for unlimited answers and advice OR, have a dedicated tax expert do your taxes for you, so you can be confident in your tax return. Enjoy up to an additional $20 off when you get started with TurboTax Live.

Before we get to the list of options for lowering your tax rate, you should first understand the difference between your effective tax rate and your marginal tax rate.

Marginal and effective tax rates

The first term we'll discuss is the "marginal tax rate." This is the highest tax bracket by which your income will be taxed.

- For instance, if you're a single person whose taxable income was $60,000 in 2021, then you fall into the 22% tax bracket. Therefore, your marginal tax rate is 22%.

However, when talking about your marginal tax rate, it's important to understand how tax brackets work. Many people believe that your tax bracket (aka your marginal tax rate) determines the rate you pay in taxes for your total taxable income. But being in the 22% bracket does not mean that you'll pay 22% of your income in taxes.

It is true that the higher taxable income you have, the more you will pay in taxes. But it's important to understand that the higher tax rate only applies to the amount of income above the minimum amount for that tax bracket.

Figuring out your tax liability, or how much you owe based on tax brackets, is easier to understand if you look at an example.

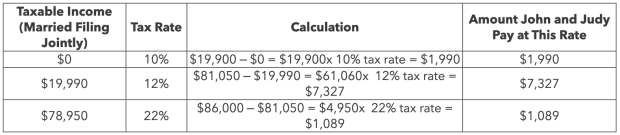

- So, let's imagine a couple — John and Judy — that's married filing jointly, and both are under the age of 65.

- Together, their taxable income in 2021 was $86,000.

This chart explains how much they will pay in taxes due to their marginal tax rate.

Based on this tax bracket for 2021, John and Judy will owe a total tax liability of $10,406.

- $1,990 + $7,327 + $1,089 = $10,406

Your “effective tax rate” is the average percentage of your taxable income that you owe in federal taxes. In order to calculate this rate, you simply divide your tax liability (what you owe) by your total taxable income.

- In our example above, the effective tax rates calculation for John and Judy would be $10,406 divided by $86,000.

- Therefore, their effective tax rate is about 12%, which is much lower than their marginal tax rate of 22%.

It's useful to know your effective tax rate so that you can make informed budget and planning decisions and lower your tax liability.

Options for lowering your effective tax rates

Now that you understand the term "effective tax rates," let's discuss how you can lower that percentage in order to minimize the amount you owe in taxes.

Maximize your deductions and get every tax break you qualify for when you file your taxes with TurboTax Deluxe. We'll search over 350 tax deductions and credits to make sure you get the maximum refund possible. Start for free, and get up to an additional $10 off TurboTax Deluxe when you file.

Consider tax-free income opportunities

Remember that the tax brackets and tax rates only apply to taxable income. There are several opportunities for you to make income or invest your income so that it isn't taxable.

Some common types of tax-free income and investments include:

- Financial gifts received from others

- Disability insurance payments

- Qualified withdrawals from a Roth IRA account

- Selling your home and meeting the requirements to exclude the gain

- Qualified municipal bonds interest income

Be strategic and smart about tax credits and deductions

As you make payments and purchases throughout the year, try to strategically plan them to maximize their effectiveness on your taxable income and tax rate. Additionally, it helps to keep some of the most common tax credits and deductions in mind, so you know what you’re working toward when it comes time to file.

- Child and dependent care tax credit

- Education tax credits

- Adoption tax credit

- Investment interest expense deduction

- Charitable donations deductions

- Casualty and theft losses deductions

- Medical expenses deductions

- Mortgage interest and points deductions

Getting started

Whether you’re setting yourself up for success at the beginning of the year or making adjustments in the latter half, there are multiple options for lowering your effective tax rate and paying less when the tax deadline comes.

To start, use a tax bracket calculator to understand your marginal tax rate and your effective tax rate. From there, you can consider applicable credits and deductions you qualify for and be well on your way to minimizing your taxes.

Remember, with TurboTax, we'll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax, you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.