/Ingersoll-Rand%20Inc%20steam%20roller-by%20bmcent1%20via%20iStock.jpg)

With a market cap of $31.6 billion, Ingersoll Rand Inc. (IR) provides mission-critical air, fluid, energy, and medical technology solutions worldwide. The company operates through two segments: Industrial Technologies and Services, offering air and gas compression, fluid transfer, and power tool solutions; and Precision and Science Technologies, delivering pumps, gas boosters, automated liquid handling, and related systems for diverse industries.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Ingersoll Rand fits this criterion perfectly. The company sells its products globally through direct sales representatives and independent distributors.

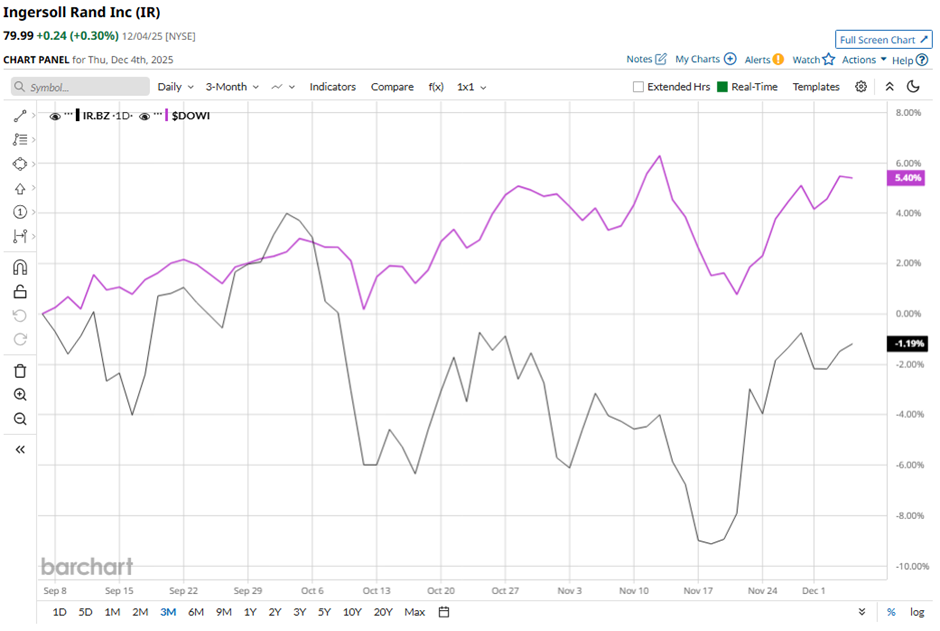

Shares of the Davidson, North Carolina-based company have declined 23.2% from its 52-week high of $104.18. Over the past three months, its shares have gained 1%, underperforming the broader Dow Jones Industrials Average's ($DOWI) 4.9% rise during the same period.

Longer term, IR stock is down 11.6% on a YTD basis, lagging behind DOWI's 12.5% return. Moreover, shares of the company have dipped 23.1% over the past 52 weeks, compared to DOWI’s 6.3% increase over the same time frame.

The stock has been in a bearish trend, consistently trading below its 200-day moving average since late December last year.

Ingersoll Rand reported strong Q3 2025 on Oct. 30, including orders of $1.94 billion, revenues of $1.96 billion, and adjusted net income of $346 million, or $0.86 per share. Both segments contributed to growth, with Industrial Technologies & Services posting $1.52 billion in orders and Precision & Science Technologies delivering $420 million in orders alongside improved adjusted EBITDA margins. However, the stock fell 3.1% the next day.

In comparison, rival GE Vernova Inc. (GEV) has outperformed IR stock. GEV stock has climbed 92.1% YTD and 81.5% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic about its prospects. IR stock has a consensus rating of “Moderate Buy” from 16 analysts in coverage, and the mean price target of $88.36 is a premium of 10.5% to current levels.