/Garmin%20Ltd%20logo%20and%20stock%20chart-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Schaffhausen, Switzerland-based Garmin Ltd. (GRMN) is a technology company that designs and manufactures GPS-enabled devices and smart wearables for fitness, outdoor recreation, aviation, marine, and automotive markets. Valued at a market cap of $38.9 billion, the company’s product portfolio includes smartwatches, fitness trackers, cycling computers, handheld GPS devices, avionics systems, navigation solutions, and sonar and chartplotter technologies for boating.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and Garmin fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the scientific & technical instruments industry. The company differentiates itself through purpose-built, high-precision products tailored to specific activities and professional applications rather than general consumer electronics. With a focus on long battery life, durability, and feature-rich performance, GRMN has built strong brand loyalty across athletes, outdoor enthusiasts, pilots, and marine professionals.

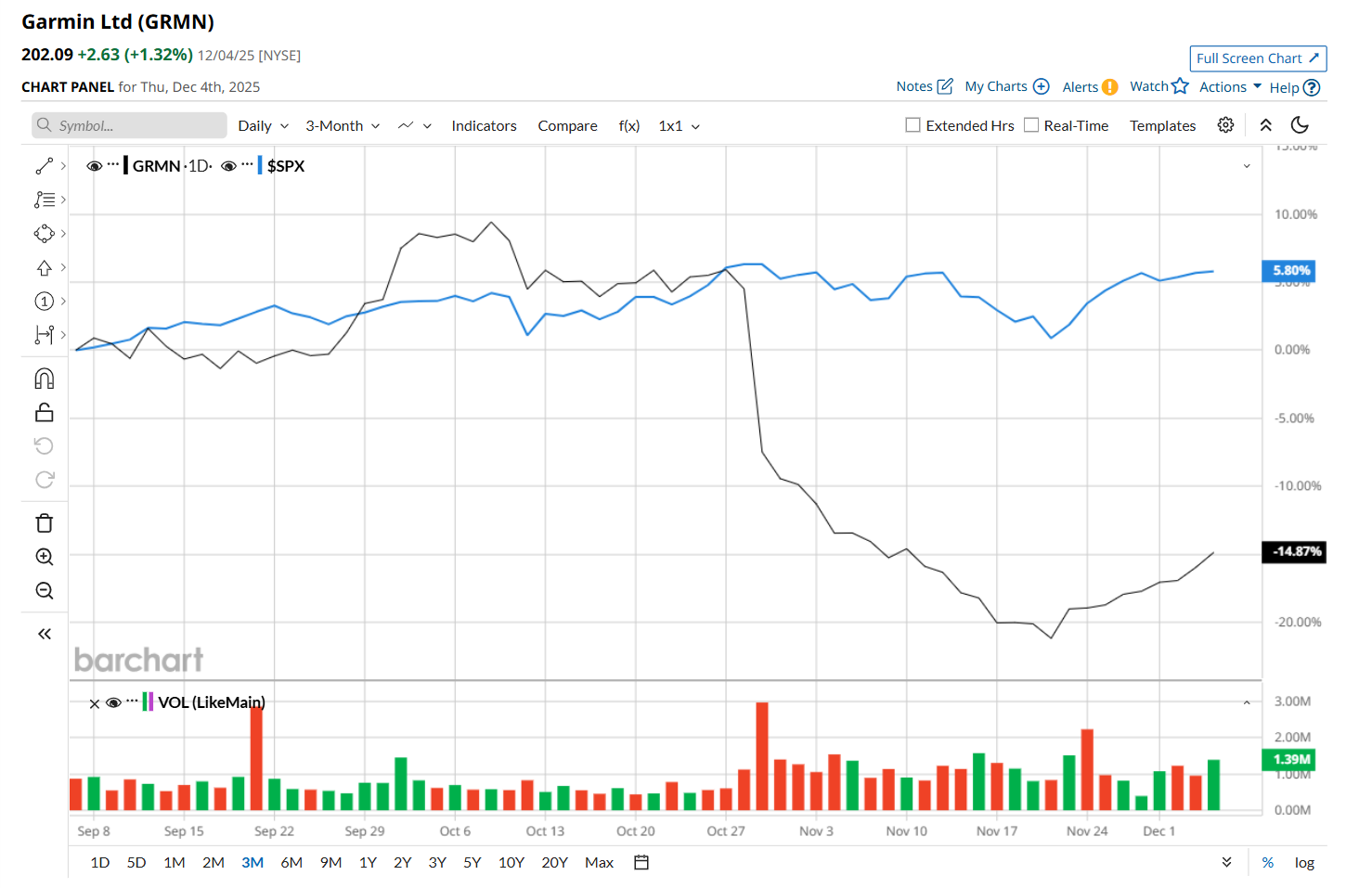

This tech company has slipped 22.8% from its 52-week high of $261.69, reached on Oct. 9. Shares of Garmin have declined 15% over the past three months, considerably underperforming the S&P 500 Index’s ($SPX) 5.5% rise during the same time frame.

In the longer term, GRMN has dropped 6.3% over the past 52 weeks, lagging behind SPX’s 12.7% uptick over the same time frame. Moreover, on a YTD basis, shares of Garmin are down 2%, compared to SPX’s 16.6% return.

To confirm its bearish trend, GRMN has been trading below its 200-day and 50-day moving averages since late October.

On Oct. 29, shares of Garmin plunged 11.5% after its mixed Q3 earnings release. The company’s adjusted EPS of $1.99 remained flat year-over-year, but topped analyst estimates by a penny. However, on the other hand, its overall revenue grew 11.7% from the year-ago quarter to $1.8 billion, but missed consensus estimates by 1.1%, which might have made investors jittery. A fall in its outdoor and auto OEM segments' sales likely contributed to its topline miss.

GRMN has also underperformed its rival, Trimble Inc. (TRMB), which gained 9.3% over the past 52 weeks and 16.5% on a YTD basis.

Given GRMN’s recent underperformance, analysts remain cautious about its prospects. The stock has a consensus rating of "Hold” from the eight analysts covering it, and the mean price target of $232.17 suggests a 14.9% premium to its current price levels.