Celsius Holdings (CELH) was already growing quickly before it inked a distribution deal with PepsiCo (PEP) last fall. Now that Pepsi’s reach is being leveraged to gain entry to more stores and win additional shelf space at existing locations, revenue and profit are surging. Given that many companies are struggling to expand sales and profit, could Celsius stock be worth owning in your portfolio?

A Look Back At Celsius Holdings' Business

Celsius Holdings is a beverage company quickly winning market share in the energy drink market. Selling highly-caffeinated beverages is a good business to be in. The U.S. energy drink market has grown by a compounded 11% annually between 2017 and 2022, reaching $18.9 billion last year, according to IBISWorld.

The global market opportunity is much larger. In 2021, energy drinks hauled in $159 billion worldwide, according to Statista. It estimates that sales globally will climb to $233 billion by 2027.

The industry’s largest players by market share are Monster (MNST) and Red Bull, but Celsius is steadily chipping away at market share. Over the past year, Celsius has been the fastest-growing energy drink within U.S. Multi-Outlet and Convenience Stores (MULO-C). As a result, Celsius Holdings has become the third-largest U.S. energy drink maker with a 7.5% market share, double its share from one year ago.

According to consumer product tracking done by SPINS, Celsius sales grew 124% year-over-year in the final four weeks of the first quarter, far faster than the 12.4% year-over-year growth for the energy drink category.

Celsius' Financials Are Solid

Given the company’s products are sold in more stores thanks to its deal with Pepsi, and sales growth finished Q1 at a triple-digit pace, it’s unsurprising that revenue has climbed dramatically.

In the first quarter, Celsius Holdings reported sales grew 95% to $260 million. North American revenue rose 101% to 249 million, accounting for the lion’s share of sales. Overseas, sales increased by 15% to $11.4 million.

The company’s bottom line performance was similarly positive. Gross profit margin expanded by 3.4% to 43.8%, and thanks to sales-driven operating leverage, earnings per share jumped 344% to $0.40.

The balance sheet appears solid, as well. Celsius Holdings finished the quarter with $614 million in cash and equivalents and just $161 million in current liabilities. It carries very little debt, with current and long-term debt totaling just $731,000 and $488,000, respectively. As a result, its current ratio is 5.18 — far above the 1.0 level most consider worrisome.

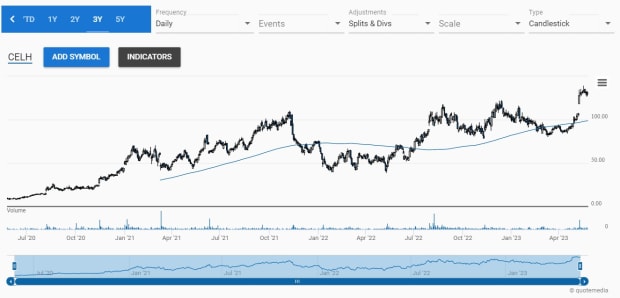

Celsius Holdings Chart Is Appealing

Celsius Holdings is trading above $131, putting shares nicely above uptrending 21-day, 50-day, and 200-day moving averages.

Real Money’s Bruce Kamich has evaluated charts professionally for nearly 50 years. Last week, he was impressed by what he saw in Celsius Holdings’ Japanese candlestick charts.

Kamich noted Celsius Holdings stock has been rallying for three years. Its share price is above the rising 40-week moving average, on-balance volume (a running total of up minus down volume) is positive, and the moving average convergence divergence momentum indicator is bullish.

Based on Celsius Holdings' weekly point-and-figure chart, Kamich calculated a price target of $232, significantly above where shares currently are trading.

Is Celsius Holdings Stock a Buy?

The company has a lot of things going its way. More people are consuming energy drinks rather than soft drinks and Celsius energy drink ingredients, and marketing is positioning it as a potentially healthier source of caffeine. Revenue and profit are climbing quickly, and it’s attractive based on technical analysis.

One drawback is Celsius Holdings’ shares aren’t cheap. Analysts expect EPS to grow 50% next year to $1.96, yet a post-earnings report rally has lifted its forward price-to-earnings ratio above 67. That’s far from bargain-basement pricing, given Monster’s forward P/E ratio is 32 and Pepsi’s is 23. However, Celsius Holdings is growing much faster than those companies, so a premium valuation is understandable. Still, this isn’t a stock likely to appeal to value investors.

Growth investors, however, might want to use any pullbacks to pick up shares. The company’s already growing rapidly, yet the overseas market opportunity is essentially untouched, and there’s also an opportunity to expand Celsius beverages into restaurants.

Another reason why Celsius Holdings shares could be a good buy? It’s arguably under-owned by mutual and hedge funds. Shares show up in 529 funds, up from 399 one year ago. For perspective, 1940 funds own shares in Monster. Given Celsius hasn’t yet caught the attention of many institutional investors, buying shares could be smart.