/Arch%20Capital%20Group%20Ltd%20logo%20on%20phone-%20by%20viewimage%20via%20Shutterstock.jpg)

Arch Capital Group Ltd. (ACGL), headquartered in Pembroke, Bermuda, provides financial services. With a market cap of $33.6 billion, the company offers life, health, and property insurance and reinsurance products, as well as mortgage insurance products.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and ACGL perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the insurance - diversified industry.

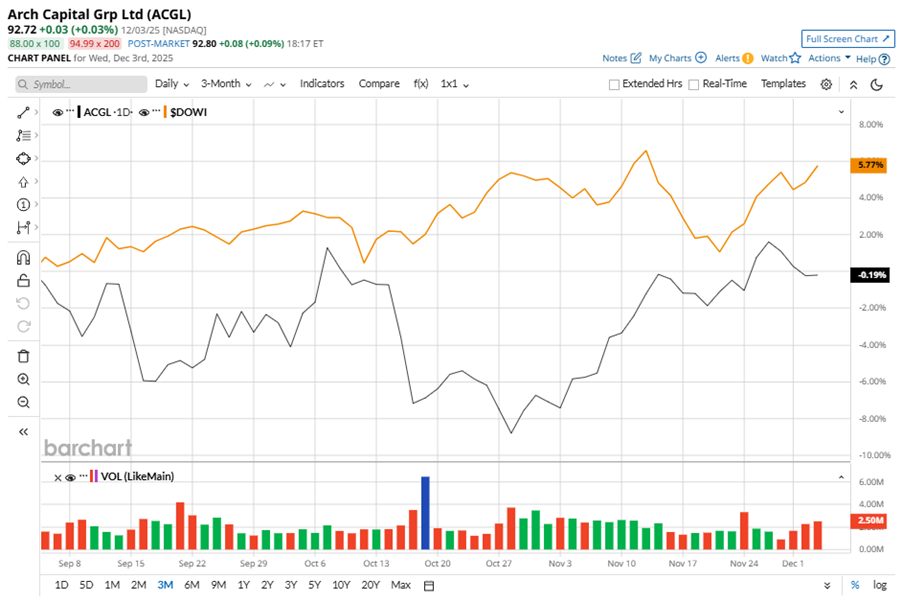

Despite its notable strength, ACGL slipped 8.8% from its 52-week high of $101.66, achieved on Nov. 27, 2024. Over the past three months, ACGL stock declined marginally, underperforming the Dow Jones Industrials Average’s ($DOWI) 5.8% gains during the same time frame.

In the longer term, shares of ACGL fell 3.2% on a six-month basis and dipped 6.8% over the past 52 weeks, underperforming DOWI’s six-month gains of 12.6% and 7.1% returns over the last year.

To confirm the bullish trend, ACGL has been trading above its 50-day and 200-day moving averages since mid-November.

On Oct. 27, ACGL shares closed down more than 1% after reporting its Q3 results. Its adjusted EPS of $2.77 exceeded Wall Street expectations of $2.19. The company’s net premiums written stood at $4 billion, down 2.1% year over year.

In the competitive arena of insurance - diversified, American International Group, Inc. (AIG) has taken the lead over ACGL, showing resilience with a 2.6% uptick over the past 52 weeks but lagging behind the stock with a 9.9% dip on a six-month basis.

Wall Street analysts are reasonably bullish on ACGL’s prospects. The stock has a consensus “Moderate Buy” rating from the 22 analysts covering it, and the mean price target of $106.53 suggests a potential upside of 14.9% from current price levels.