Valued at a market cap of $58.1 billion, Air Products and Chemicals, Inc. (APD) is a leading industrial gases company that supplies hydrogen, nitrogen, oxygen, helium, and specialty gases to customers across refining, chemicals, manufacturing, electronics, metals, and healthcare industries. The Allentown, Pennsylvania-based company also builds and operates large-scale gas production facilities and provides equipment and services for gas processing, air separation, and liquefied natural gas (LNG).

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and APD fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the specialty chemicals industry. With a strong project pipeline, long-term customer contracts, and a capital-intensive business model that supports durable cash flow, the company remains a major player in the industrial gases and clean energy infrastructure market.

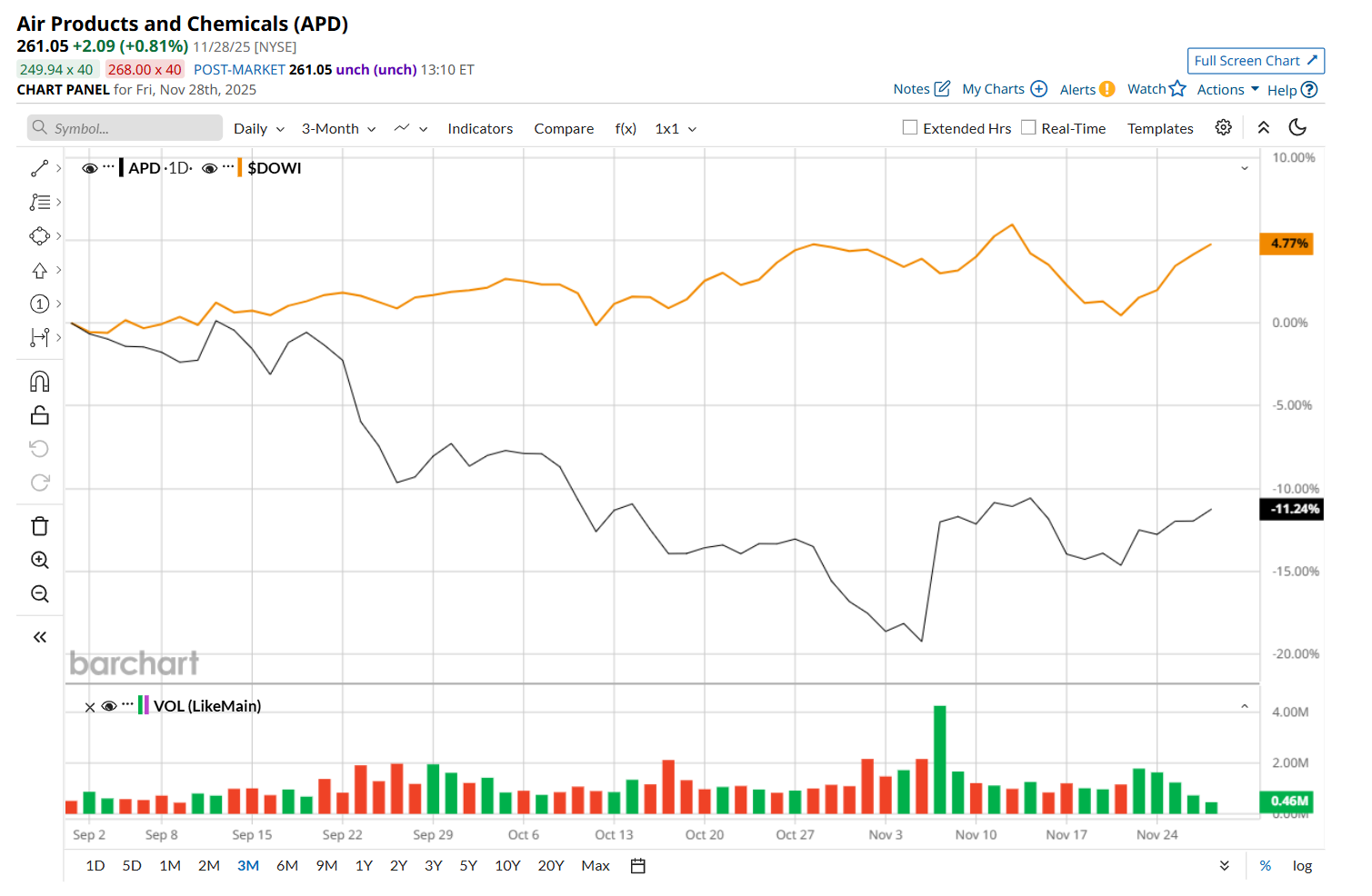

This industrial gases company has slipped 23.5% from its 52-week high of $341.14, reached on Feb. 4. Shares of APD have declined 11.5% over the past three months, lagging behind the Dow Jones Industrial Average’s ($DOWI) 4.6% rise during the same time frame.

In the longer term, APD has fallen 21.7% over the past 52 weeks, notably underperforming DOWI's 6.7% uptick over the same time period. Moreover, on a YTD basis, shares of APD are down 10%, compared to DOWI’s 12.2% return.

To confirm its bearish trend, APD has been trading below its 200-day moving average since mid-March, with slight fluctuations, and has remained below its 50-day moving average since mid-September, with minor fluctuations.

Shares of APD rose 8.9% after its Q4 earnings release on Nov. 4. The company’s revenue declined marginally year-over-year to $3.2 billion, largely due to lower volumes. Meanwhile, on the earnings front, its adjusted EPS of $3.39 also fell 4.8% from the year-ago quarter. However, its selling and administrative expenses decreased 3.9% from the same period last year, reflecting productivity gains and strong cost control, which helped bolster investor confidence.

APD has also underperformed its rival, Linde plc (LIN), which dropped 10.2% over the past 52 weeks and 2% on a YTD basis

Despite APD’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 23 analysts covering it, and the mean price target of $308.38 suggests an 18.1% premium to its current price levels.