As 3D NAND memory prices are falling due to weaker-than-expected demand in the IT sector, major flash makers are mulling adjusting their output and reducing investments in non-volatile memory, reports DigiTimes, citing South Korean media. Instead, they could invest more in DRAM production as demand for HBM memory from the AI industry is setting records.

Right now, all major makers of 3D NAND—Kioxia, Micron, Samsung, and SK Hynix—are considering reducing the output of non-volatile memory and reducing investments in building out additional flash capacities. If they do it, this will stabilize the pricing of 3D NAND and may somewhat reduce the pricing of DRAM, at least in the short and mid-terms.

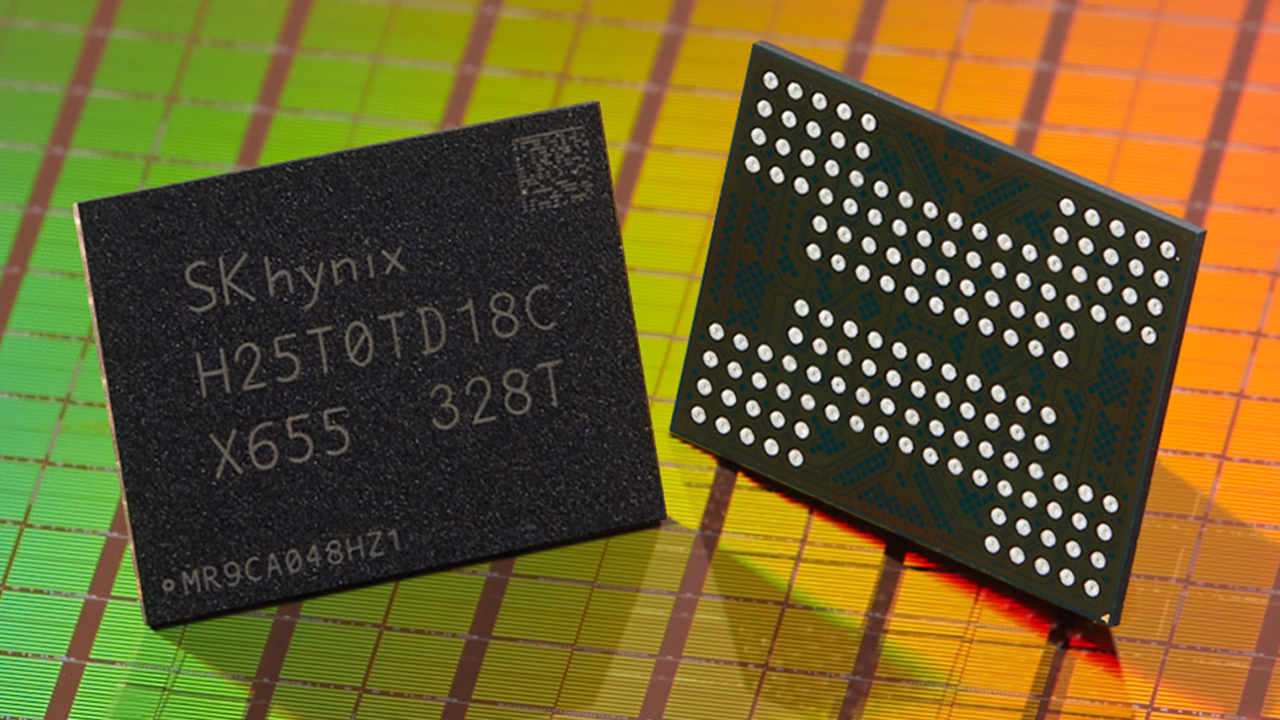

Given the current market conditions, companies like Samsung and SK Hynix focus on DRAM, where demand is stronger, particularly in AI. According to the report, they are exploring the possibility of converting parts of their NAND production lines to focus on DRAM in general and HBM in particular, including Samsung's potential conversion of its P4 line and SK Hynix's plans for its Cheongju M14, M15X, and M16 facilities.

Demand for PCs declined in 2H 2022 and 1H 2023, as did demand for 3D NAND memory. As a result, both PC makers and suppliers of SSDs got their hands full of NAND flash and ceased buying more memory. As a result, 3D NAND makers cut their production rates, and utilization rates of their flash production lines dropped from 20% to 30% in 2023. As demand for PCs grew and so did demand for non-volatile memory, 3D NAND manufacturers increased production, and their utilization rates rebounded to 80% - 90% in early 2024.

However, demand has remained subdued, especially for standard 3D NAND products, causing companies to adjust production gradually in line with market trends. High-capacity NAND devices are among the exceptions, but they still see consistent demand as AI and other data centers need high-capacity SSDs.

The IT industry had anticipated a boost in sales of PCs and mobile devices in the latter half of 2024, expecting a replacement cycle to drive up orders. Unfortunately, an economic downturn has dampened consumer confidence, delaying the expected surge in sales to the second half of 2025. This delay has forced manufacturers to reevaluate their production strategies, extend the timeline for inventory management, and consider more aggressive production cuts.