The global economy is on the brink of a soft landing, with inflation steadily decreasing and growth maintaining stability, according to the International Monetary Fund's latest World Economic Outlook (WEO).

The organization says that the world's major economies exhibited resilience in the latter half of the previous year, supported by factors like increased labor force participation and restored supply chains.

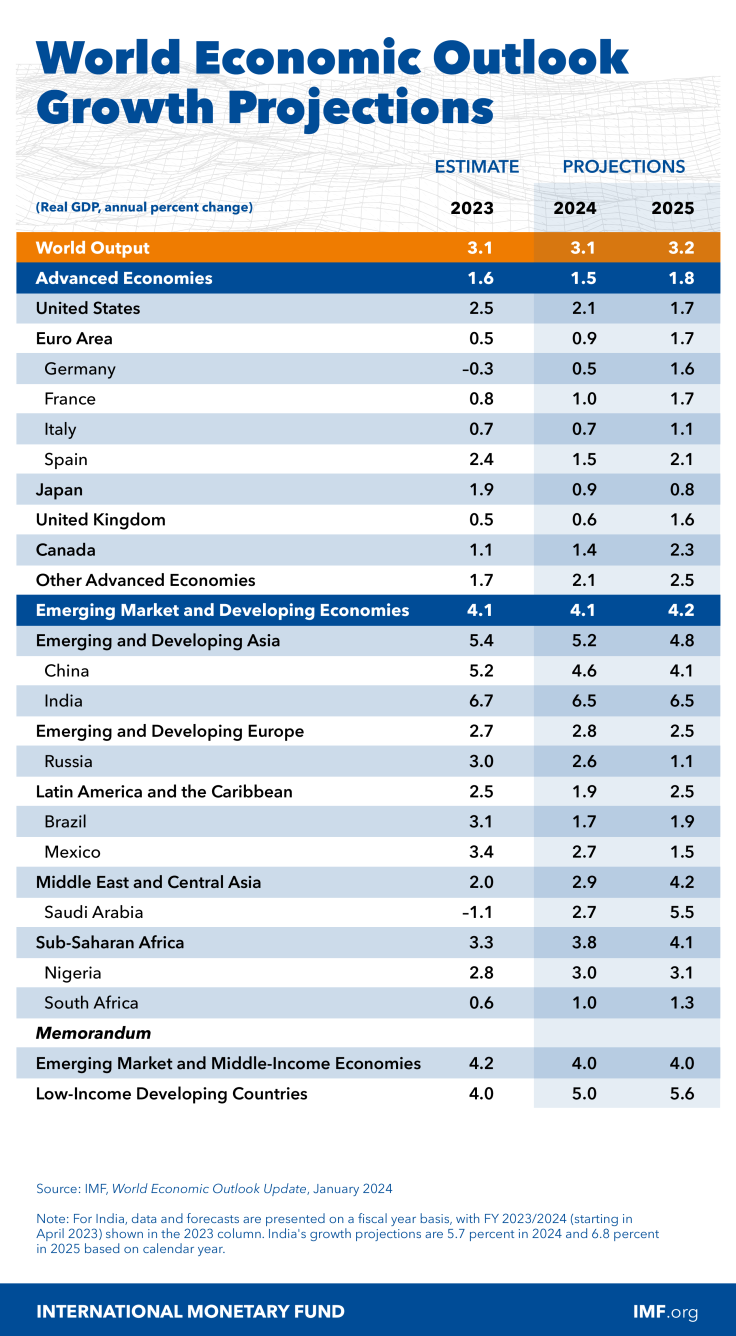

This trend is expected to persist, with global growth projected to steady at 3.1 percent this year, marking a 0.2 percentage point upgrade from October forecasts, and edging up to 3.2 percent next year.

However, significant divergences persist across the globe. The United States and China are anticipated to experience slower growth due to tight monetary policies and weaker consumption and investment, respectively.

In contrast, the euro area is expected to rebound slightly after facing challenges in 2023. Moreover, economies like Brazil, India, and Southeast Asia demonstrate notable resilience, showcasing accelerated growth. In Latin America, Mexico is also expected to show a strong performance, as the IMF expect its economy to grow 3.4% this year.

However, the economies of both the U.S. and Latin America are expected to decelerate next year. The former is set to grow 2.1% and 1.9%, respectively, and then diverge in 2025 as the U.S. would continue decelerating, only growing 1.7%, and Latin America experiencing a mild rebound to 2.1%.

In terms of inflation, global headline inflation is predicted to decline to 4.9 percent this year, a 0.4 percentage point decrease from October projections. Core inflation for advanced economies is expected to hover around 2.6 percent, aligning with central banks' targets.

Risks and outlook are now more balanced with the improved economic landscape, the IMF highlighted, saying there is a potential for faster disinflation, especially if labor market conditions ease further.

On the downside, however, new commodity and supply disruptions could emerge amid geopolitical tensions, while core inflation might prove more persistent. Market optimism about early rate cuts is noted by the report, posing a risk if investor sentiments shift.

Policy challenges can as inflation recedes and growth remains steady. The WEO advices policymakers to carefully navigate the two-sided risks, avoiding premature easing that could lead to a rebound in inflation, while also considering the strain on interest rate-sensitive sectors. A timely pivot towards monetary normalization is crucial to prevent jeopardizing growth, it adds.

The most pressing challenge is managing elevated fiscal risks. Countries emerging from the pandemic with higher public debt levels must implement steady fiscal consolidation. While fiscal measures introduced during the energy crisis should be phased out, the danger lies in both doing too little or too much. Striking the right balance is imperative to prevent fiscal crises and ensure sustainable growth.

The report concludes by saying that global attention should shift to medium-term growth, addressing structural challenges such as the climate transition and sustainable development. Reforms in governance, business regulation, and trade barriers can unleash latent productivity gains. Strengthening global interconnectedness through multilateral cooperation remains essential for tackling shared priorities, despite uncertainties that may lie ahead.

© 2024 Latin Times. All rights reserved. Do not reproduce without permission.