/Idex%20Corporation%20logo%20and%20chart%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

IDEX Corporation (IEX), based in Northbrook, Illinois, is a global applied solutions leader, engineering and manufacturing mission-critical components that support essential industrial functions.

Commanding a market capitalization of around $13.4 billion, its technology base spans fluid handling, precision engineering, and safety applications, with products ranging from pumps and valves to meters, processing systems, sealing solutions, and specialized rescue tools.

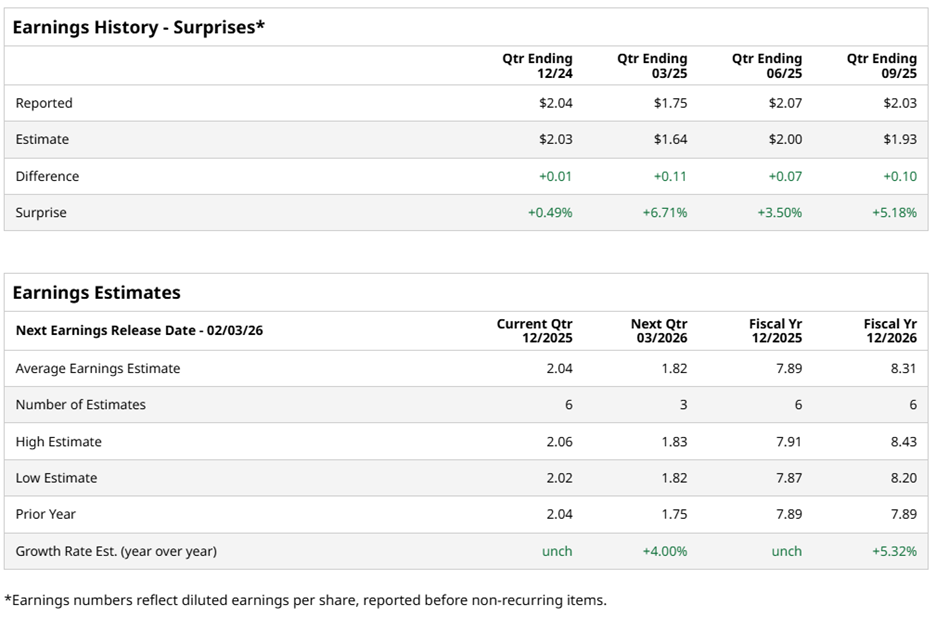

Market attention is now on IDEX’s fiscal 2025 fourth-quarter earnings release, scheduled for Tuesday, Feb. 3. Wall Street expects diluted EPS of $2.04, unchanged from the same period last year. Notably, the company has surpassed EPS estimates in each of the past four quarters, reinforcing credibility.

Extending the view forward, analysts project fiscal 2025 diluted EPS of $7.89, matching the prior year. For fiscal year 2026, expectations call for a 5.3% increase, lifting EPS to $8.31.

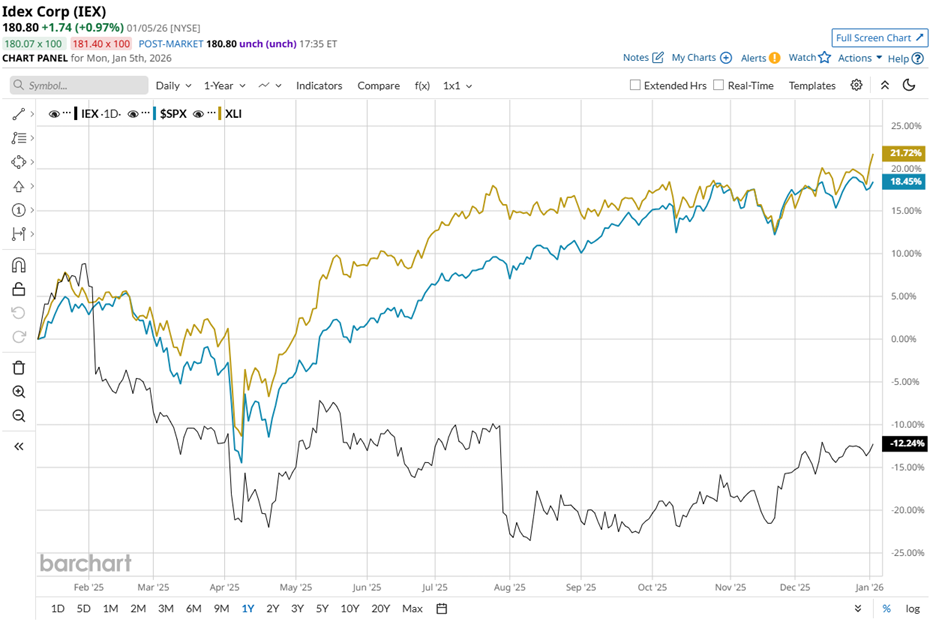

Share-price performance has lagged broader benchmarks. In the past 52 weeks, IEX stock declined 12.7%, although it remains up 1.6% on a year-to-date (YTD) basis. By contrast, the S&P 500 Index ($SPX) advanced 16.2% over the same period, while delivering only modest gains so far this year.

A similar gap appears at the sector level. The State Street Industrial Select Sector SPDR ETF (XLI) climbed 20.4% over the last year and added 3.1% YTD, outpacing IEX.

Despite that lag, IDEX delivered a significant positive catalyst on Oct. 29, 2025, when the stock jumped 3.9% intraday following its fiscal Q3 2025 earnings release. During the quarter, revenue increased 10.1% year over year to $878.7 million, exceeding analyst estimates of $861.1 million. Adjusted EPS rose 6.8% from the year-ago level to $2.03, surpassing the Street's expectations of $1.93.

IDEX's management attributed the performance to momentum in Health & Science Technologies, alongside solid demand from data centers, municipal water projects, and pharmaceutical customers. CEO Eric Ashleman emphasized the firm’s “8020 philosophy,” noting it sharpened operational focus, accelerated acquisition integration, and lifted contributions from material science and intelligent water platforms.

Supported by these fundamentals, Wall Street has assigned IEX stock an overall rating of “Moderate Buy,” unchanged over the past three months. Among 12 analysts, six rate the stock “Strong Buy,” one recommends “Moderate Buy,” and five suggest “Hold.”

The mean price target of $192.27 implies potential upside of 6.3%. Meanwhile, the Street-High target of $210 represents a gain of 16.2% from current levels.