As artificial intelligence (AI) becomes more pervasive in everyday use, we wondered just how helpful ChatGPT might be for individual investors.

Professional services such as the Bloomberg Terminal have long been used by financial institutions and wealthier investors, but services like these are typically out of reach for small-time investors.

More limited platforms, such as Yahoo Finance and Google Finance, make some stock market data available to the public for free. We tested how ChatGPT can customize the fundamental stock market information available through Google and Yahoo to help retail investors make more informed trading decisions.

Want to graph different periods of moving averages on a stock? Need to calculate free cash flow, but don’t want to take the time to search for the items needed in the formula from a company’s financial statements? As it turns out, ChatGPT can help with that.

Here’s what we discovered.

Related: Can AI help you invest? How online services like ChatGPT & Magnifi work

What is ChatGPT?

ChatGPT is a language model developed by OpenAI, a company founded by AI advocates, including Elon Musk and Sam Altman to further the development of advanced AI technologies.

Musk has accused Altman of misusing OpenAI for for-profit motives rather than as a platform to benefit the public. Microsoft has a business partnership with OpenAI, and Microsoft has incorporated OpenAI’s ChatGPT into some of its services and applications.

ChatGPT itself is an application that is based on GPT, which stands for Generative Pre-trained Transformer, a type of AI that generates text. As a “pre-trained” model, GPT learns language patterns, grammar, and information, and it takes past responses of patterns and data it learned to generate a specific task or application. In building a sentence, it predicts the next word based on preceding words. When a question is asked on ChatGPT, it can search the internet for an appropriate response.

For example, typing “What is the S&P 500 Index?” in the message field at the bottom of the screen will generate a generic answer pulled from various sources on the internet as well as previous responses. The replies tend to improve as more queries are inputted and additional information becomes available.

Another inquiry, “What is Apple predicted to produce in net income next year?” will generate a response based on data already created or may not provide an answer based on the limitations of its sources of information.

Related: How to invest in AI: From individual stocks to ETFs

Versions of ChatGPT & how to use them

You will need to open an account with OpenAI to access ChatGPT, but there are other ways to access it via existing accounts with Microsoft (MSFT), Google (GOOG), or Apple (AAPL).

ChatGPT 3.5

ChatGPT 3.5 is the latest iteration that is available free to the public. This version of GPT analyzes text and responds with text.

ChatGPT 4.0

ChatGPT 4.0 is different from ChatGPT 3.5 in that, in addition to text, it is able to analyze other types of data, including images and voice, and provide a response with text or create images.

Free version

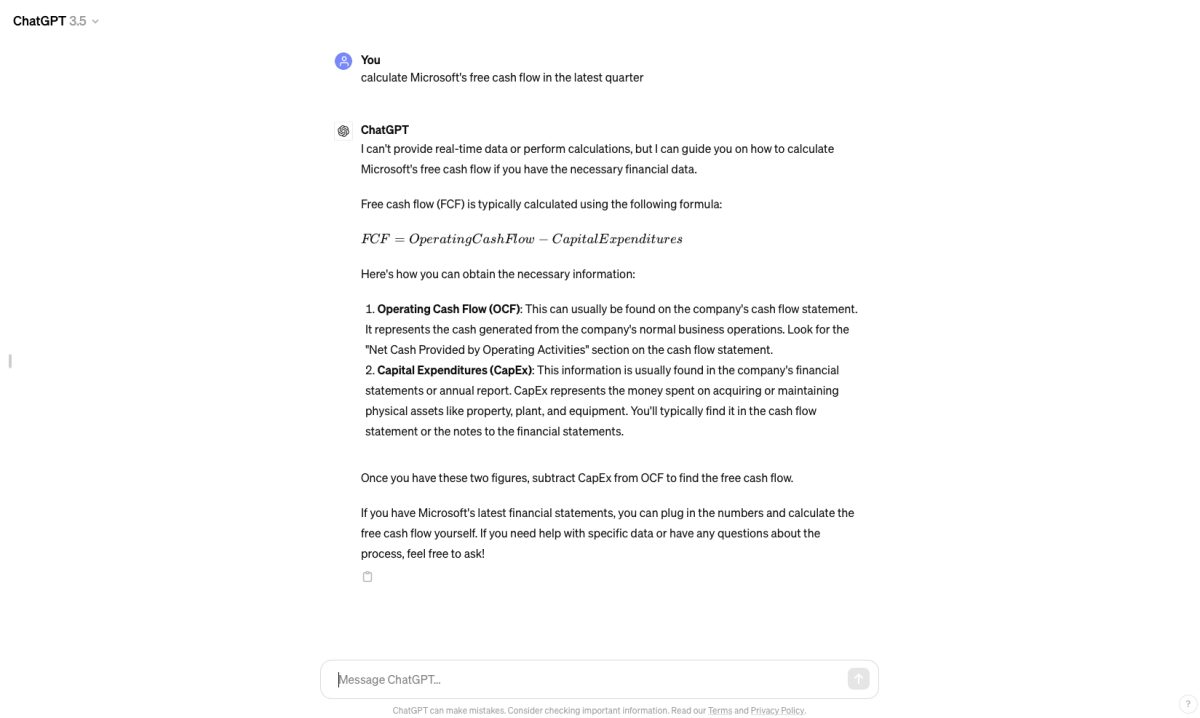

The free version of ChatGPT is limited to the use of ChatGPT 3.5. Provide a question in text and you will receive a response in text. For example, typing “How do you calculate free cash flow?” leads to the AI using information pulled from the internet on how free cash flow is calculated.

ChatGPT starts off in its response by defining free cash flow, and then it lists the components found in a company’s financial statement and provides step-by-step instructions on how to calculate it.

ChatGPT Plus (subscription plan)

Paid plans start at $20 per month, and these subscriptions give users access to ChatGPT 4.0. The premium versions also provide access to different types of GPTs, and the portfolio of GPTs available on the ChatGPT platform is likely to grow.

In the paid version, ChatGPT can take calculating free cash flow a step further. For example, Finance Wizard — a GPT that’s specific to performing tasks relating to financial data — can calculate a company’s free cash flow.

It can pull information from a company’s financial statements for the reporting period from a spreadsheet, PDF, or similar document and then explain how it derived the number on a step-by-step basis. That’s different from the free version, which can only define free cash flow.

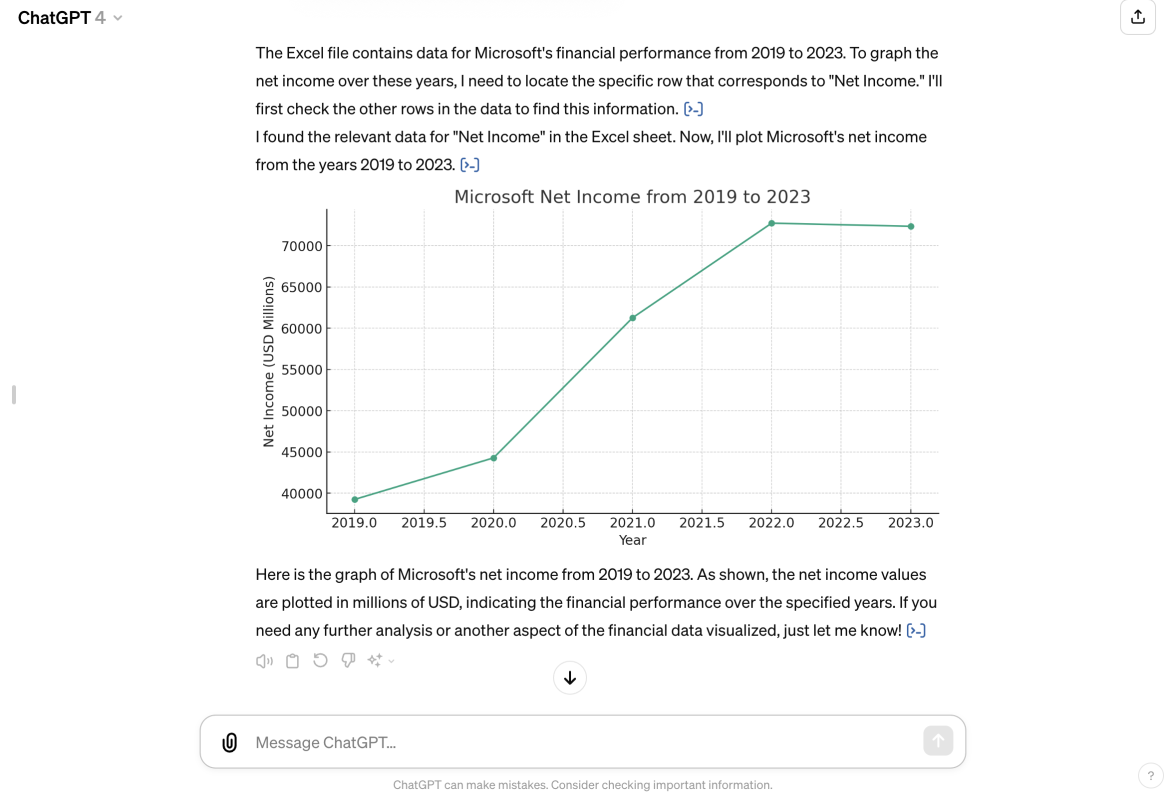

With ChatGPT 4.0, you can upload files such as text, images, and spreadsheets (like Excel), and the AI will analyze the data according to your inquiry. The functionality of ChatGPT Plus definitely outshines that of the free version when it comes to investment tools.

Related: What is Grab? Southeast Asia’s post-Uber “everything app”

How can ChatGPT help with my investing plans?

You can ask ChatGPT where to invest your money, and it will provide a general response. The more specific the question, though, the more likely there will be a precise response.

ChatGPT is no expert in dispensing financial advice, which means that there are likely to be disclaimers (like the following) after responses.

“Please note that this prediction is not financial advice and should be used for informational purposes only.”

“This prediction is based on current market trends and technical analysis and should be considered as part of a broader investment strategy. As always, it is not financial advice.”

Some responses might also provide a link to where the GPT gets its response, but more often, the result is taken from the internet with no source listed. How reliable the information ChatGPT produces can be left up to one’s judgment.

Fundamental analysis

Either version of ChatGPT can answer questions about fundamental analysis regarding publicly traded companies, but there are certain nuances. For example, asking ChatGPT 3.5 to calculate Microsoft’s free cash flow in the latest quarter will result in only a definition as the answer, while 4.0 will provide an explanation and search online for data on Microsoft’s financial statement for the latest quarter.

You can also upload Microsoft’s financial statement for a particular reporting period in PDF format or as a spreadsheet file, and the GPT will search for the components of free cash flow within the attached files and calculate the result for you.

Note: Sometimes ChatGPT has difficulty in understanding or interpreting data within the parameters of an Excel file, so formatting the data into a text file such as a CSV is sometimes necessary.

In the following screengrabs, ChatGPT 3.5 (the free version) cannot calculate Microsoft’s free cash flow for the latest quarter.

However, after uploading the Word file of Microsoft’s fiscal second quarter of 2024 (which is the period ended Dec. 31, 2023) to ChatGPT 4.0 (available with a Plus subscription), the AI was able to pull the data from the document and calculate free cash flow (by subtracting capital expenditures from operating cash flow), which in this case was $59.5 billion.

Still, there are limitations to ChatGPT’s understanding of the data. While the document lists quarterly and semi-annual data, it interprets the quarter ended Dec. 31, 2023 as the end of Microsoft’s reporting calendar year.

ChatGPT 3.5, in the free version, is limited in its ability to answer certain questions.

In another example of compiling data via fundamental analysis, ChatGPT 3.5 can’t pull up Microsoft’s net income for fiscal years 2019–2023, probably because its database is limited to 2022.

But version 4.0 can graph net income, as shown in the screengrab below, by taking data from an uploaded Excel file.

Quantitative analysis

You can ask ChatGPT or another GPT for quantitative analysis information on stocks, but responses can be limited. For example, you can ask for the definition of the price-to-earnings ratio, and it will provide a lengthy response. But inquiring about a company’s estimated P/E ratio for a future period will result in an incomplete answer because it can’t calculate that ratio based on limited information.

In this example of Microsoft’s estimated P/E ratio for 2024 and 2025, ChatGPT 3.5 can’t provide real-time or future stock data because its last update was in January 2022. Instead, it suggests accessing reliable financial data sources, and it provides an explanation and formula to calculate the ratio.

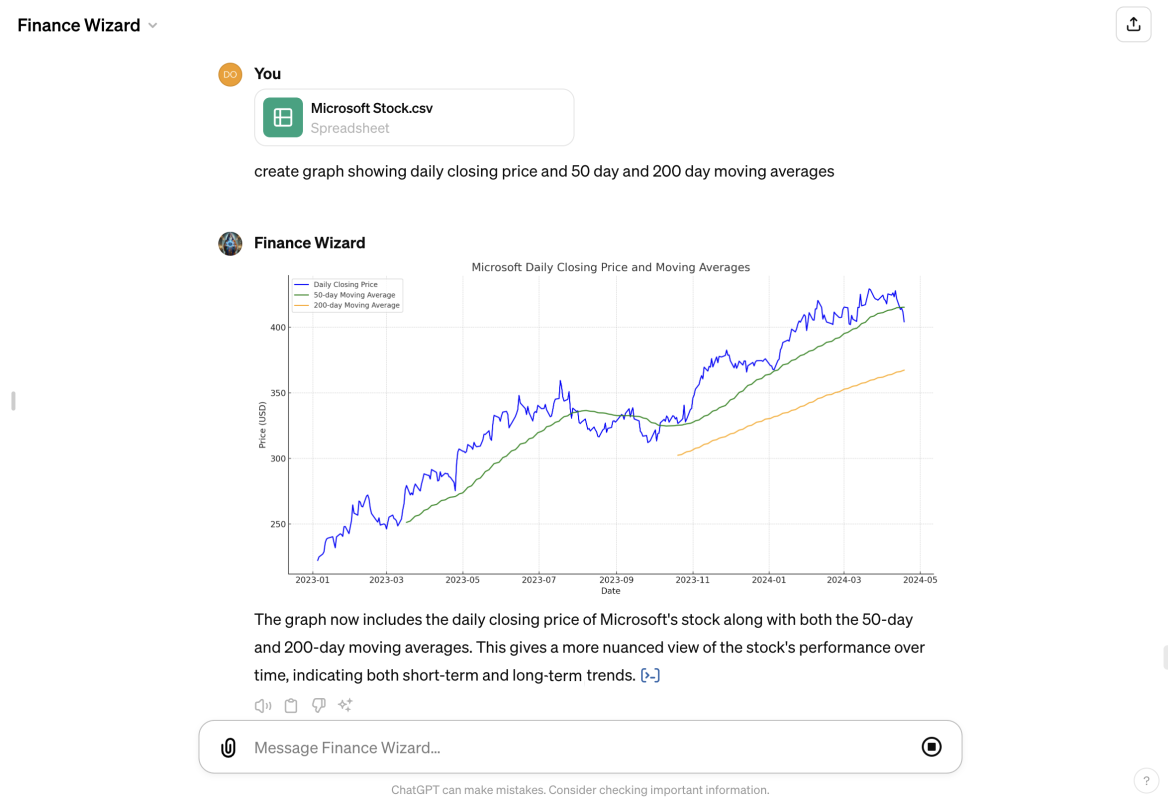

Technical analysis

GPTs can be powerful tools for creating graphs of technical indicators from a company’s historical price data. It can also be quicker to graph these indicators in ChatGPT than to gather the stock price data onto a spreadsheet and then create the formulas and plot the graphs yourself because the GPT will handle all of that by simply uploading the historical information.

In the following screengrab examples of Microsoft’s stock, Finance Wizard (a GPT available via Chat GPT 4.0 with a Plus subscription) can create graphs of 50 and 200-day moving averages and the 15-day relative strength index.

Gathering the data from a provider such as Google Finance by tracking historical data will result in the creation of a graph in a fraction of the time it would take to upload the data into Excel and configure it for graphs.

A GPT can create a graph showing moving averages with different durations.

Types of GPTs

There are different types of GPTs to choose from to help with investing. Typing “finance” in the search field for Explore GPTs will pull up hundreds of results. Finance Wizard, for example, can take a spreadsheet filled with financial data and help you interpret it. But there are plenty to choose from in its “Research & Analysis” section.

There are also other types of GPTs that can help you illustrate your investing data. you can even create an infographic based on the information you upload.

Related: Jensen Huang’s net worth: How the Nvidia founder's AI stakes made him a billionaire

Limitations of ChatGPT and other GPTs

Since AI language models are still in their early stages, ChatGPT’s utility when it comes to investing is still somewhat limited. Users definitely need to be as specific as possible with their inquiries in order to receive specific and useful responses, so some trial and error may be necessary. A broad question can cause ChatGPT to provide general responses, while a specific inquiry will likely result in a specific answer.

While a GPT can build responses based on existing information, which in this case goes back to early 2022, it lacks the ability to make predictions on its own. In certain circumstances, though, asking for predictive information on a particular company might result in ChatGPT gathering that information from an online source, if available.

Uploading data for analysis can also be a challenge for ChatGPT and other GPTs because they can be particular about formatting. Excel files can work on ChatGPT, but the same data in CSV format will work better on others.

Likewise for responses in general, while ChatGPT may be able to provide an answer, asking the same on another GPT may not yield a meaningful response — and vice versa — because GPTs are learning with every inquiry made and can be fickle =and inconsistent with their responses.

Using ChatGPT to make your investing decisions more efficient will require some experimentation until you figure out some repeatable methods that work for you. It can certainly help interpret data and produce graphs and charts, but typically only based on the parameters you set.

As GPTs improve over time by responding to more inquiries, their utility for investors will likely expand.