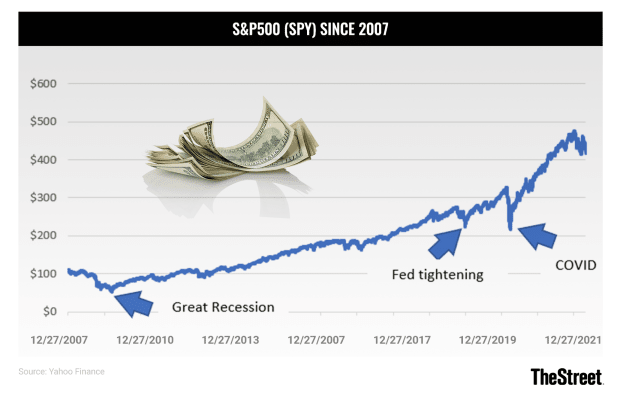

It's been a tough few months for investors. After more than doubling from the COVID low in 2020, the S&P 500 has fallen 14%. It's been worse for growth investors. The technology-heavy NASDAQ has lost 23% of its value in 2022. The traditional ruler for a bear market is a 20% decline, so the NASDAQ is clearly in one, while the S&P 500 has been flirting with it.

Navigating bear markets can be tricky. It's hard to keep a level head when all you see is red every time you open your portfolio. Fortunately, TheStreet is home to many seasoned investors with decades of experience managing market volatility. So, we asked them how they manage their portfolios in a bear market.

Their answers vary, but if there's a common thread, it's that risk control matters. Read on to learn how they're protecting their portfolios.

Todd Campbell, TheStreet Smarts

I've boosted my monthly contributions to an S&P 500 index fund in my retirement account. Because accumulating more shares at lower prices can shorten the time to recover to past highs, dollar-cost averaging throughout a bear market can pay off.

Remember, every bear has preceded a big move up in the S&P 500 and, eventually, all-time highs. So, if your time horizon is long, consider calling human resources to increase your contribution rate.

If your horizon is short-term, you can't dollar-cost average into an index, or you invest in individual stocks, it's different.

You don't pick a fight with a Grizzly bear! In the Great Recession, every major market sector fell by double-digit percentages, so nothing is safe in a recession besides cash or Treasuries.

Therefore, it's important to play defense if you need the money soon. For example, avoiding margin steers you clear of forced liquidation. And keeping a higher-than-normal amount of cash to pay expenses will keep you from selling great companies at their lows to pay your bills. Stop losses, shorting, and low-beta value stocks can help, too.

Overall, understanding what you own (borrowing conviction from others is a killer) and proactively creating plans for buying and selling is essential. If you react to the market's whims and whispers, you'll churn your account to pieces.

Stephen Guilfoyle, Real Money

It depends on what kind of bear market we're talking about. If liquidity dries up along with price discovery, traders/investors will want to either remain "cash-y" or stash the cash in medium-term debt securities such as U.S. Two Year Notes if they will yield 2.5% plus.

Beyond that, it is probably best to trade more than to invest.

I find it easier, though I don't always do it with the precision I should... to segregate funds meant for trading and funds meant for investment. If you have to, use two accounts.

The trading account goes home mostly cash, if not every night, then at least every weekend. The investment account focuses on true staples with some exposure to areas of high personal conviction. For me, that's the semiconductor stocks. For example, my semis are sitting there in my account right next to the toothpaste, shampoo, and diet soda.

Oh, and do a lot of push-ups. Won't help your book, but it will improve your focus. Trust me.

(Read Stephen "Sarge" Guilfoyle's Market Recon column and trading ideas each day on Real Money, TheStreet's premium site.)

James 'Rev Shark' DePorre, Real Money

My best advice for a bear market is:

1. Raise cash. It is never too late to sell. You can always rebuy. If you rebuy at a higher price, consider it an insurance premium.

2. Don't get sucked into trying to predict the ultimate low. Focus on buying stocks as their chart improves. It is better to be late than early. Only amateurs try to predict exact turning points.

3. Develop a shopping list of stocks that you like fundamentally but wait for some signs that the market agrees with your assessment.

4. Maintain a positive mindset. Bear markets will create terrific opportunities for patient traders and investors.

(James "Rev Shark" DePorre provides market commentary and trading ideas throughout the day on Real Money, TheStreet's premium site. Click here to learn more.)

Bob Byrne, Real Money Pro

My approach to trading a bear market is straightforward. Since it's impossible to know when or where stocks will bounce, I rely on a few moving averages to guide my trading.

If the stock price is beneath its 10-day and 21-day exponential moving average (EMA), I assume sellers are in control, and I stay on the sidelines. Sure, day-trading opportunities may arise for scalpers, but swing traders will save themselves a lot of stress (and money) if they avoid buying all stocks and ETFs when they're trading beneath a 21-day EMA.

Once a stock trades above its 21-day EMA, I give buyers the benefit of the doubt and look for set-ups to trade long. My primary target is generally the 50-day simple moving average.

While chart patterns and basic support and resistance areas play a role in this, merely trading on the right side of the 21-day EMA can keep you from getting stuck in a nasty downtrend.

(Bob Byrne is a regular contributor to Real Money Pro, the TheStreet's premium site for active traders, where he writes about the market and trading strategy. Click here to learn more.)

Chris Versace, Action Alerts PLUS

A bear market reveals itself only after equities have experienced an extended fall, usually bringing with it ample uncertainty and a "shoot first, ask questions later" mentality. Normally, bad news is bad news, but bear markets tend to result in good news not being good enough, punishing companies almost across the board. As a result, emotions run high as frustration sets in, which is rarely a good thing for investing.

While it can be difficult, we have to check our emotions at the door, revisit our investment thesis, and ask what's driving the bear market action. This year, many factors are at play, including the protracted Russia-Ukraine war, the risk of extended China COVID lockdown supply chain issues (crippling manufacturing and revenue streams), and a Fed hell-bent on fighting inflation, even if it means tipping the U.S. economy into a recession.

At times such as these, Action Alerts PLUS not only culls a variety of economic data but also asks where a company's business is likely to be in the future compared to where it is today. Some companies will be impacted more by the headwinds we're facing. For example, we recently exited the shares of Union Pacific (UNP). And because retailers are poised to have a difficult time because of bloated inventories, we're also revisiting the portfolio's stakes in retail stocks. Alternatively, the factors driving chip demand, elevated prices for key agricultural crops, and cybersecurity spending remain in place. Similarly, the forthcoming spending associated with the Biden Infrastructure Law should accelerate nonresidential construction activity and EV charging stations.

At the same time, we recognize that many activities will continue no matter the environment, from basics like eating and taking care of ourselves to searching the internet, streaming content, and communicating with co-workers, family, and friends. In short, we want to be where the spending is still occurring and exit companies that are likely to experience demand destruction.

Overall, there are many tools one can use to preserve capital. One of the easiest is keeping higher cash levels, but another one for risk-tolerant investors is market hedging, including via inverse ETFs. We're using both of those tactics in the Action Alerts PLUS portfolio.

In a bear market, several Wall Street sayings can help guide you, but this one from Victor Sperandeo sticks out to me, "The key to building wealth is to preserve capital and wait patiently for the right opportunity to make the extraordinary gains."

(Chris Versace is Co-Portfolio Manager of TheStreet's Action Alerts PLUS. Click here to learn how to subscribe.)