- At the end of every year, I find that it is important to review the total returns of five major investment categories.

- Stocks have delivered an 87.11% total return, leading the major asset classes.

- However, precious metals have outperformed, driven by record commodity performance.

- Bonds and cryptocurrency have been negative. What will the new year bring?

Every year at this time, I like to look back and see what the long-term, 5-year investment return was for the five major investment categories: stocks, bonds, real estate, precious metals, and crypto. I chose five exchange-traded funds (ETFs) that are representative of each category.

I chart the price, Trend Seeker (adjusted for the 50-week period), and the 50-week moving average.

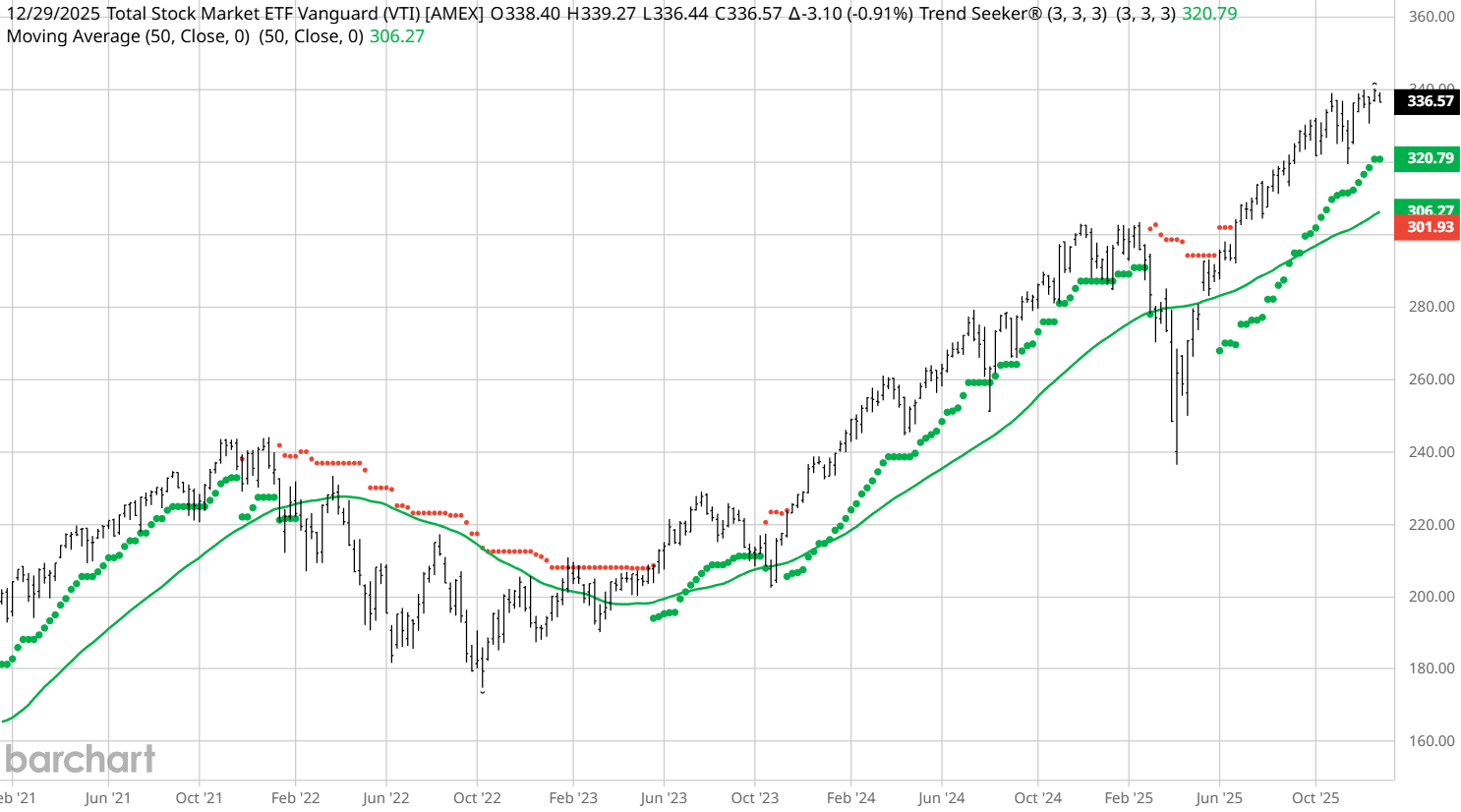

Stocks

Vanguard Total Stock Market ETF (VTI)

The Vanguard Total Stock Market ETF seeks to track the performance of the CRSP US Total Market Index. It contains 3,530 stocks. The total return over the last 5 years is 87.11%.

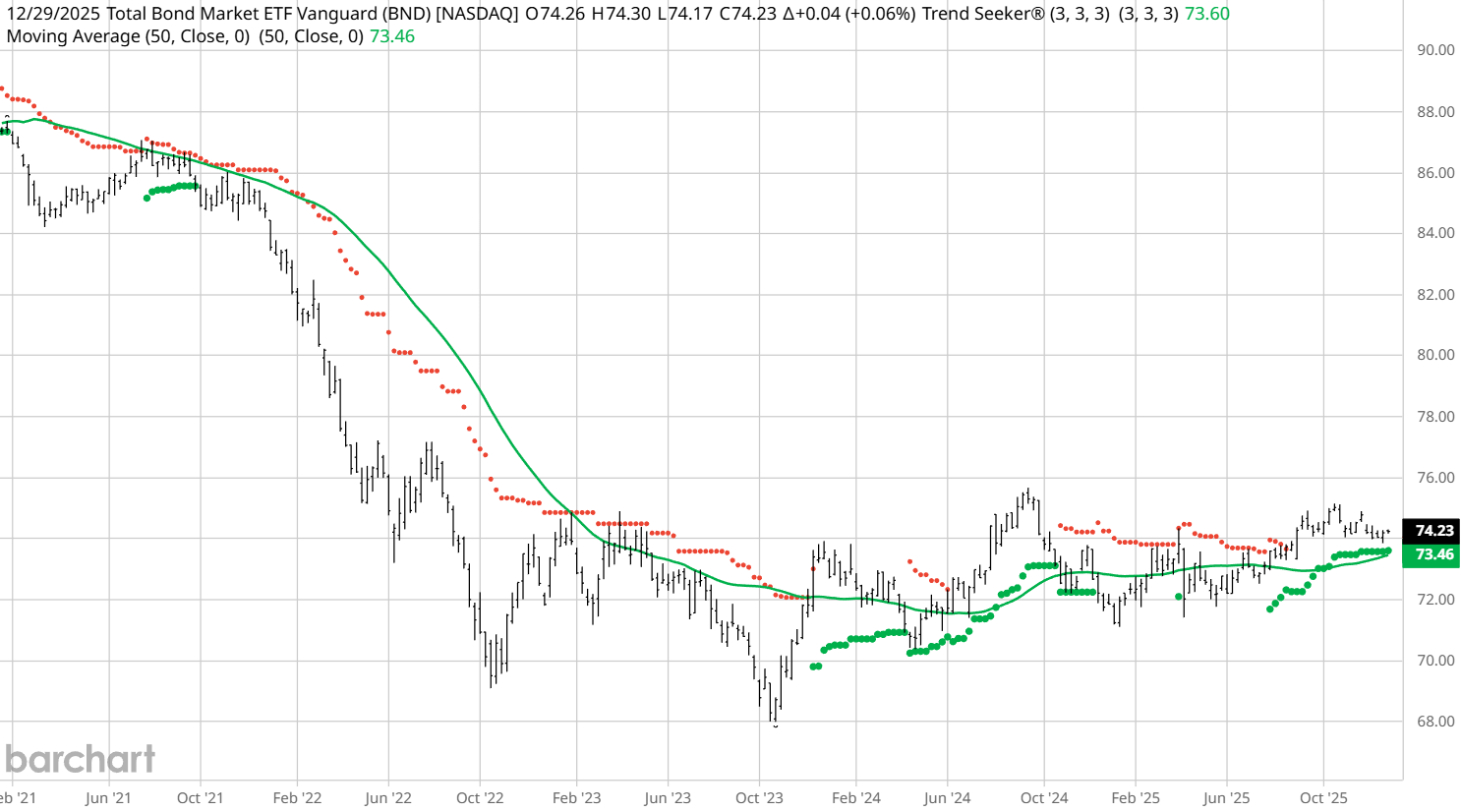

Bonds

Vanguard Total Bond Market ETF (BND)

The Vanguard Total Bond Market ETF seeks to track the performance of the Bloomberg Barclays U.S. Aggregate Float Adjusted Index. It contains 9,477 bonds and its total return over the last 5 years is a 1.57% loss.

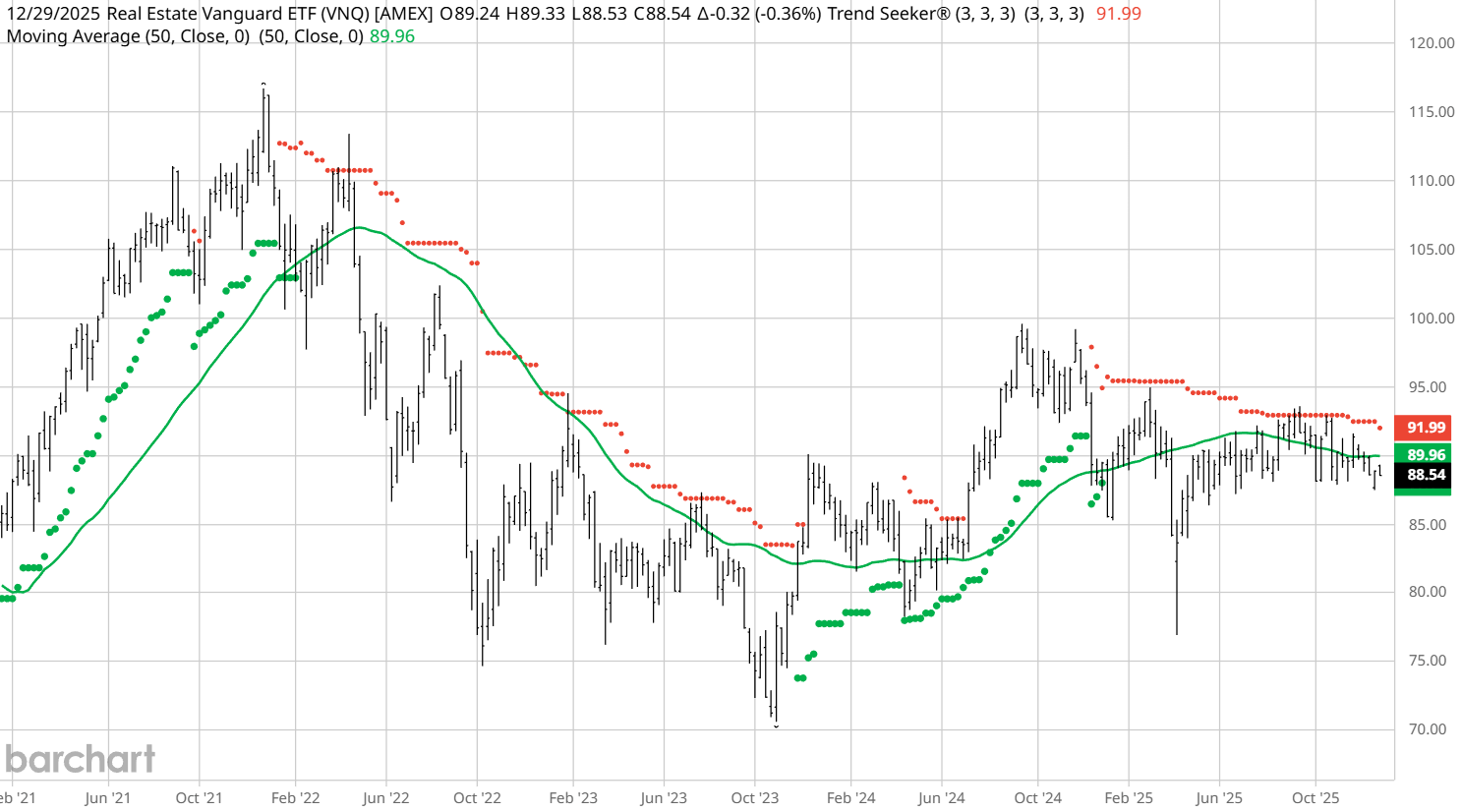

Real Estate

Vanguard Real Estate ETF (VNQ)

The Vanguard REIT ETF seeks to track the performance of the MSCI US REIT Index. It contains 155 real estate investment trusts (REITs). Its total return over the last 5 years is 27.70%.

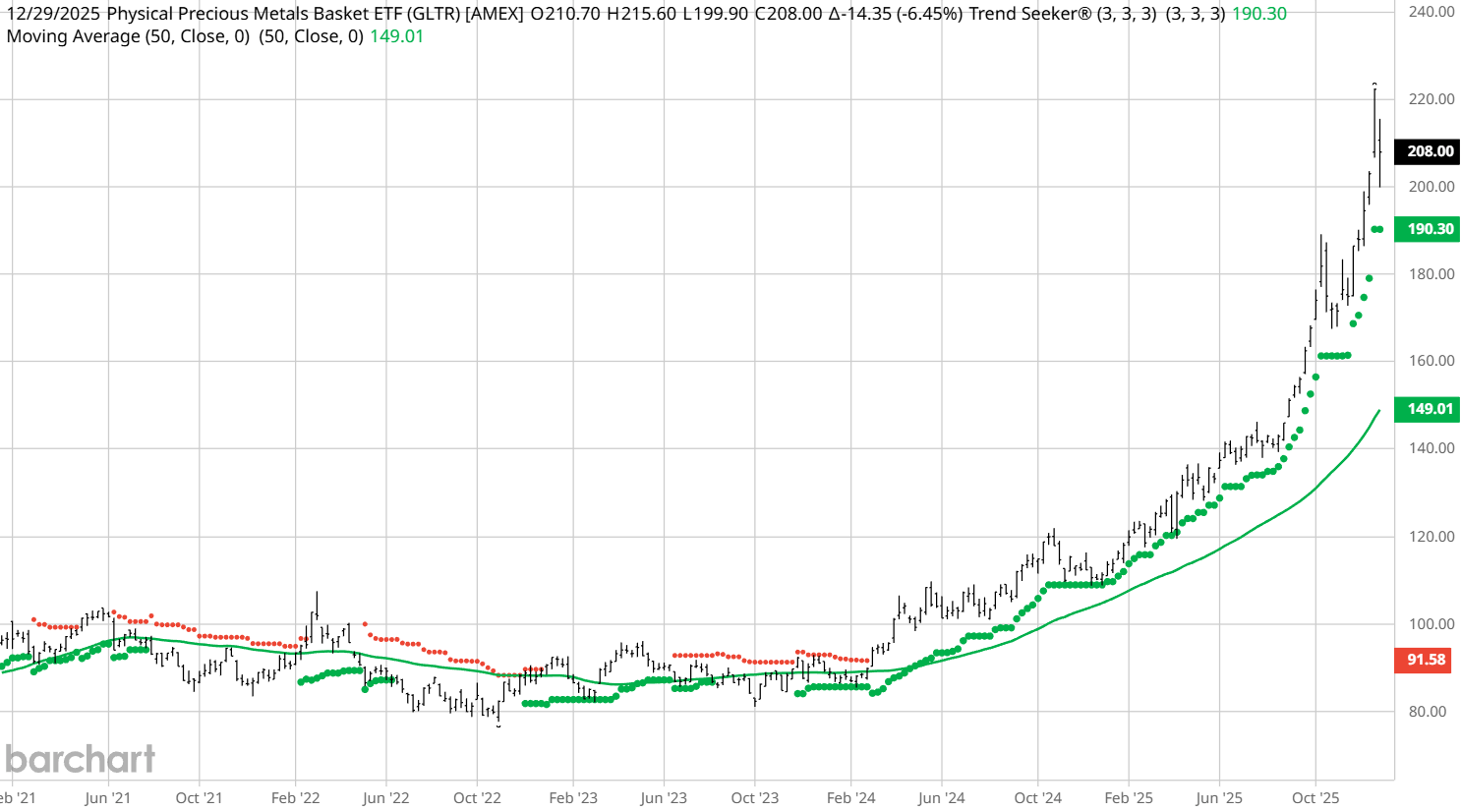

Precious Metals

Physical Precious Metals Basket Shares ETF (GLTR)

The goal for the GLTR ETF is for the shares to reflect the performance of the price of a basket of gold, silver, platinum, and palladium bullion, less the expenses of the trust’s operations. Its total return over the last five years is a whopping 115.29%

Cryptocurrency

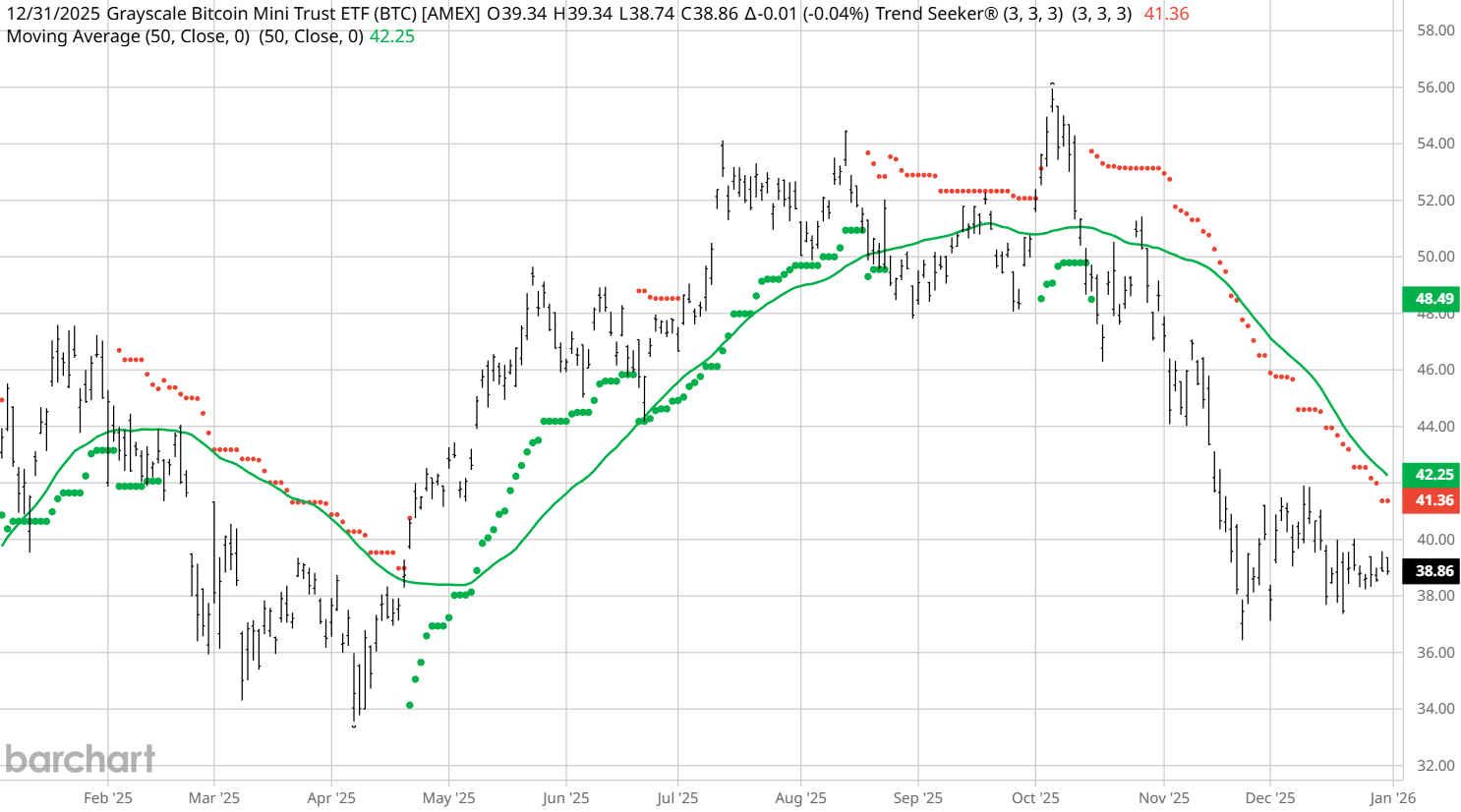

Author’s Note: The Bitcoin Trust does not have a 5-year track record, so I use a 1-year chart

Grayscale Bitcoin Mini Trust ETF (BTC)

The Grayscale Bitcoin Mini Trust ETF seeks to reflect the value of Bitcoin held by the trust, less expenses and other liabilities. Its total return over the last 1-year period is a 6.90% loss.

The Bottom Line

I’ll make no comments, I’m just stating the facts. Remember no investment is forever, just your health and happiness.

I wish you all health, wealth, and happiness, and time to enjoy all three in the year ahead. Hapy New Year!

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.