TheStreet’s Conway Gittens brings the latest business headlines from the floor of the New York Stock Exchange as markets open for trading Thursday, June 20.

Related: Nvidia has $4 trillion value in sight as AI seen powering chip sales

Full Video Transcript Below:

CONWAY GITTENS: I’m Conway Gittens reporting from the New York Stock Exchange. Here’s what we’re watching on TheStreet today.

Stocks are on track for yet another winning week as Wall Street returns from the Juneteenth holiday. The S&P 500 and the tech-heavy Nasdaq both crossed new record highs on Tuesday.

Investors are reacting to weekly jobless claims – 238,000 Americans filed for unemployment benefits last week, that’s down from 243,000 the previous week.

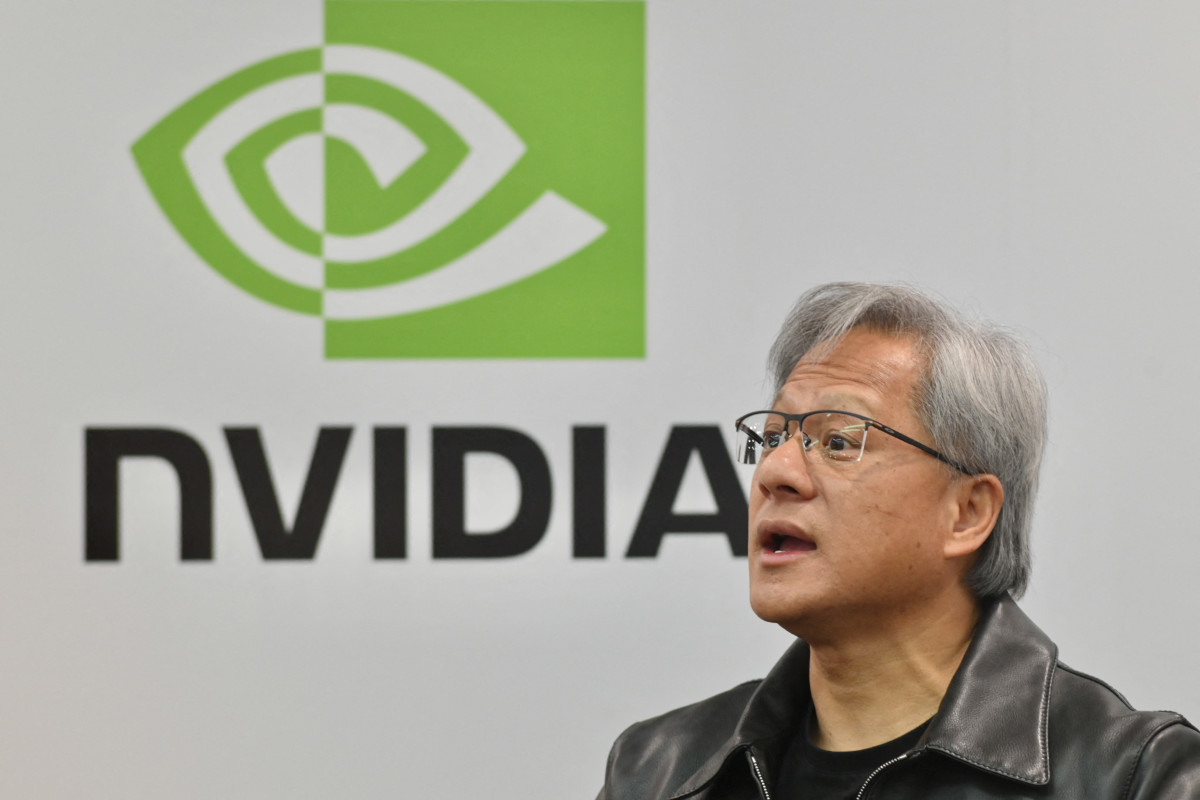

And in other news, Nvidia has officially surpassed Microsoft to become the most valuable public company in the world. Nvidia’s market cap is roughly $3.4 trillion, just above Microsoft’s $3.32 trillion dollar value. Apple trails closely behind at $3.27 trillion.

But this didn’t happen overnight. After Nvidia saw its stock skyrocket 239 percent in 2023, shares have rallied another 181 percent so far in 2024.

More on Nvidia:

Nvidia has $4 trillion value in sight as AI seen powering chip sales

Analyst resets Nvidia stock price target as CEO unveils new AI platform

Over the last five years, the stock has shot up over 3,400 percent.

Nvidia announced a stock split earlier in June, making its shares more affordable for the everyday investor.

More importantly, demand for the stock is tied to Nvidia’s dominance as the leader in the AI chip race. It controls 80 percent of the processor market by some estimates. The chipmaker recently announced its next generation chip slated for 2025 and a new platform called ‘Rubin’ slated for 2026.

That’ll do it for your daily briefing. From the New York Stock Exchange, I’m Conway Gittens with TheStreet.

Related: Veteran fund manager picks favorite stocks for 2024