The United Auto Workers and the three big U.S. manufacturers continued to negotiate on a new contract over the weekend as some 18,000 workers were out picketing.

But there was little evidence late Sunday an agreement is coming soon.

In fact, the strike could be expanded, particularly against General Motors (GM) -) and Chrysler parent Stellantis (STLA) -). Customers, workers, managements and investors all have a stake in the outcome.

Related: General Motors delivers hard-nosed message to UAW workers

The union has minimized the strike impacts on Ford Motor Co. (F) -) because the union has said the negotiations were making some progress. Historically, Ford has had better relations with the UAW, and a contract with Canada's auto workers was ratified this weekend.

The strike as of Sunday is affecting some 38 parts distribution centers and a handful of plants. The distribution centers are important because dealers need parts to be able to repair and service customer vehicles, a very lucrative part of their businesses, the Associated Press noted over the weekend.

The UAW has demanded progress and could shut down more plants and facilities.

The strike is the first against all three manufacturers at once since before World War II. Since the end of the war, the UAW's strategy was to strike one company, and the other two companies would largely go along with the settlement.

Not so in 2023 because UAW members want more money and benefits and better working conditions. The stated goal is to win 40% wage increases over the 4-year term, a four-day workweek, cost of living increases and an end to a two-tiered pay scale instituted after the near-collapse of the U.S. industry during the 2008-09 recession.

The automakers are now profitable, UAW argues, and the workers want to catch up from the sacrifices they made— financial and otherwise — to ensure the industry's survival.

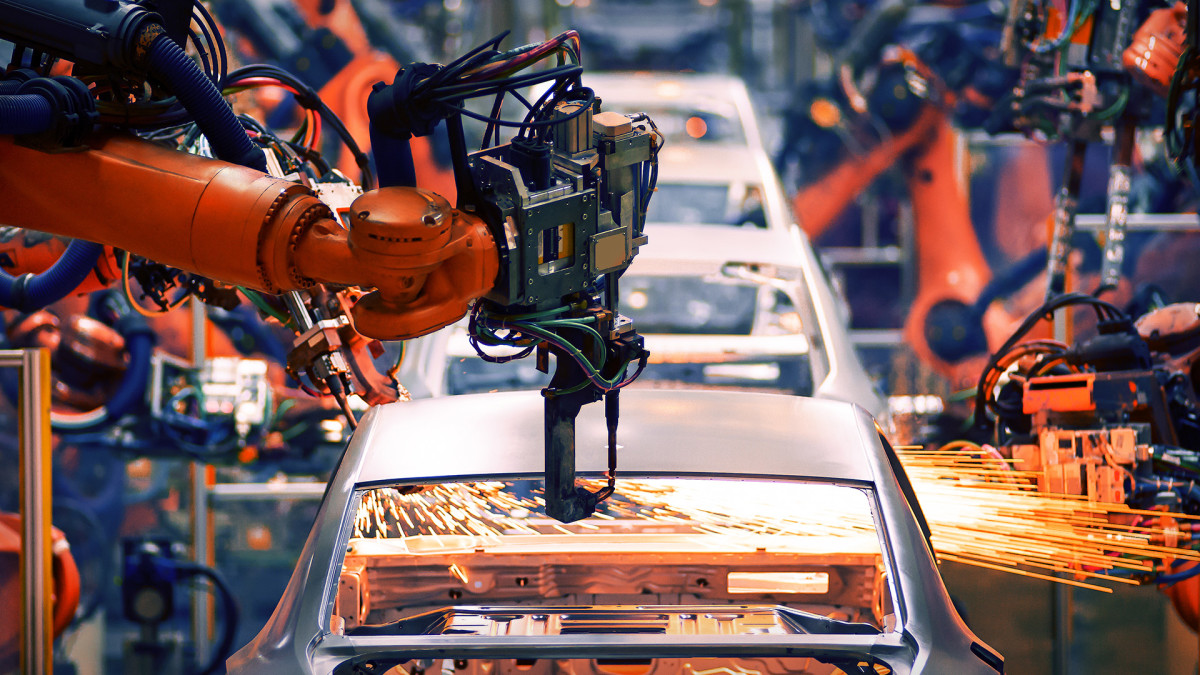

The automakers are resisting, arguing they need to reinvest their profits in new plant and equipment to build up electric-vehicle capacity to compete against Tesla (TSLA) -), Rivian Automotive (RIVN) -), and other electric vehicle manufacturers.

The New York Times reported the strike may have already cost the U.S. economy about $1.6 billion in lost sales and wages. The estimate was provided by the Anderson Economic Group, a Michigan consulting firm.

The dispute is not all about the money. It's also very much about the drive to substitute electric vehicles for gas-fueled cars and trucks. That, in turn, raises the question of what that future might hold for traditional UAW members.

UAW president Shawn Fain wants his members to be in the middle of the transformation, even if new plants are being built in states like Tennessee and Kansas, neither of which is union friendly.

The UAW believes it has lots of domestic support, particularly in states with big auto plants. President Joe Biden is set to visit Michigan on Tuesday to show his support. Donald Trump plans to give a speech in Michigan this week.

UAW officials also believe they have leverage in how they're managing the strike — starting with small walkouts and gradually expanding the scope so that automakers become short of inventories of new vehicles to sell and the parts to service them.

Under that scenario, customers angry at company intransigence, empty showrooms and delays on repairs, will force the auto giants to bargain seriously.

It's not idle thinking. Dan Ives, an investment analyst with Wedbush Securities in New York, told the Associated Press he thinks the UAW has to be more aggressive to win the fight, with walkouts at core GM and Chrysler plants in and around Detroit.

The companies believe union stubbornness will backfire. And, in Stellantis' case, its business, which includes such brands as Fiat, Peugeot, Citroen, Alfa Romeo as well as Ram trucks and Jeep vehicles, now sprawls across four continents. Presumably the company can absorb a U.S. strike, The Wall Street Journal suggested.

It was not clear Sunday which side is right.

Canada may offer a hint. Ford and Unifor, the main Canadian union, agreed on a new contract before the U.S. strike began. Members ratified the deal on Sunday.

GM shares were down 1.1% to $32.35 this past week as the strike got bigger. Ford saw a small gain to $12.43. Stellantis shares were up 6.1%. Tesla shares, interestingly, fell back 3.6% as Wall Street suffered one of its worst weeks of the year.

Shares of Honda (HMC) -), Toyota TM, Nissan (NSANY) -) and Volkswagen (VWAGY) -) were all higher.