Labour has accused Rishi Sunak of having been dragged “kicking and screaming” into a U-turn after Conservative ministers spent months panning the idea of a windfall tax.

The Chancellor conceded on Thursday that the economic picture had worsened and it was necessary to “tax extraordinary profits fairly”, as he imposed what he only called an “energy profits levy”.

Shadow chancellor Rachel Reeves claimed a victory after her party had called for the measure since January.

Here are previous comments by senior ministers on a windfall tax:

Boris Johnson:

In February, Mr Johnson said the move would “clobber the oil and gas companies”, adding: “It would be totally ridiculous, and it would raise prices for consumers.”

The following month he said the move would “simply be to see the oil companies put their prices up yet higher”.

And he said it would make it “more difficult” for them to be “divesting from dependence on Russian oil and gas”.

But as the chances of a U-turn grew ever more likely, Mr Johnson voiced his opposition in increasingly more moderate language.

A fortnight ago, after the BP boss said his firm’s investment plans would not be hindered by such a tax, Mr Johnson refused to rule out taking the action.

But he said: “I don’t like them. I didn’t think they’re the right thing. I don’t think they’re the right way forward.”

Then on Monday he said he was “not attracted, intrinsically” to new taxes but stressed “no option is off the table” as he cited the need to help the public through the “aftershocks” of Covid and the Russian invasion of Ukraine.

Rishi Sunak:

The Chancellor back in February taunted Labour by saying a windfall tax would only be “superficially appealing” because it would “deter investment – it is as simple as that”.

But he too toned down his opposition over time, saying on May 12 that he was “pragmatic” about imposing the measure despite being “not naturally attracted to the idea”.

He told the BBC then: “What I want to see is significant investment back into the UK economy to support jobs, to support energy security, and I want to see that investment soon. If that doesn’t happen, then no options are off the table.”

On Thursday, however, he imposed a 25% tax on the firms’ extraordinary profits until they “return to historically more normal levels” to raise £5 billion over the next year.

“The oil and gas sector is making extraordinary profits, not as the result of recent changes to risk-taking or innovation or efficiency, but as the result of surging global commodity prices driven in part by Russia’s war,” he told MPs.

“For that reason I am sympathetic to the argument to tax those profits fairly.”

Jacob Rees-Mogg:

Some of the most vehement criticism has come from Brexit opportunities minister Jacob Rees-Mogg, who has argued it is wrong to raid the “honey pot of business”.

As recently as Friday he told reporters: “All taxation ultimately falls on individuals so when you’re calling for a windfall tax you’re saying you want to pay more tax.”

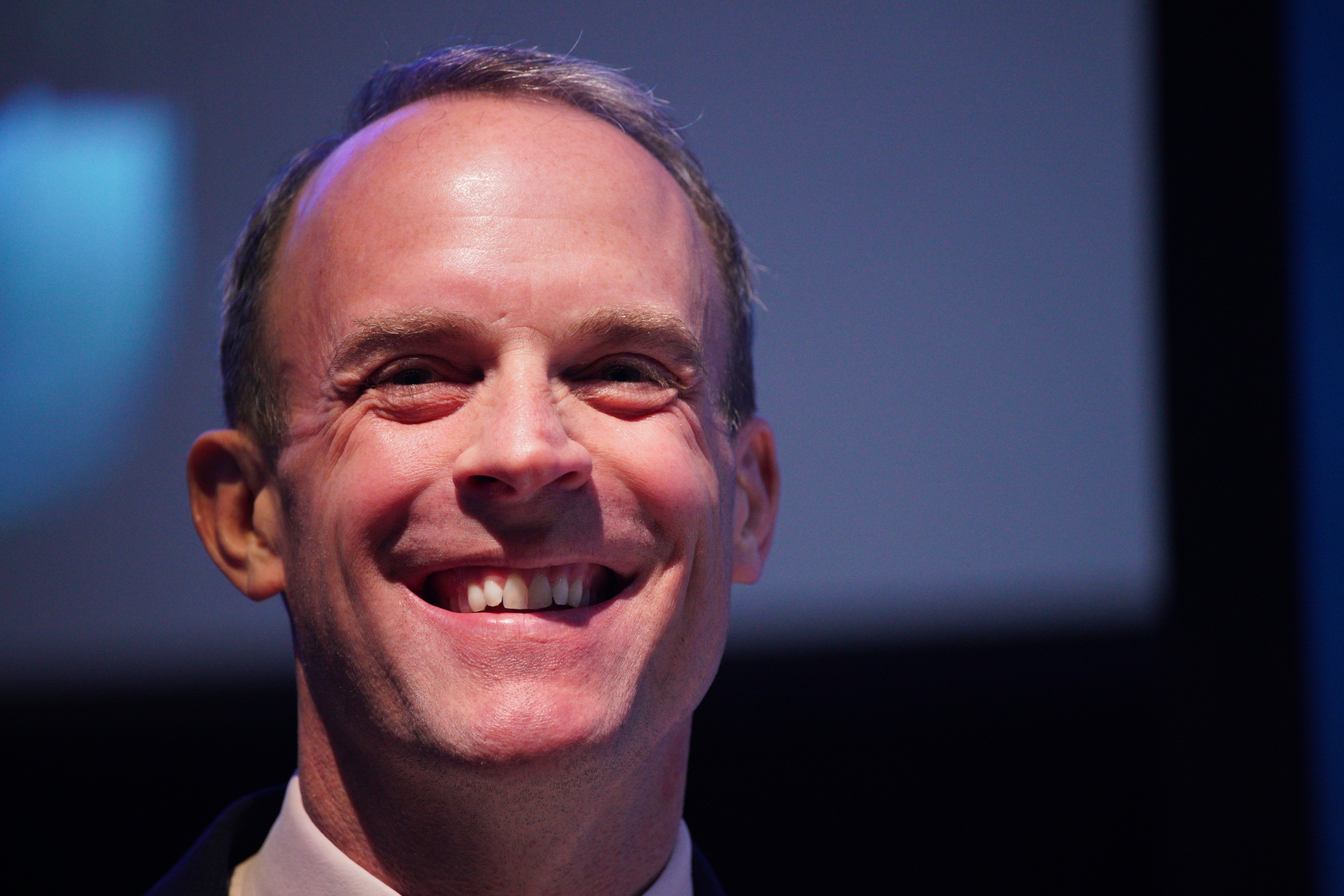

Dominic Raab:

One month ago, the Deputy Prime Minister told Sky News: “If you look at Labour’s policy, you asked about it – of a windfall tax – that would damage investment in energy supplies we need and hike bills. It’s disastrous. It’s not serious.

“So what this shows is they’re coming up with frankly ill thought through policies, but we have got a plan, a concerted plan, and I think that’s what voters want to see.”

Kwasi Kwarteng:

The Energy Secretary has repeatedly said he is “not a fan” of windfall taxes.

Earlier this month, he said “they discourage investment” and that it is nonsensical to hit firms with a “windfall tax which is arbitrary and unexpected”.