/Franklin%20Resources%2C%20Inc_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Franklin Resources, Inc. (BEN), headquartered in San Mateo, California, is a global investment management firm serving clients in over 150 countries. Valued at $12.6 billion by market cap, the company offers a wide range of services across equity, fixed income, alternative investments, and multi-asset strategies, and manages over $1.6 trillion in assets.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and BEN perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the asset management industry. BEN excels through its diverse asset management portfolio, featuring a balanced mix of equity, fixed-income, and alternative funds, as well as a global footprint with 30% of assets under management internationally. This diversification provides resilience against regional market fluctuations. BEN's strong brand reputation and trust with investors further drive client retention and attraction.

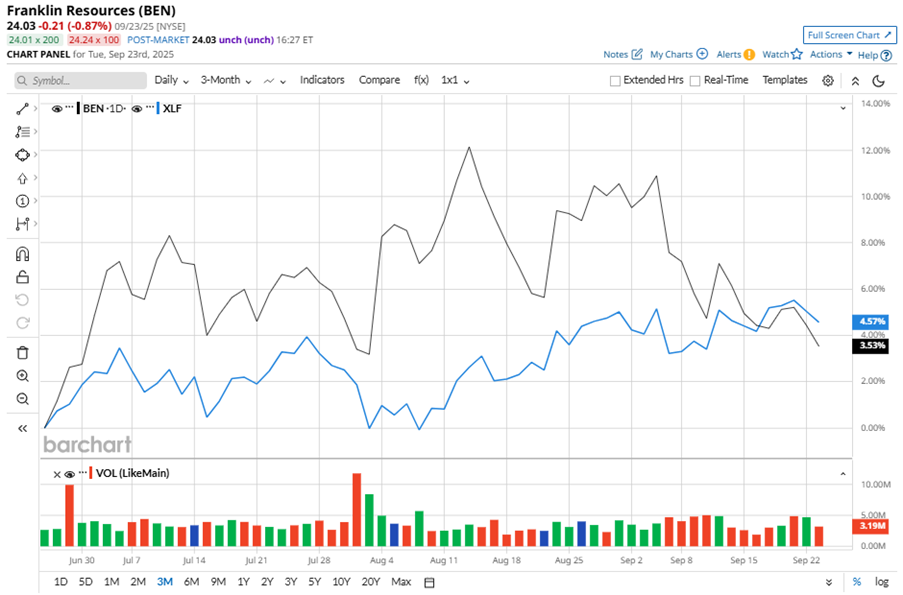

Despite its notable strength, BEN slipped 7.9% from its 52-week high of $26.08, achieved on Aug. 13. Over the past three months, BEN stock gained 5%, underperforming the Financial Select Sector SPDR Fund’s (XLF) 5.8% gains during the same time frame.

In the longer term, shares of BEN rose 18.4% on a YTD basis, outperforming XLF’s YTD gains of 11.2%. However, the stock climbed 15.8% over the past 52 weeks, underperforming XLF’s 18.3% returns over the same time period.

To confirm the bullish trend, BEN has been trading above its 200-day moving average since early May. However, the stock has been trading below its 50-day moving average since early September.

On Aug. 1, BEN's Q3 performance beat expectations, but its shares dipped slightly due to a 2.8% year-over-year decline in operating revenue, mainly caused by lower investment management fees. Despite this, the revenue figure surpassed consensus estimates by 3%. Its adjusted EPS also dropped 18.3% from the year-ago quarter to $0.49, although it beat analyst expectations. A significant decline in operating margin impacted profitability, potentially contributing to the muted investor response.

BEN’s rival, State Street Corporation (STT) shares lagged behind the stock, with a 15.1% gain on a YTD basis, but outpaced the stock with a 26.7% uptick over the past 52 weeks.

Wall Street analysts are cautious on BEN’s prospects. The stock has a consensus “Hold” rating from the 13 analysts covering it, and the mean price target of $24.67 suggests a potential upside of 2.7% from current price levels.