With the year-end holiday season upon us, many investors are taking a break from their screens to travel and catch up with family and friends.

For other investors, particularly professional ones like fund managers, the year-end holidays are an important period of portfolio management that may be characterized by disposing of certain stocks to minimize capital gains taxes or make last-minute additions.

Related: Do capital losses offset income? Tax-loss harvesting for beginners

Historical stock market performance: Thanksgiving through New Year’s

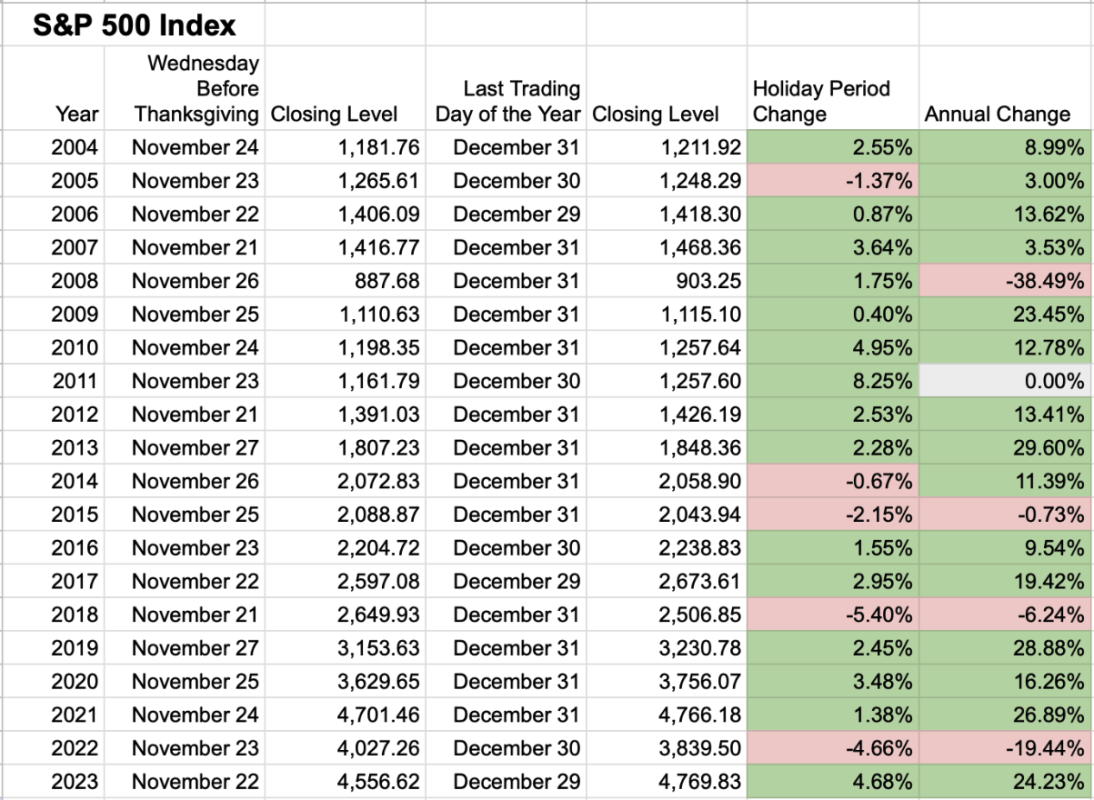

Here’s a look at how the stock market, as measured by the Standard & Poor’s 500 Index, has performed during the holiday period — from market close the Wednesday before Thanksgiving to the last trading day of the year for the last 20 years (2004 – 2023).

How does the stock market usually perform between Thanksgiving Day and New Year’s?

During the last 20 years, the market typically eked out small gains or losses in the holiday period from Thanksgiving to the New Year. There have been more holiday-season gains (15) than there have been losses (5) for the S&P 500 over the 20-year period. The biggest increase during the holiday period was 8.3% in 2011. The largest decrease was 5.4% in 2018.

More on stocks:

- The stock market’s performance after the past 5 elections

- How to create a stock tracker with live data using Google Finance

- How to track stocks from Google Finance in Google Sheets

There have also been a few instances when the market performed better during the holiday period than it did during the entire year. In 2007, the S&P's gain during the Thanksgiving and New Year holiday period was just slightly better than its annual increase. In 2008, just at the tail end of the 2007–2008 financial crisis, the S&P rose 1.8% during the holidays, compared to a 38.5% overall decline for the year. In 2018 and 2022, the loss was smaller than for either year. In 2011, the market gained 8.3% during the holiday period, versus being unchanged for the entire year.

On the flip side, for the holiday periods in 2005, 2014, and 2015, the market underperformed the entire year.

For the most part, however, the market’s overall annual performance has been better than its performance between Thanksgiving and New Year’s.

Related: Try these easy (and free) ways to give to charity

Does tax-loss harvesting drive stock prices down at year-end?

Many investors engage in tax-loss harvesting toward the end of the year. This is the practice of selling some losing stocks to increase one’s capital losses for the year so that they can help offset any capital gains when measured for tax purposes.

Judging by the market's year-end performance during the last 20 years, however, the impact of tax-loss harvesting doesn't seem enough to drive the market down as a whole.

Related: The 10 best investing books (according to stock market pros)