/Robinhood%20app%20on%20phone%20by%20Andrew%20Neel%20via%20Unsplash.jpg)

Robinhood Markets (HOOD) stock bounced off support at the 110 level on Friday as it aims to evolve from a trading app into a broader personal finance platform.

By using a combination of option strategies, we could potentially buy the stock for a significant discount, or achieve a healthy profit if the stock trades sideways.

Here’s the trade:

Sell to open the HOOD February 20 put with a strike price of $105, which was trading around $5.55 on Friday.

Then, add a bear call spread:

Sell to open the HOOD February 20 call with a strike price of $140, which was trading around $2.90 on Friday.

Buy to open the HOOD February 20 call with a strike price of $145, which was trading around $2.20 on Friday.

The sold put brings in around $555 in option premium, and the bear call spread adds another $70 in premium. In total, the combination of the two trades generates $625 in premium.

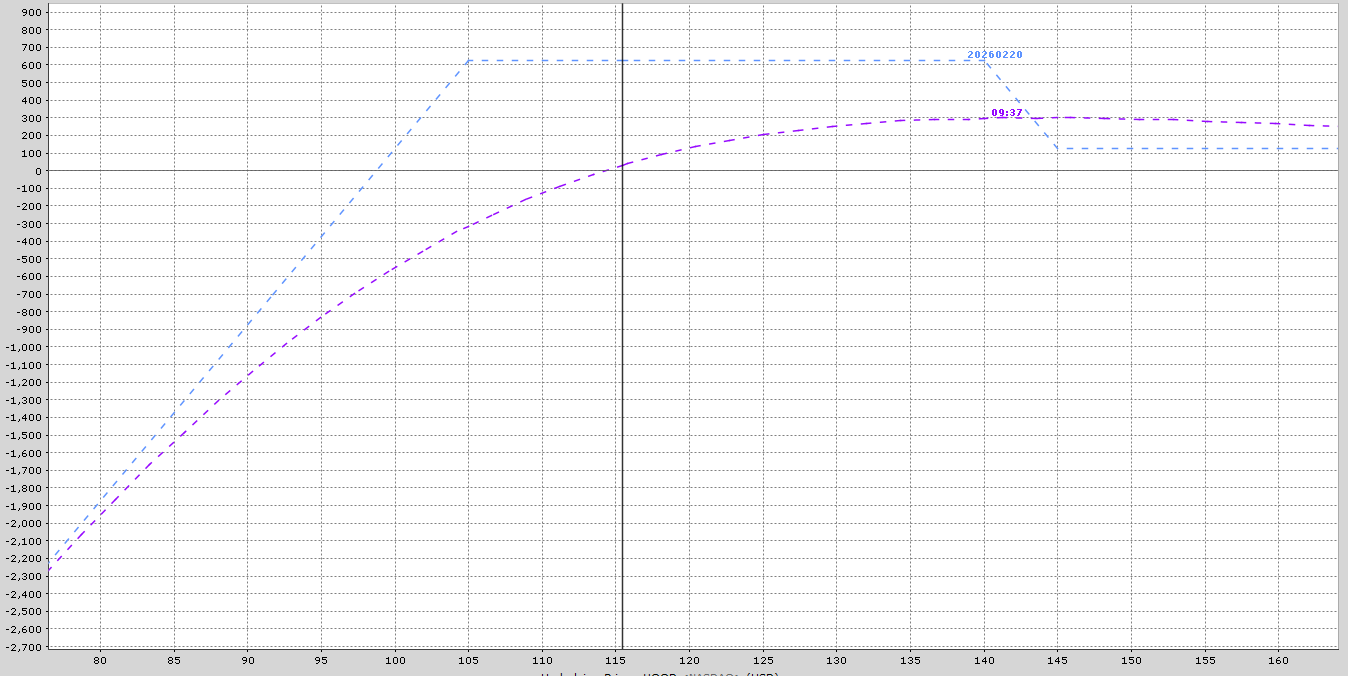

Here’s how the trade looks at trade initiation. The blue line represents the profit or loss at expiration and the purple line shows the trade as of today.

The position starts with a delta of 25, meaning it is roughly equivalent to owning 25 shares of HOOD stock. This figure will change as the trade progresses.

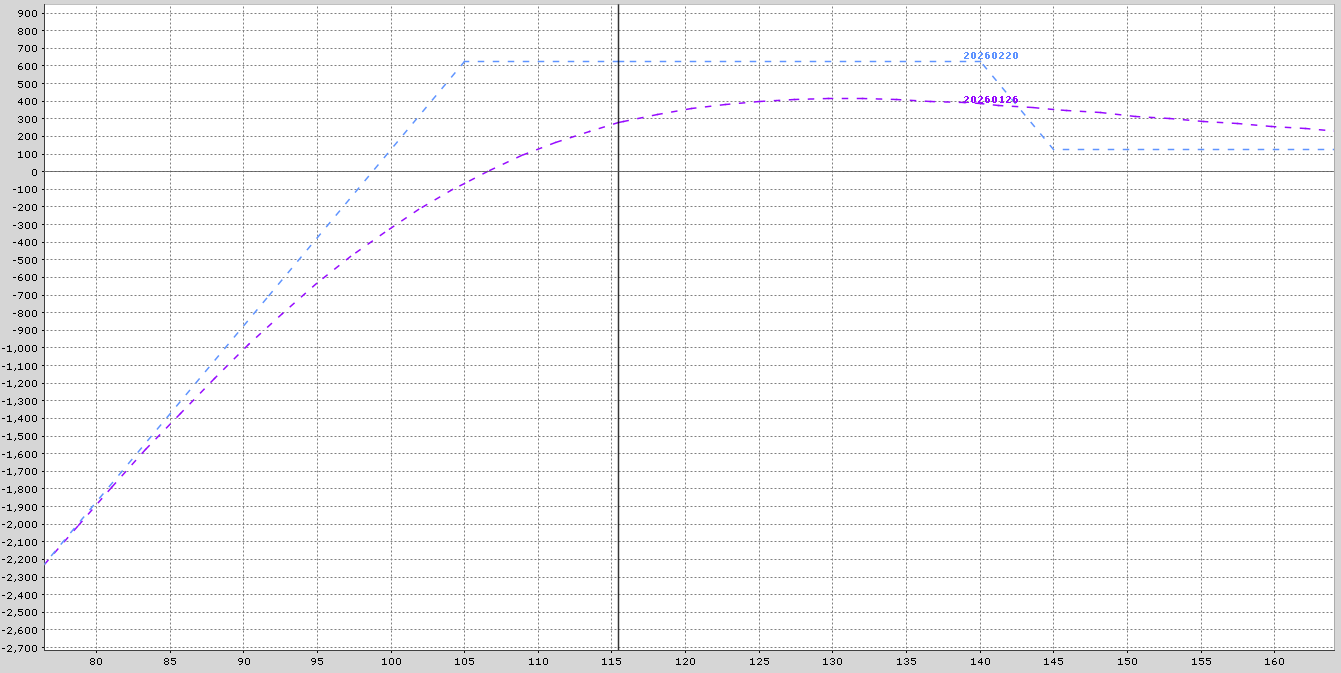

This is how the trade could look in around three week’s time.

Looking pretty good as long as the stock is above $107.

Possible Scenarios For This HOOD Stock Option Trade

Let’s work through a couple of scenarios of how this trade could look at expiration on February 20.

- If HOOD stock trades sideways and finishes between $105 and $140, the sold put and bear call spread will both expire worthless. The total profit will be equal to the premium received of $625.

- IF HOOD falls below $105 at expiration, we will be assigned on the sold put and will be forced to buy 100 shares at $105. However, our net cost basis will be $98.75, thanks to the $625 in option premium received. That is 14.3% below the closing price on Friday.

- If HOOD rallies above $145, the bear call spread will suffer a full loss of $500, but this will be fully offset by the $625 premium received, leaving the trade with a small profit of $125.

Not that this trade contains earnings risk with Robinhood Markets due to report on February 10th.

Company Details

The Barchart Technical Opinion rating is a 8% Buy with a Weakest short term outlook on maintaining the current direction.

Of 21 analysts covering HOOD stock, 14 have a Strong Buy rating, 2 have a Moderate Buy rating, 4 have a Hold rating and 1 has a Strong Sell rating.

Implied volatility is 52.61% compared to a twelve-month high of 114.38% and a low of 49.53%. That gives HOOD stock an IV Percentile of 2% and an IV Rank of 4.76%.

Robinhood Markets is a financial technology company best known for its commission‑free trading app, which opened the door for millions of new investors to access stocks, ETFs, options, and cryptocurrencies.

Its stock reflects the company’s rapid growth in retail trading activity, driven by a simple interface and strong brand recognition among younger investors.

As Robinhood expands into areas like retirement accounts, credit cards, and spending products, it aims to evolve from a trading app into a broader personal finance platform.

Summary

While this type of strategy requires a lot of capital, it is a great way to generate an income from stocks you want to own.

If you end up being assigned, you can start selling covered calls against the stock position.

You can do this on other stocks as well, but remember to start small until you understand a bit more about how this all works.

Mitigating Risk

With any option trade, it’s important to have a plan in place on how you will manage the trade if it moves against you.

Some traders like to add a deep out-of-the-money long put to reduce risk. For example, a February 20 put option with a strike price of $90 could be purchased for around $200. Buying this put, would cap losses below $90 and reduce total capital at risk.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.