With a market cap of $34.5 billion, PG&E Corporation (PCG) provides electricity and natural gas services to residential, commercial, industrial, and agricultural customers across northern and central California. It generates power from a diverse mix of sources, including nuclear, hydroelectric, fossil fuel, fuel cell, and photovoltaic energy, and operates extensive transmission, distribution, and storage infrastructure.

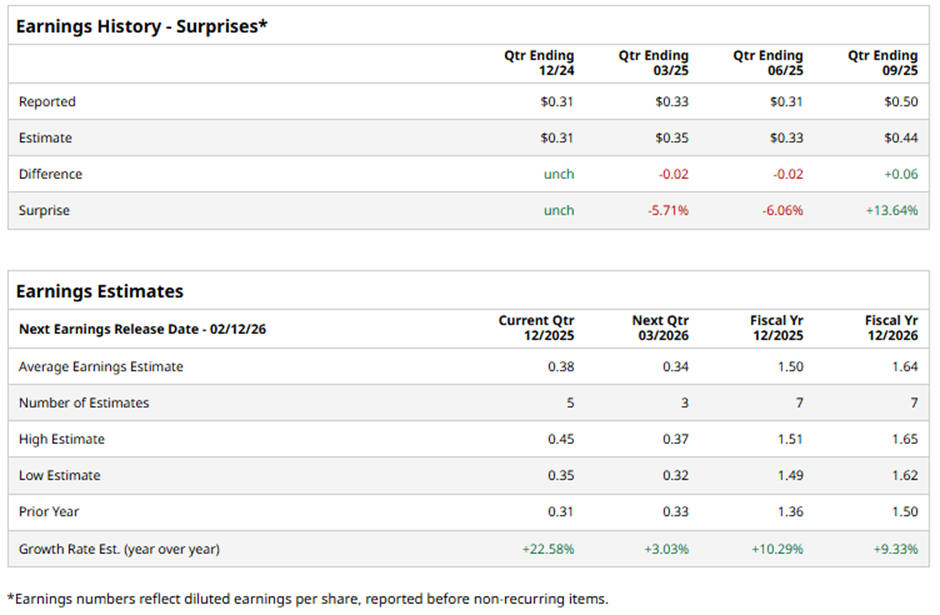

The Oakland, California-based company is set to unveil its fiscal Q4 2025 results soon. Ahead of this event, analysts predict PCG to report an adjusted EPS of $0.38, an increase of 22.6% from $0.31 in the year-ago quarter. It has surpassed or met Wall Street's bottom-line estimates in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts expect the power company to report adjusted EPS of $1.50, up 10.3% from $1.36 in fiscal 2024.

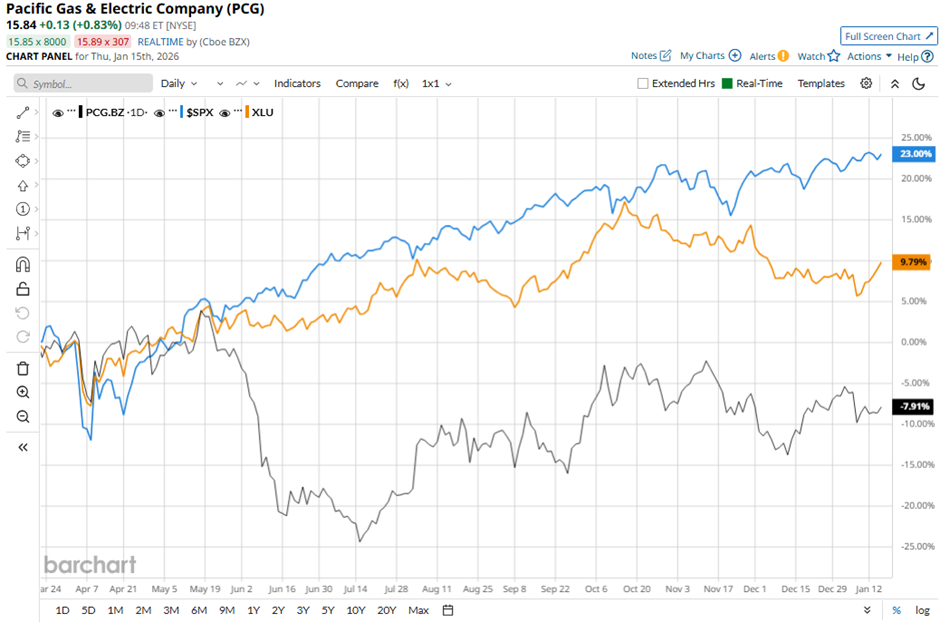

PCG stock has declined 6.6% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 17.1% gain and the State Street Utilities Select Sector SPDR ETF's (XLU) 12.3% increase over the same period.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $0.50, PG&E shares fell 1.7% on Oct. 23 after the company posted revenue of $6.25 billion, which missed Street forecasts. The stock was also pressured by higher wildfire-related claims, net of recoveries and Wildfire Fund expenses. In addition, PG&E narrowed 2025 adjusted core EPS guidance to $1.49 - $1.51 and initiated 2026 guidance of $1.62 - $1.66.

Analysts' consensus rating on PCG stock is bullish, with a "Strong Buy" rating overall. Out of 17 analysts covering the stock, opinions include 12 "Strong Buys” and five "Holds.” The average analyst price target for PG&E is $21.32, indicating a potential upside of 34.6% from the current levels.