/Packaging%20Corp%20Of%20America%20manified%20logo%20by-%20CasimiroPT%20via%20Shutterstock.jpg)

Valued at $18.6 billion by market cap, Packaging Corporation of America (PKG) is a leading producer of containerboard and corrugated packaging products, serving a broad range of industrial and consumer end markets. Headquartered in Lake Forest, Illinois, the company operates under an integrated business model that includes manufacturing containerboard and converting it into corrugated boxes and packaging solutions.

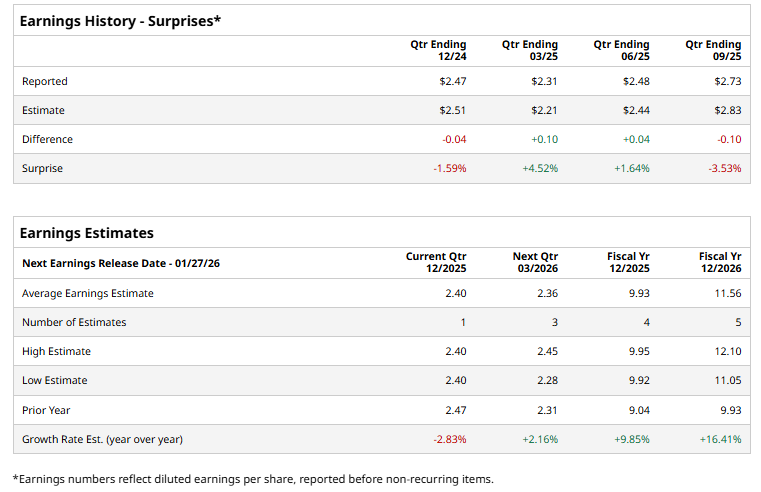

The packaging giant is expected to announce its fourth-quarter results shortly. Ahead of the event, analysts expect PKG to deliver an adjusted earnings of $2.40 per share, down 2.8% from $2.47 per share reported in the year-ago quarter. While the company has missed the Street’s bottom-line estimates in two of the past four quarters, it has surpassed the expectations on two other occasions.

Furthermore, for the current year, PKG’s earnings are expected to grow 9.9% to $9.93 per share from $9.04 per share in fiscal 2024. Moreover, its earnings are expected to improve 16.4% year-over-year to $11.56 per share in fiscal 2026.

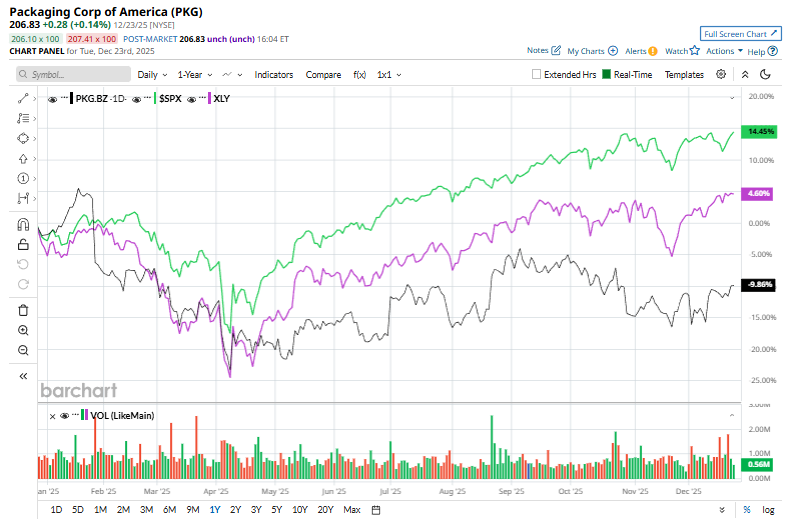

Packaging Corp. has declined 8.9% over the past 52-week period, underperforming the S&P 500 Index’s ($SPX) 15.7% gains and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 6.6% surge during the same time frame.

On Dec. 3, PKG shares rose 2.8% after the company declared a regular quarterly dividend of $1.25 per share, reinforcing investor confidence in its cash flow strength and shareholder returns. The dividend is scheduled to be paid on January 14, 2026, to shareholders on record as of December 15, 2025, highlighting PKG’s continued commitment to disciplined capital allocation and consistent dividend payouts.

The stock holds a consensus “Moderate Buy” rating overall. Of the 11 analysts covering the PKG stock, opinions include five “Strong Buys,” five “Holds,” and one “Strong Sell.” Its mean price target of $231.90 implies a modest 12.1% upside from current market prices.