/Cboe%20Global%20Markets%20Inc_%20logoon%20phone-by%20Piotr%20Swat%20via%20Shutterstoc.jpg)

Cboe Global Markets, Inc. (CBOE), headquartered in Chicago, Illinois, is a global exchange operating company. Valued at $27.6 billion by market cap, the company operates a financial options trading platform that provides cutting-edge trading and investment solutions, including equities, foreign exchange, indices, data and analytics, and trade reporting solutions. The world's leading derivatives and securities exchange network is expected to announce its fiscal fourth-quarter earnings for 2025 before the market opens on Friday, Feb. 6.

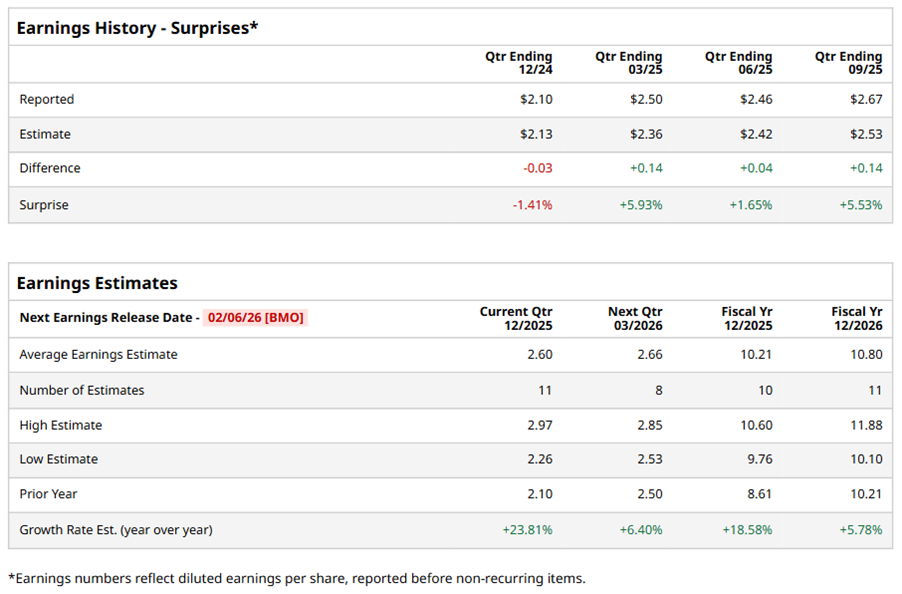

Ahead of the event, analysts expect CBOE to report a profit of $2.60 per share on a diluted basis, up 23.8% from $2.15 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect CBOE to report EPS of $10.21, up 18.6% from $8.61 in fiscal 2024. Its EPS is expected to rise 5.8% year over year to $10.80 in fiscal 2026.

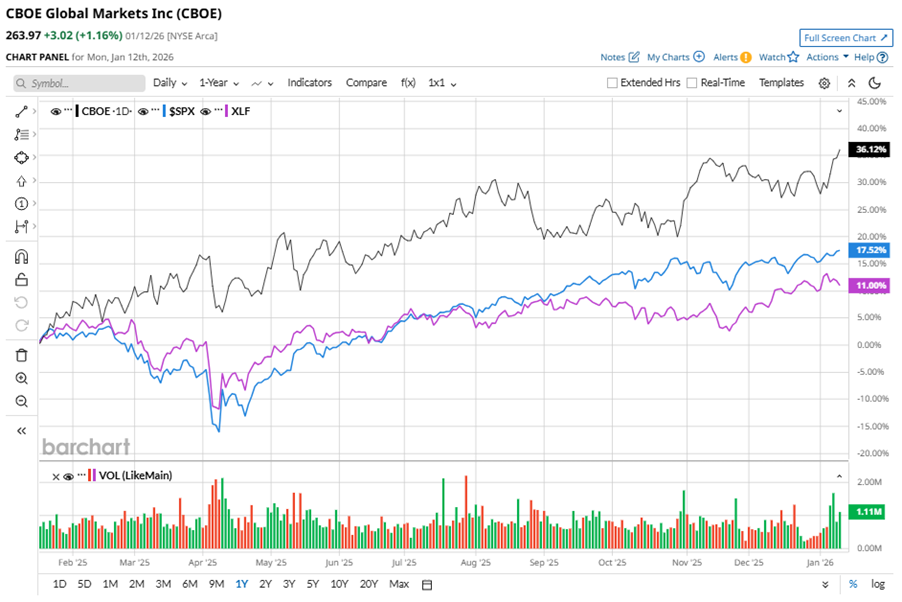

CBOE stock has outperformed the S&P 500 Index’s ($SPX) 19.7% gains over the past 52 weeks, with shares up 38.3% during this period. Similarly, it outperformed the Financial Select Sector SPDR Fund’s (XLF) 16.8% gains over the same time frame.

On Oct. 31, 2025, CBOE shares closed up by 3.7% after reporting its Q3 results. Its revenue stood at $605.5 billion, up 13.8% year over year. The company’s adjusted EPS increased 20.3% year over year to $2.67.

Analysts’ consensus opinion on CBOE stock is cautious, with a “Hold” rating overall. Out of 16 analysts covering the stock, three advise a “Strong Buy” rating, 10 give a “Hold,” and three recommend a “Strong Sell.” While CBOE currently trades above its mean price target of $263.62, the Street-high price target of $310 suggests an upside potential of 17.4%.