Shares of Ulta Beauty (ULTA) raced to all-time highs on Thursday, and expectations were high going into the company’s earnings report after the close.

And since the cosmetics retailer found a way to deliver, Ulta stock is hitting new highs on Friday.

That’s even as the overall market trades lower on Friday in response to the better-than-expected jobs report.

Ulta Beauty beat on earnings and revenue estimates and raised its full-year outlook for sales and earnings above consensus expectations.

The retailer has been enjoying a resurgence lately. While the overall market is mired in a bear market, select retail stocks continue to trade quite well.

As I outlined earlier this week, Ulta is one of those names. With the earnings report now out of the way, let’s take an updated look at the chart.

Trading Ulta Beauty Stock on Earnings

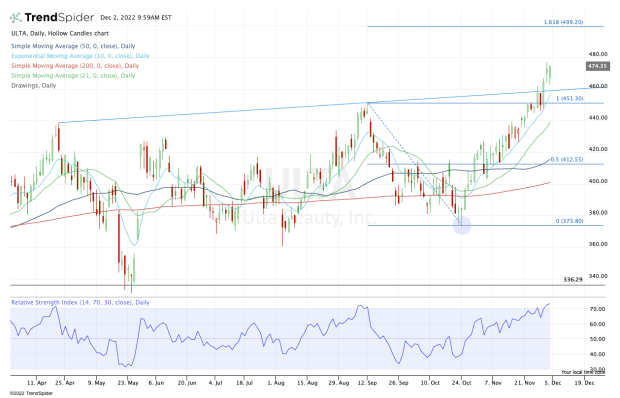

Chart courtesy of TrendSpider.com

Earlier this week, Ulta stock chopped around just below uptrend resistance (blue line). But with the market’s big rally on Wednesday, the stock broke out to new highs.

All the while the retailer has been riding uptrend support via the 10-day moving average.

Even with the market broadly weak, Ulta stock is still trading higher on the day. Unless the shares break below the 10-day moving average, the bulls will remain in control of this stock.

Going a step further, I would even say Ulta Beauty stock looks quite healthy so long as it remains above the $445 level.

As long as it can do that, the trend remains intact and the bulls can look to ride Ulta Beauty stock higher.

Just how high can it go, though?

The bulls must remember that while Ulta is displaying relative strength amid a bear market, that trend can unravel at any time. So long as it doesn’t do that, though, all signs point toward $500 as a potential upside target.

Not only is that a nice round number of psychological significance, but it also marks the 161.8% extension from the current range.

If the stock reaches this level, it would be a reasonable area for bullish traders to lock in some profits.

Cyber Week Deal

Get Action Alerts PLUS for our lowest price of the year! The markets are tough right now, but this is the best time to have professional guidance to help navigate the volatility. Unlock portfolio guidance, stock ratings, access to portfolio managers, and market analysis every trading day. Claim this deal now!