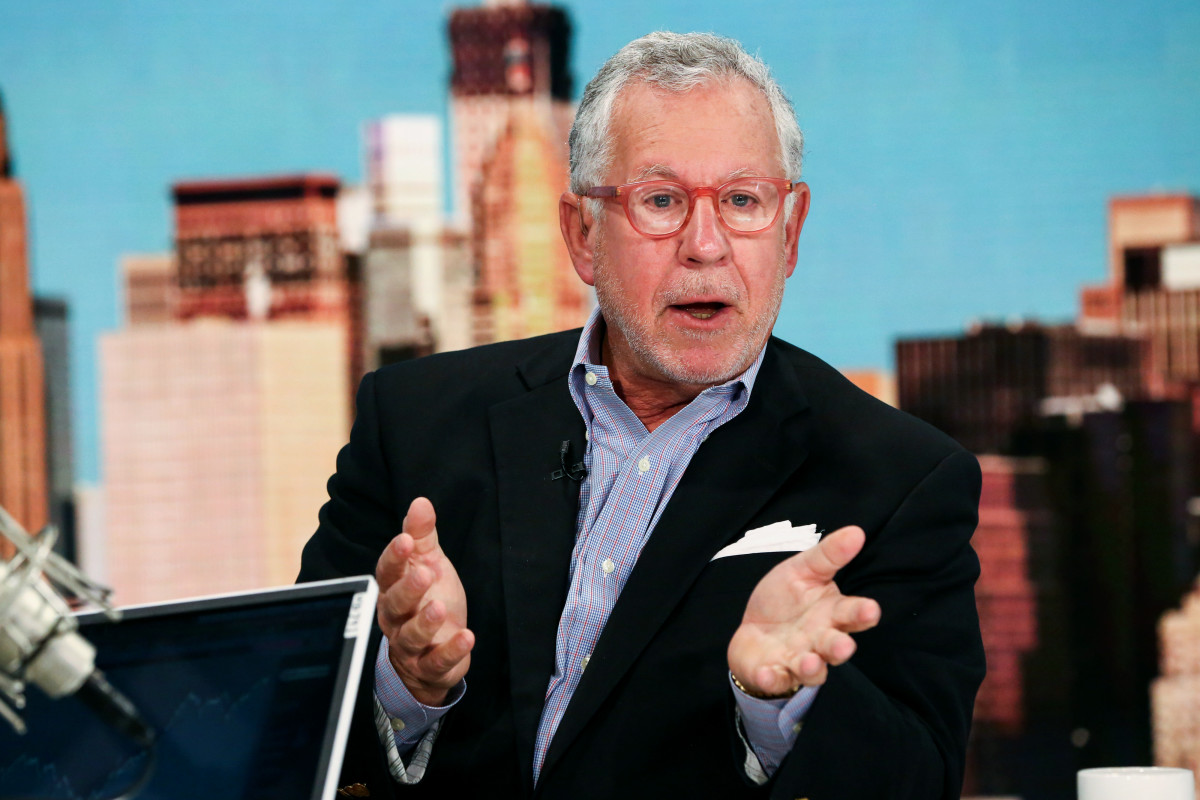

Hedge-fund manager Doug Kass has seen a thing or two throughout his career.

Kass began working at Putnam in the 1970s, so he’s invested through more than his share of bull and bear markets. The experience has given him a broad perspective, helping him manage the current high-inflation-low-growth environment.

For example, in December Kass accurately predicted that stocks would rally in the first half of 2023. And he also forecast correctly that stocks would struggle in the back half.

Recently, Kass tilted his hedge fund net long at the end of October to take advantage of a deeply oversold market, pocketing handsome profits.

Given Kass’s success this year, it pays to listen to what he thinks could happen next. Unfortunately, his opinion in his Real Money Pro trading diary may frustrate many investors.

Credit: Abby Nicolas

Stocks rally amid economic uncertainty

Although Kass was recently finding more stocks to buy because sentiment had become overly sour, that’s no longer the case.

The S&P 500 rallied 7% from its October low, and the technology-heavy Nasdaq 100 rose 9%. Individual technology stocks, including Nvidia NVDA and Microsoft MSFT, did even better, climbing 22% and 12% respectively.

Related: Analyst who predicted Tesla would fall in October has a new price target

The rally was so strong and widespread that it triggered a Zweig Breadth Thrust, a measure of stock market participation that has historically preceded gains the following year.

That’s encouraging — but Kass is more focused on the risk that a slate of worrisome factors could derail the recent rally, causing stocks to stumble rather than continue their winning ways.

Inflation has moderated from mid-2022 when the CPI inflation report showed 9.2% year-over-year growth in June. In September, the measure was up a more manageable 3.7%. But prices aren't falling so much as they're rising more slowly.

And that might be OK if wages kept pace, but they’re not. Real wages, or pay minus inflation, remain negative, so households are still losing ground.

As a result, the savings rate has collapsed to 3.4%, the lowest pace since the Great Recession, and personal savings built because of covid-era stimulus payments have dwindled.

The situation is so dire that credit-card balances in Q3 soared $154 billion from a year earlier, the most since the New York Federal Reserve began reporting these numbers in 1999. U.S. households owe more than $1 trillion on credit cards at a time when average credit card interest rates have surged to 21%. For perspective, the figure was 12% in 2014.

In addition, worrisome data in the job market are emerging. While many jobs remain unfilled, they’ve declined by 1.3 million over the past year. This year, continuing unemployment claims have increased to 1.8 million from below 1.5 million one year ago.

If those job trends continue, spending on services, which has propped up the economy while manufacturing has contracted, could stumble, propelling stocks into a recession.

Trend is bad news for tech stocks: Kass

That would be bad news for many stocks, but Kass thinks it would be terrible news for technology companies, making it too risky to buy shares.

“I am considering that today might be a speculative blowoff top in technology,“ wrote Kass in his trading diary on Nov. 7.

The risk to technology stocks from an economic reckoning could mean that the so-called magnificent seven companies responsible for much of the S&P 500’s double-digit returns this year are about to fall.

More From Wall Street Analysts

- Analyst who forecast the S&P 500 correction has a new price target

- Analyst who predicted Nvidia's stock sell-off has a new price target

- Analyst who predicted JP Morgan's rally has a new price target

Apple AAPL could be particularly at risk since it represents 7% of the S&P 500 and 11% of the Nasdaq 100. Its price-to-earnings multiple, a standard valuation metric, is 30, even as its sales last quarter slipped only 1% year-over-year.

"My largest individual short is now" Apple, Kass wrote in his diary on Nov. 8.

Valuation for many others in the magnificent seven is arguably rich, too. Nvidia is the poster child of this year’s rally, having more than tripled (up 227%) in 2023 as demand for its artificial-intelligence chips surged. Its p/e multiple is 89.

Microsoft, best known for its Office productivity software suite, is similarly pricey. It’s p/e multiple is 35. Tesla TSLA, which saw its year-over-year revenue growth slow to 9% last quarter from 47% in Q2, is trading at 58 times.

Those valuations are arguably rich given that interest rates have risen, devaluing future earnings, and that the risk of a recession remains.

For this reason, Kass has shifted from buying stocks in late October before the rally to shorting stocks. He’s opportunistically trading the market to take advantage of short-term pops and drops, but he says stocks will generally continue downward.

Since his track record is so good this year, investors may want to keep that in mind before chasing stocks higher this week.

Sign up for Real Money Pro to learn the ins and outs of the trading floor from Doug Kass’s Daily Diary.