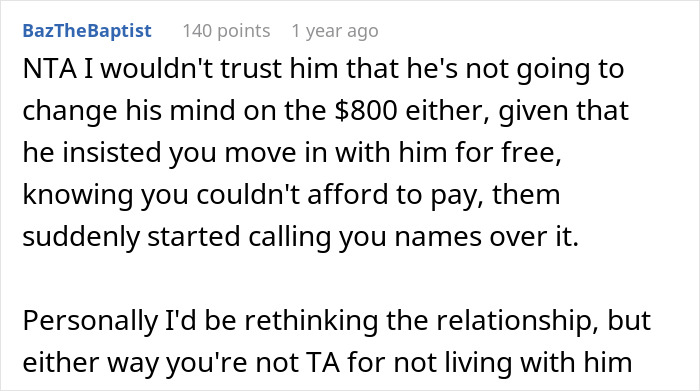

When a couple starts living together, one of the first issues to figure out is how they’re going to split the rent. Sometimes, one person in the couple might still be in school or between jobs, so the burden then falls entirely on the shoulders of the other. There are cases, however, when a partner volunteers to cover all the rent.

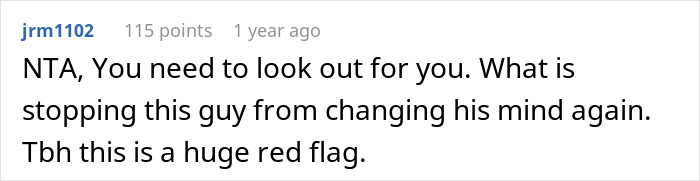

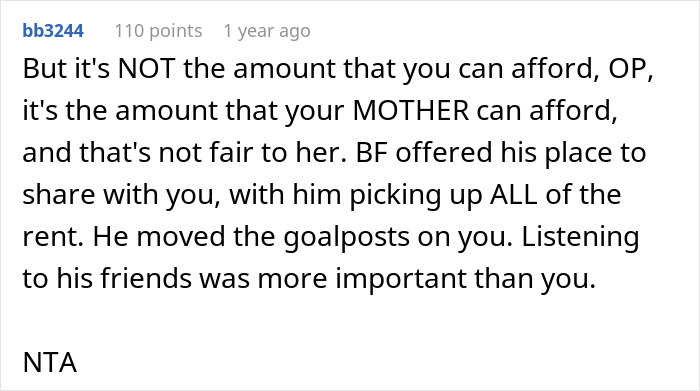

This story started that way, as the boyfriend asked his girlfriend to move in and agreed to pay the rent. But later, after talking to his friends, he decided that she was “a gold digger” and demanded she start paying half: $2.5k a month. Taken aback and unable to pay this much, the woman decided she would rather move somewhere more affordable. But she started to wonder: was she being a jerk by moving out and refusing to help her boyfriend pay rent?

Figuring out how to split rent can be a contentious topic for many couples

Image credits: Alexander Grey / unsplash (not the actual photo)

This woman decided to move out after her boyfriend suddenly started demanding she help him pay rent

Image credits: Andrea Piacquadio / pexels (not the actual photo)

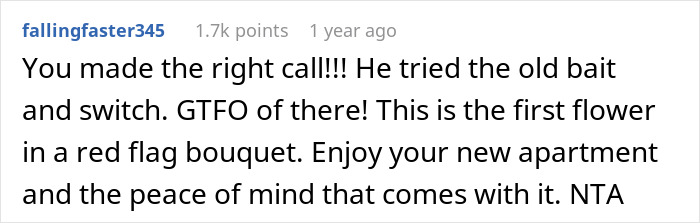

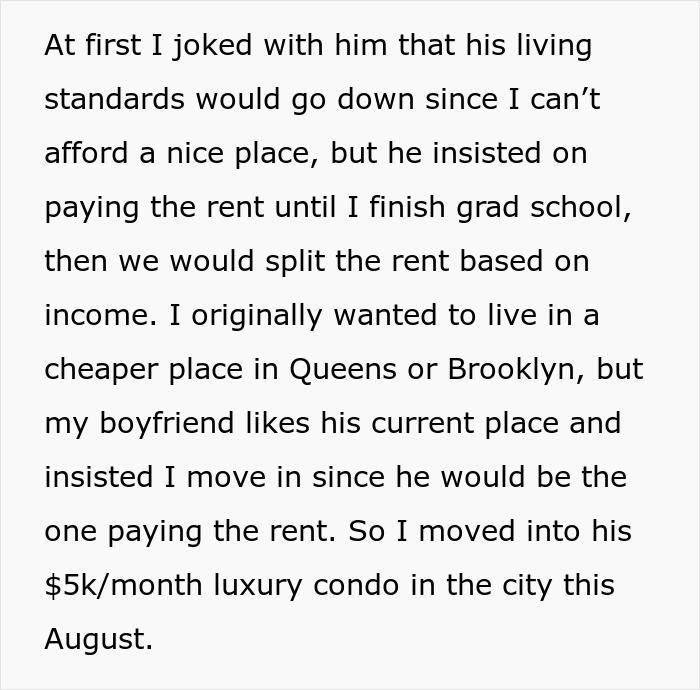

In an update, the woman shared how she left her boyfriend and explained the particulars of renting in NYC

Image credits: idiotrichboyfriend

Many young couples don’t discuss their finances before important milestones, but they should

Image credits: Blue Bird / pexels (not the actual photo)

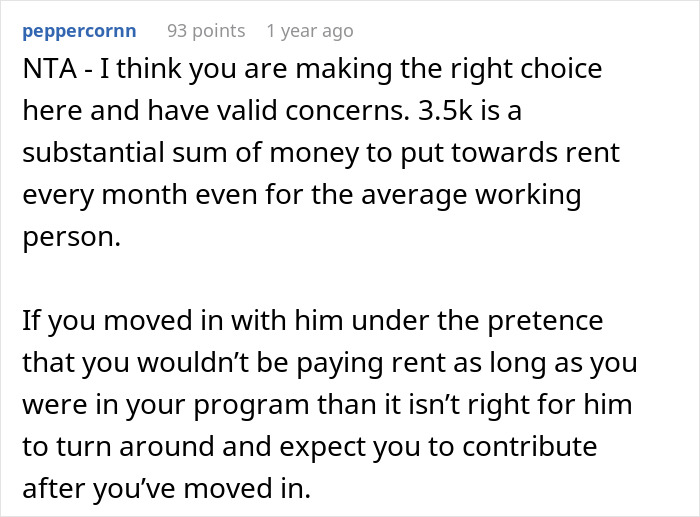

The situation described here happens more often than we think. Credit Karma reports that for many young people, money issues are the dealbreaker in a relationship. 38% of Gen Z and 36% of Millennials say they would break up with a partner if they didn’t share the same money values.

Many respondents also said they don’t talk about finances until they reach an important milestone, like moving in together or getting engaged. This points to a big mistake young couples make, one that personal finance experts highlight as a must for all couples who want to be successful in the long-run.

That’s being open and communicating about each other’s finances from the get-go. Instead of doing that, however, many couples choose to sus out their potential partner’s financial situation online. 35% of Gen Z and 25% of Millennials said in the Credit Karma survey that they look up their dates on LinkedIn and Glassdoor to gauge how much they’re making.

Yet many personal finance experts say that it’s crucial for partners to be transparent about money. Kayla Welte, financial planner at District Capital Management, told Bloomberg it’s never too early to discuss money. Couples should talk about their career plans, savings, credit scores, and attitudes toward spending at the very beginning of the relationship. Bankrate recommends starting small if you’ve been dating for a month or less. Discuss date budgets and whether you can take that weekend vacation or not.

If couples are not sure how to do that, Brittany Wolff, founder of Wolff Financial in South Carolina, also says how they can arrange ‘money dates,’ a time when they can discuss their situation and goals. Making it fun – like a date – can take the pressure off, keeping the conversation light and productive.

When one partner makes more than the other, there are bound to be disagreements

Image credits: Karolina Grabowska / pexels (not the actual photo)

In an ideal world, money doesn’t matter in relationships. However, in reality, income gaps between partners often lead to arguments and misunderstandings between couples. Relationship expert Susan Winter told Insider that a significant income disparity can strain a relationship. “Traditionally speaking, money equals power. And the one with the power is the one who controls the relationship.”

What’s the solution? Again, communication. Winter said that the individual who feels discomfort because they’re making less or their partner is making significantly more should let their feelings be known. They should also evaluate what exactly makes them feel this discomfort.

Because in many cases, the person who makes less money can contribute in other ways, whether that’s taking on more of the household chores or bearing more of the emotional labor. Winter also notes how the partner can express their affection for their significant other so as to let them know it’s not about the money, or they can plan inexpensive dates to treat them.

Also, the fact that you’re making less doesn’t mean you can’t contribute. There are three different ways couples can distribute income. The first one, of course, is the 50/50 model, where each person contributes equally. However, ‘fair’ doesn’t always have to be ‘equal.’ Like in this story, one person in a couple can be making significantly less or even no money at all.

Then the proportional model would be appropriate. If one partner earns more, they should be contributing more. A good way to calculate this is to work out each person’s share of the combined income. Let’s say that one person earns $30k and the other $50k. By dividing each of their incomes by 80, they would know what percentage of total expenses each should cover.

The last technique is “all in.” That’s when both partners put their salaries together and cover expenses from the joint account. This model might work best when there’s complete trust between the couple and both are on the same page about what their expenses should look like. Every couple should work out which technique works best for them, and if none do, perhaps their financial values just don’t align.

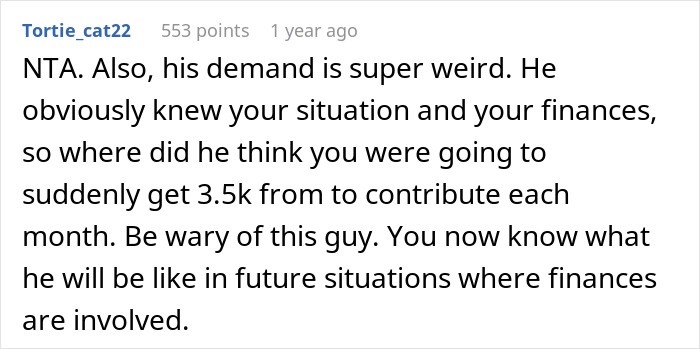

People in the comments called out the jerk boyfriend for being so easily swayed by his friend’s opinions