Ark Innovation Fund (ARKK) has held investors' attention for several years. When the covid-19 pandemic struck, it was hit hard like everything else.

The fund's manager, Cathie Wood, came to prominence for her bullish stance on Tesla (TSLA). The electric-vehicle maker was an intense battleground stock. Once the bulls won out and Tesla ran to a market cap in excess of $1 trillion, Wood was well-known for her correct call.

That and the rush to growth stocks led to surging inflow for her Ark ETF products, with the flagship fund, ARKK, getting most of the attention. From the Covid low to the February 2021 high, the shares nearly quintupled.

Wood & Co. have gone from famous to infamous in a hurry, as the ARKK ETF has fallen almost 80% from that high to last week’s low.

Now, though, there is some promise that ARKK could be finding its footing.

Trading ARKK Stock

Chart courtesy of TrendSpider.com

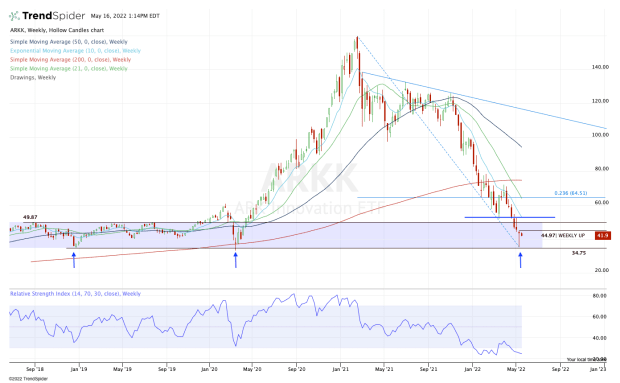

The weekly chart above highlights a few prominent areas, perhaps most notably the $33 to $35 range.

This level was support in the fourth quarter of 2018, when the markets saw a sharp Fed-induced selloff. It was also support during the covid selloff in 2020.

Otherwise, this has been the bottom of the range for the prior four years, while $50 has acted as a sort of loose level of resistance. That was until ARKK underwent a powerful breakout in 2020.

On May 12 ARKK rallied 5.6%. On May 13 it closed 12% higher. In all, the ETF had climbed more than 24% from May 12's low to May 13's close.

At last check on May 16 it’s down about 3.5%, which isn’t bad considering the rally we’ve seen over the past few days.

It’s currently stalling near $45 and struggling with its 10-day moving average. That’s only natural after such a big fall.

Despite a strong finish last week, ARKK still ended up lower on the week, down for its sixth straight week. Since it closed near the week’s high, though, it leaves us with the potential for a weekly-up rotation over $45.

If that happens and ARKK doesn’t reverse lower, we could be looking at a potential push toward $53.

There we find a few measures, mainly the May high and the declining 10-week moving average. ARKK hasn’t tested the latter in more than six weeks.

If it blows through that level, then we could be looking at a potential rally into the mid-$60s, where ARKK finds its 23.6% retracement and declining 21-week moving average.

If we never get that weekly-up rotation over $45 and ARKK continues lower, keep an eye on this key $33 to $35 area.