Investment banking activity, such as mergers and acquisitions, had stalled for the past couple of years, hurt by the Federal Reserve’s interest-rate hikes.

But now that the Fed has begun to lower rates, investment banking is making a comeback.

🏦 Free Newsletter From TheStreet - TheStreet 🏦

For example, the number of global M&A deals valued at more than $1 billion soared 31% in the third quarter from a year earlier to 46, according to consulting firm WTW. That’s the highest number in two years.

Corporate-bond issuance, another bedrock of investment banking, soared 33% in the first nine months of the year to $1.57 trillion from the year-earlier period, according to the Securities Industry and Financial Markets Association.

The impact of low interest rates

Low rates help mergers and acquisitions because they make financing deals cheaper. And on the bond front, lower rates also make it cheaper to borrow, inspiring companies to do so.

Equity underwriting is a part of investment banking, too. And when rates are low, stocks often rise, producing an attractive climate for initial public offerings.

Banks also improved their operations when the investment banking environment was less favorable over the last few years.

Related: Fed official's latest words reignite interest-rate cut debate

Banks faced not only high interest rates, but also war, market volatility, supply-chain bottlenecks, climbing inflation and financial regulation shifts, noted Acuity Knowledge Partners, a financial-services research firm.

“Against this challenging backdrop, investment banking firms were forced to implement measures to increase their operating efficiency and contain costs,” Acuity said.

The work paid off in the third quarter. Let’s have a look at the top two banks in the Financial Times’ investment-bank league tables.

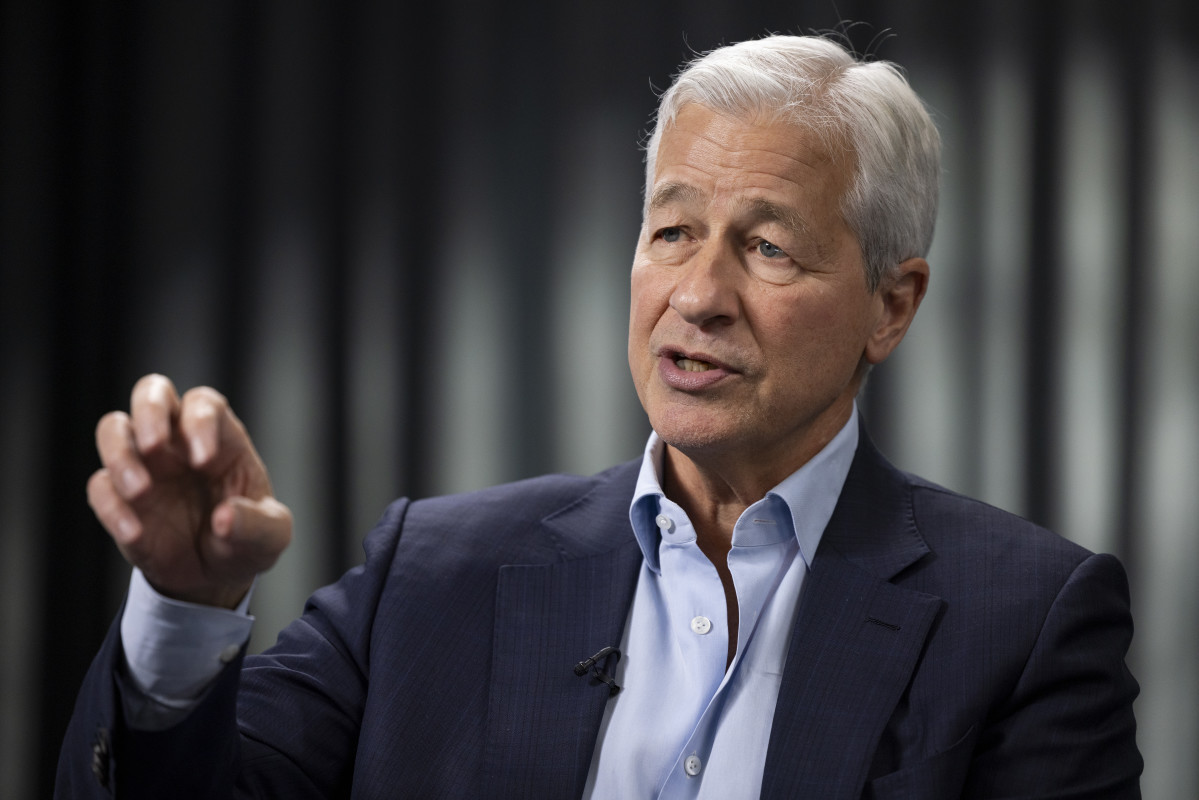

JP Morgan posts strong investment-bank numbers

No. 1 is JP Morgan Chase (JPM) , with investment banking fees of $6.64 billion year to date as of Sept. 25.

No. 2 is Goldman Sachs (GS) , with investment banking fees of $4.98 billion.

For JP Morgan investment-banking revenue soared 29% in the third quarter from a year earlier, about double the company’s guidance, to $2.35 billion. That increase was driven by higher fees across all products, it said.

Related: Druckenmiller, Summers deliver blunt messages to Fed on interest rates

And the bank sees more good times ahead. “In light of the positive momentum throughout the year, we're optimistic about our [investment banking] pipeline," Jeremy Barnum, JP Morgan’s chief financial officer, said on the company’s earnings call last week.

“But the M&A regulatory environment and geopolitical situation are continued sources of uncertainty.” He was referring to the Biden administration’s opposition to some big mergers and wars in Ukraine and the Mideast.

Goldman Sachs succeeds in investment banking

As for Goldman, it reported a 20% increase for investment banking revenue in the third quarter to $1.87 billion.

That reflects “significantly higher net revenues in debt underwriting, higher net revenues in equity underwriting and slightly higher net revenues in advisory,” the bank said. Debt underwriting includes bond issuance, and advisory includes M&A work.

Goldman benefited in the third quarter from advising Kellanova (K) , the former snacks segment of Kellogg, on its $36 billion acquisition by candy king Mars. That’s the biggest U.S. merger so far in 2024. Goldman could earn $93 million from that assignment, it said in a regulatory filing.

Wall Street Analysts:

- Analysts update Meta stock price target with Q3 earnings in focus

- Analysts update outlook for Nvidia's Blackwell chips amid AI boom

- Analyst reboots Reddit stock price target ahead of earnings

“Across investment banking, corporate and sponsors remained actively engaged, and we see significant pent-up demand from our clients,” Goldman Sachs Chief Executive David Solomon said in the earnings conference call.

Related: Legendary investor unveils updated stock picks

“Our backlog rose again this quarter driven by advisory, and we expect our leading investment banking franchises to benefit from the continued resurgence in activity.”

Analysts reacted positively to Goldman’s earnings report. It produced "a powerful revenue beat across all segments, showcasing the rebound in capital markets is underway, and we believe has durability," said Stephen Biggar, banking analyst at Argus Research, according to Reuters.

The author of this story owns shares of JP Morgan and recently sold shares of Goldman Sachs.

Related: Veteran fund manager sees world of pain coming for stocks