Goldman Sachs (GS) -) shares edged lower Tuesday after the investment bank posted better-than-expected third quarter earnings but booked more than $800 million in writedowns linked to its real estate and home improvement lending divisions.

Goldman said earnings for the three months ending in September were pegged at $5.47 billion, or $3.08 per share, down 34% from the same period last year and topping the Street consensus forecast of $5.31 per share. Group revenues, Goldman said, fell 1.3% to $11.82 billion but topped analysts' forecasts of an $11.18 billion total.

Investment banking fees were unchanged from last year at $1.55 billion, Goldman said. Fixed income revenues were down 6% to $3.38 billion, while equity trading revenue rose 8% to $2.96 billion, just ahead of Street forecasts.

Merger activity is over the first nine months of 2023 is down around 27% from last year's levels, according to Refinitiv data, with around $2 trillion in deals completed - the lowest total since 2013. Overall third quarter fees, according to Dealogic, are down 17% from last year at $15.2 billion.

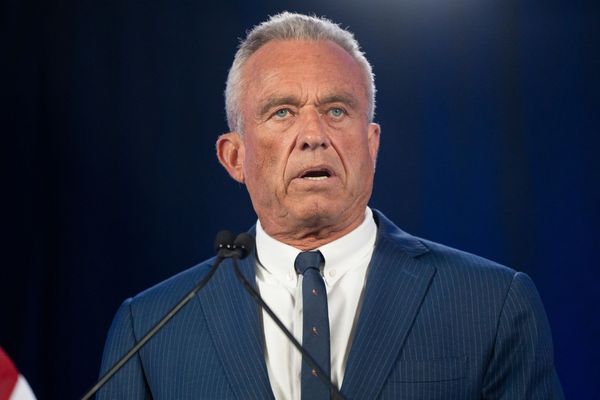

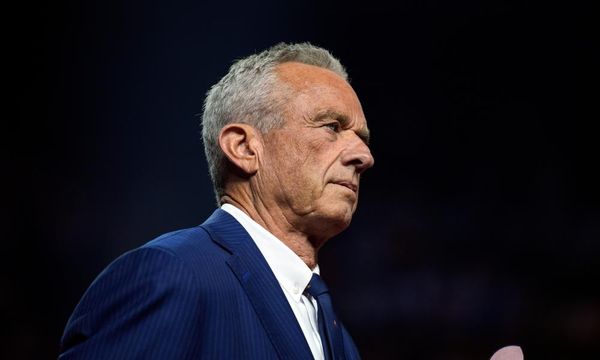

“We continue to make significant progress executing on our strategic priorities and we’re confident that the work we’re doing now provides us a much stronger platform for 2024," said CEO David Solomon. "I also expect a continued recovery in both capital markets and strategic activity if conditions remain conducive."

"As the leader in M&A advisory and equity underwriting, a resurgence in activity will undoubtedly be a tailwind for Goldman Sachs," he added.

Goldman Sachs shares were marked 0.4% lower in early Tuesday trading immediately following the earnings release to change hands at $313.11 each.

Goldman will also take a 19 cents per share hit to its third quarter earnings from the sale of GreenSky, it home improvement lending unit, which wrapped-up earlier this month.

Goldman bought the unit for $1.7 billion in 2021 and solid it to a consortium lead by private equity group Sixth Street Partners after booking a $504 million writedown over the second quarter.

Goldman also took a $358 million hit to its commercial real estate portfolio

Solomon, under fire from some investors over the bank's lackluster profits, said the GreenSky sale was part of the bank's pivot towards banking and markets as well as its renewed focus on wealth management, where revenues were down 2% to $3.23 billion.

- Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.